Great News: FBS Drops Trading Spreads on NZDUSD!

The NZDUSD pair, often called the "Kiwi," represents the exchange rate between the New Zealand dollar and the US dollar and serves as a barometer of economic interaction between these countries. The New Zealand dollar is predominantly influenced by domestic economic conditions such as trade balances and commodity prices, especially dairy and meat, which are significant exports for New Zealand. On the other hand, the US dollar is affected by broader economic indicators, such as employment rates, GDP growth, and Federal Reserve policies, which reflect the overall health of the American economy.

New Zealand interest rate decision, May 22, 04:00 (GMT+2)

The Reserve Bank of New Zealand is expected to maintain the interest rate at 5.50%. If the rate remains unchanged, it could retain investor confidence in the stability of New Zealand's economy, which might help stabilize or moderately strengthen the NZD against the USD. On the other hand, if the Bank of New Zealand unexpectedly increases the rate, the NZD could see a sharper rise as higher yields attract investor capital. Conversely, due to concerns over economic slowdown, a surprise rate cut may lead to a depreciation of the NZD as lower interest rates typically deter foreign investment, pressuring the NZDUSD pair downwards.

US new home sales, May 23, 16:00 (GMT+2)

US new home sales are projected to increase to 668K from the previous 637K. If the actual sales data surpasses this expectation, it would indicate a robust housing market and overall economic strength. This positive outcome could lead the Federal Reserve to consider tightening monetary policy sooner than expected, which generally boosts the USD by making dollar-denominated assets more attractive. Such a scenario would likely result in a decline for NZDUSD. Alternatively, if the sales figures disappoint and come in below the 668K mark, it may raise concerns about the US economic recovery, potentially weakening the USD. A weaker USD would likely cause the NZDUSD pair to increase as investor confidence shifts away from the dollar.

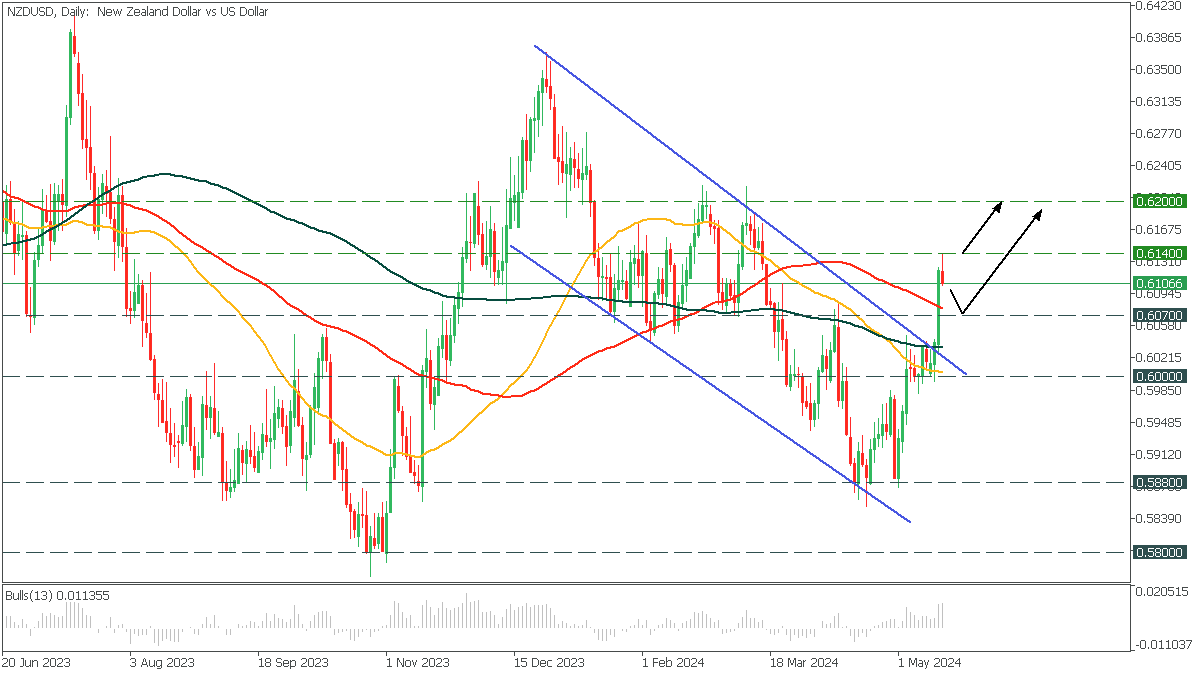

In the daily timeframe, NZDUSD broke the upper trendline after a prolonged decline in the descending channel. Given the trend breakout and bullish solid sentiment, confirmed by the moving averages and Bull Power Indicator, we can expect further growth.

NZDUSD may continue a minor correction to 0.6070 support and then rally to 0.6200 resistance.

However, if the bulls push the price above the 0.6140 resistance, it can rise instantly.