Key Economic Calendar Events

Monday, July 1

- EUR: Non-monetary ECB meeting.

- PMI: Manufacturing PMI data from Germany, Eurozone, and the UK.

- USD: S&P and ISM manufacturing PMI.

- AUD: RBA minutes.

- EUR: Christine Lagarde speech.

Tuesday, July 2

- EUR: Speeches from various ECB members, CPI data, and unemployment rate.

- USD: Powell's speech and JOLTs data.

- API: Weekly crude oil inventory report.

Wednesday, July 3

- EUR: Services and composite PMI in Germany and Eurozone.

- USD: S&P and ISM non-manufacturing PMI, initial jobless claims.

- Crude Oil Inventories: EIA weekly report.

- USD: FOMC minutes.

- EUR: ECB members' speeches.

Thursday, July 4

- Holiday: US Independence Day, markets closed.

- GBP: General elections in the UK.

- EUR: ECB minutes.

Friday, July 5

- USD: Non-farm payroll data, unemployment rate, and average hourly earnings.

- CAD: Employment data and unemployment rate in Canada.

- EUR: Christine Lagarde speech.

Weekly Focus

This week, the focus will be on the depreciation of the USD driven by the recent slowdown in US inflation, with the PCE showing its lowest level in three years. Expectations of rate cuts by the Fed in September and December, with probabilities of 63.4% and 32% respectively, will influence major pairs. Speeches by Powell and other Fed members will be key to confirming or adjusting these expectations, especially in light of the initial jobless claims and non-farm payroll data to be released on Wednesday and Friday, respectively.

In Europe, PMI data from the Eurozone and Germany, along with speeches from various ECB members and CPI figures, will be crucial in determining the direction of the EUR. The recent uptick in manufacturing PMI in Germany and the Eurozone, although still in contraction territory, suggests a possible economic stabilization that could support the EUR. Additionally, statements from Lagarde and other senior ECB officials may provide clues on future monetary policies in response to inflation and economic growth.

The JPY could appreciate this week due to improved business confidence in Japan and speculation about government intervention to curb the recent yen weakness, especially on the day the US market is closed. These factors, along with a global environment of low inflation and potential US rate cuts, could limit gains in USDJPY. The strength of the JPY could also influence gold prices, which may benefit as a haven asset amid US political uncertainty and expected market volatility due to the combination of these key economic events.

USDX Overview

The Dollar Index (DXY) maintains its bullish structure despite a bearish start to the week, with the last significant support of the bullish move located at 104.95. Therefore, as long as this support is not broken, the continuation of the bullish trend above last week’s resistance at 105.72 is expected, targeting 106.00 or the April resistance at 106.16 this week. This implies gains for the USD against its counterparts. Conversely, if the key support is decisively broken and confirmed with a second lower low, the dollar will reverse its trend in favour of a pullback.

