Yesterday on the 1st of July, we had our usual market breakdown session on the FBS Analytics and Education YouTube channel. Interestingly, the vast majority of commodities analyzed already presented a total of over 280pips as at the time of writing; however, here presented are a few others that haven’t really moved far yet and may still present other entries as the week progresses.

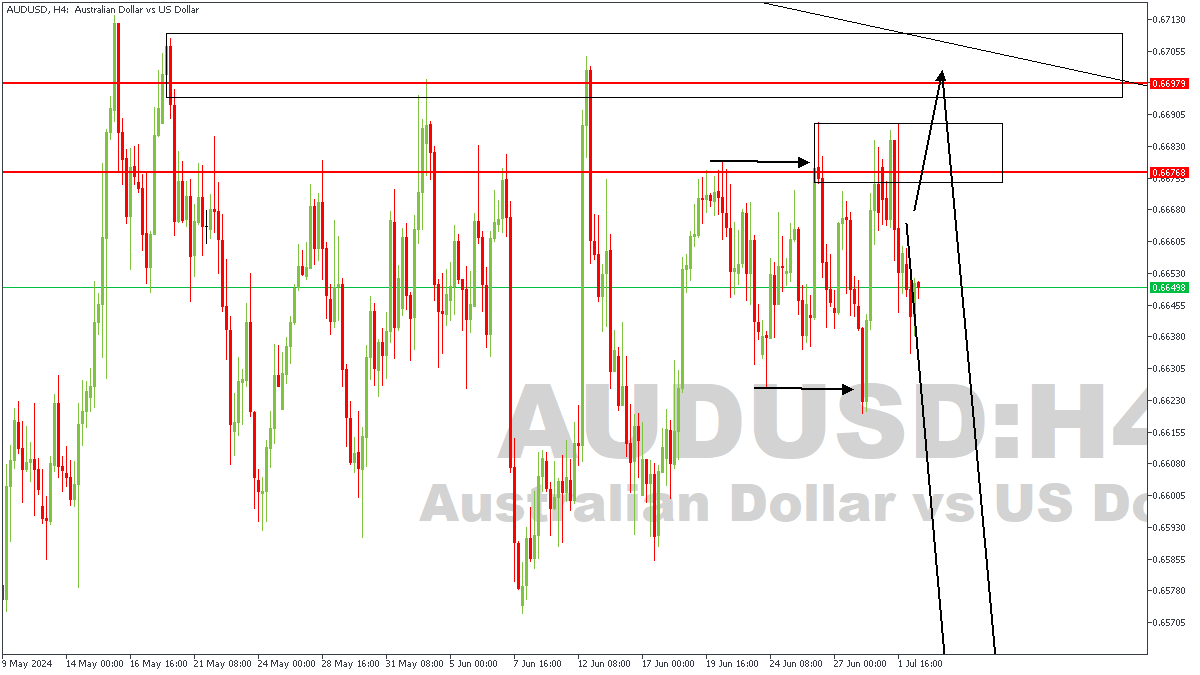

AUDUSD – H4 Timeframe

On the 4-hour timeframe of AUDUSD chart, we see price currently being rejected from the pivot zone of the daily timeframe based on the QMR pattern that was created by the price action. The sweep, break and retest move suggests that price is set to commence a bearish move from the current region, albeit after an initial bullish retracement.

Analyst’s Expectations:

Direction: Bearish

Target: 0.65482

Invalidation: 0.67161

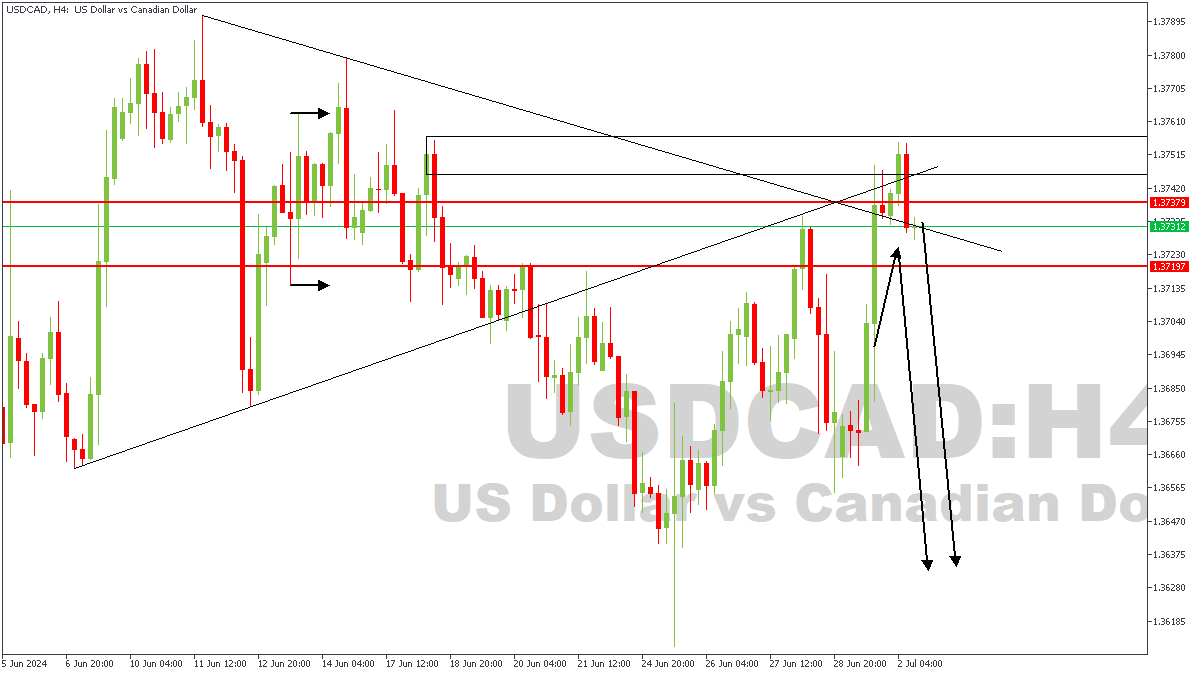

USDCAD – H4 Timeframe

USDCAD on the 4-hour timeframe as seen on the chart, recently broke out of a triangle pattern, right afterwards, we see a retest of the supply zone, serving the initial signal of an impending bearish move. Also, the Sweep-Break-Retest price action as highlighted by the horizontal arrows adds a confluence to our initial bearish sentiment, where the retest of the trendline resistance affirms that sentiment to a large extent.

Analyst’s Expectations:

Direction: Bearish

Target: 1.36782

Invalidation: 1.37588

CONCLUSION

You can access more of such trade ideas and prompt market updates on the telegram channel.