Fundamental Analysis

The pound has faced strong bearish pressure following statements from Bank of England Governor Andrew Bailey, who hinted that the institution might adopt a more proactive stance on rate cuts if inflation continues to decline. Additionally, the September services and composite PMI data came in at 52.4 and 52.6, respectively, below previous figures and market expectations. These results reflect a slowdown in UK economic activity, further weakening the pound, which fell to 1.3130, its lowest level in two weeks.

On the other hand, the strengthening of the US dollar has exacerbated GBPUSD’s decline, driven by solid US labour market data, increasing expectations of a less aggressive rate-cut scenario by the Federal Reserve. Despite market volatility due to tensions in the Middle East, the dollar has solidified its position as a safe haven, keeping pressure on the pair and opening the possibility of further declines if support at 1.3100 does not hold.

Technical Analysis

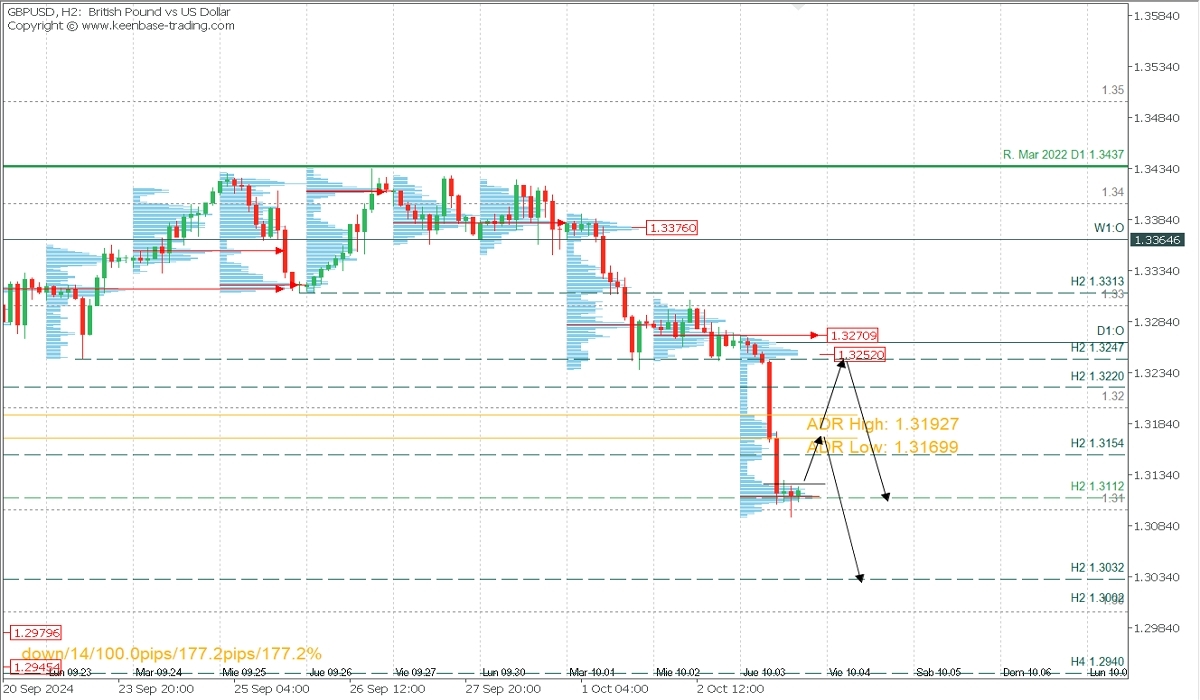

GBPUSD, H2

- Supply Zones (Sells): 145.08 and 145.89

- Demand Zones (Buys): 143.13, 142.00, and 140.60

After reaching a buy zone at 1.3112, breaking through the day’s bearish range, a corrective rebound towards 1.3154 and the high-volume node zone below the daily bullish range can be expected. There's potential to extend the buying on Friday during early sessions towards 1.3220 or the supply zone around 1.3252. Both areas have the potential to trigger bears to renew intraday sells toward 1.31 again and 1.3032 or 1.30 on further downside on Friday.

Technical Summary

- Buys above 1.3128 with TP at 1.3154, 1.32, 1.3220, or 1.3247 extension. All these levels have the potential to activate bulls, so it’s suggested to wait for the formation and confirmation of an exhaustion/reversal pattern on M5.

- Sells below 1.3190 if an exhaustion/reversal pattern (PAR) forms and confirms on M5; otherwise, wait to sell around 1.3247.

Always wait for the formation and confirmation of an Exhaustion/Reversal Pattern (PAR)on M5 like those shown [here](https://t.me/spanishfbs/2258) before entering any trade in the key zones indicated.

POC Discovered:

POC = Point of Control: The level or zone where the highest concentration of volume occurred. If a bearish move follows, it is considered a sell zone, forming a resistance zone. Conversely, if a bullish move follows, it is considered a buy zone, usually located at lows, forming support zones.

@2x.png?quality=90)