Technical Analysis

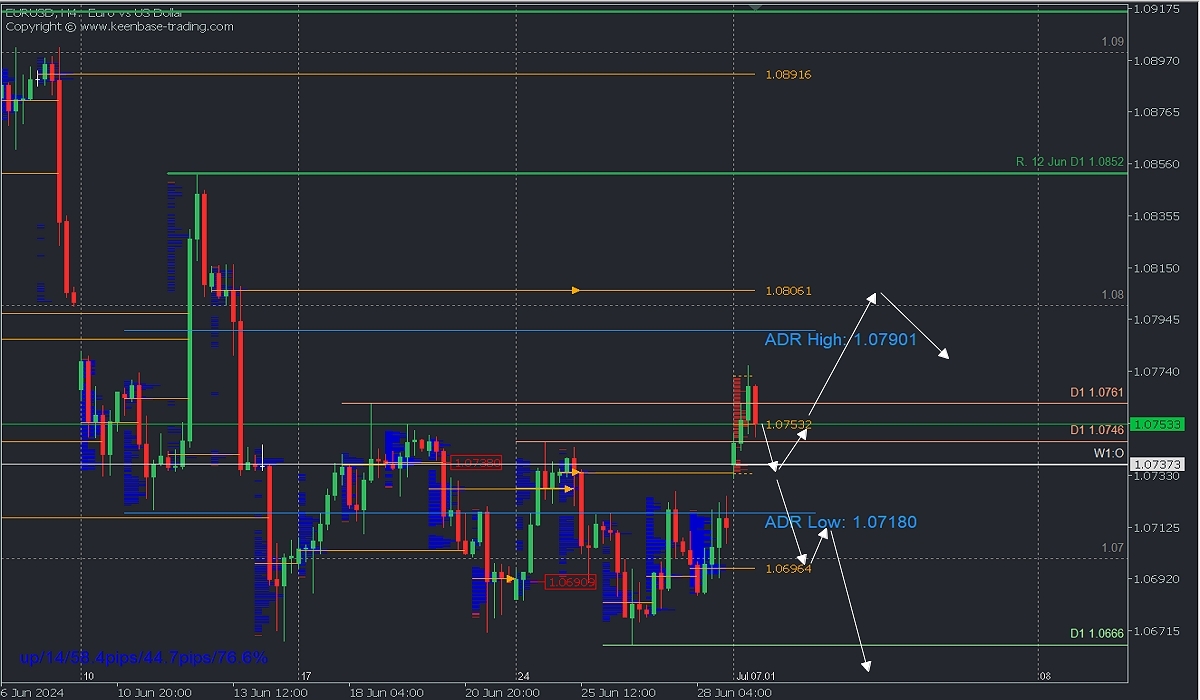

EURUSD

- Selling Zones: 1.0806

- Buying Zones: 1.0733/1.0696

The pair opens with a bullish gap surpassing last week’s resistance at 1.0745, so the pullback towards the broken selling zone around 1.0734 could offer a new opportunity for an extended rally towards the next selling zone around 1.0806, where an uncovered POC from three weeks ago is located. However, if the price falls decisively below 1.0734, it will fill the opening gap ahead of schedule, with a possible extension towards 1.0696, the last demand zone from last week, anticipating a new rally. The pair’s bearish continuation will be determined by the decisive break of the indicated demand zone and subsequently of the supports at 1.0685 and 1.0665.

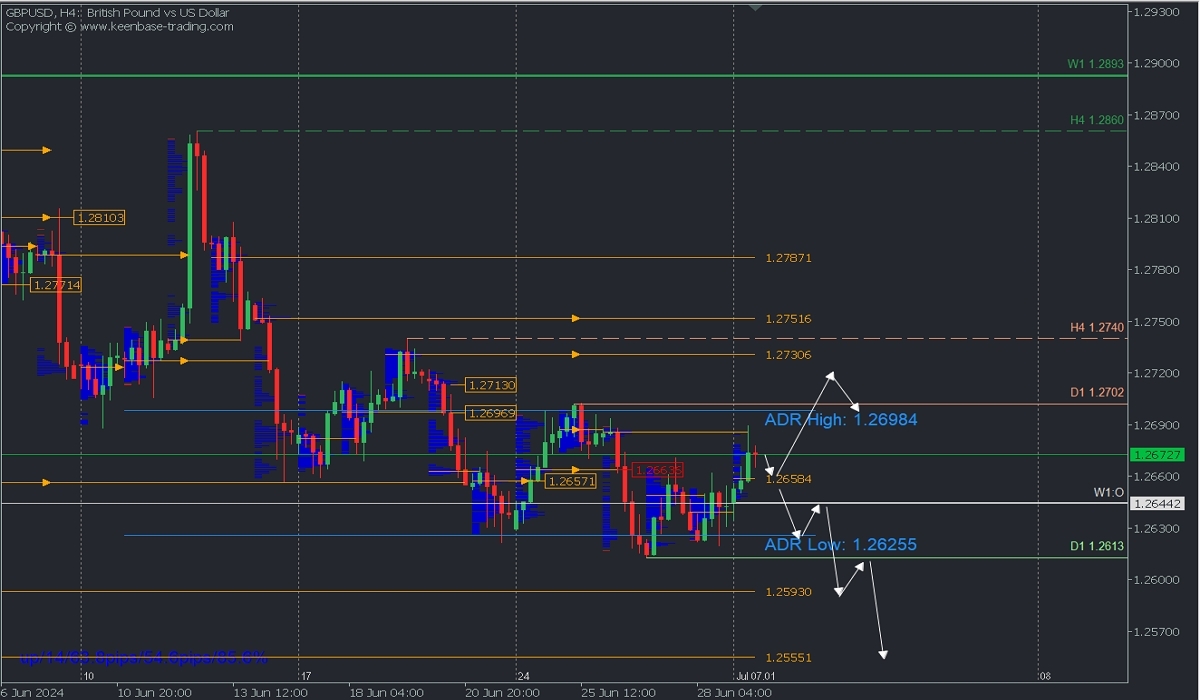

GBPUSD

- Selling Zones: 1.2685/1.2713/1.2730

- Buying Zones: 1.2640/1.2593/1.2555

The pair corrects towards last week’s selling zone at 1.2885. If a short pullback occurs without breaking the Asian POC at the opening around 1.2658, it can be expected that the new rally will attempt to break the last relevant resistance of the bearish trend at 1.2702 to seek liquidity around the selling zones from two weeks ago between 1.2713 and 1.2730. However, a decisive fall below 1.2658 will aim to renew the bearish continuation towards the week’s opening at 1.2644, support at 1.2613, and the next uncovered buying POCs at 1.2593 and 1.2555 for the week.

@2x.png?quality=90)