The EURGBP exchange rate remained steady earlier despite the release of UK labor market data. While wage growth (excluding bonuses) came in slightly higher than expected, the more critical month-on-month rise in private sector pay, which the Bank of England (BoE) watches closely, was more subdued. This suggests the job market is gradually cooling, with expectations for wage growth now below 4%, according to the BoE’s recent survey. The data does not significantly change the outlook for the BoE, with a February interest rate cut still anticipated. In the short term, EURGBP may see upward movement as markets continue to factor in potential BoE easing and risks tied to the UK’s higher borrowing rates. At the same time, the euro could benefit from reduced fears of EU-targeted trade tariffs.

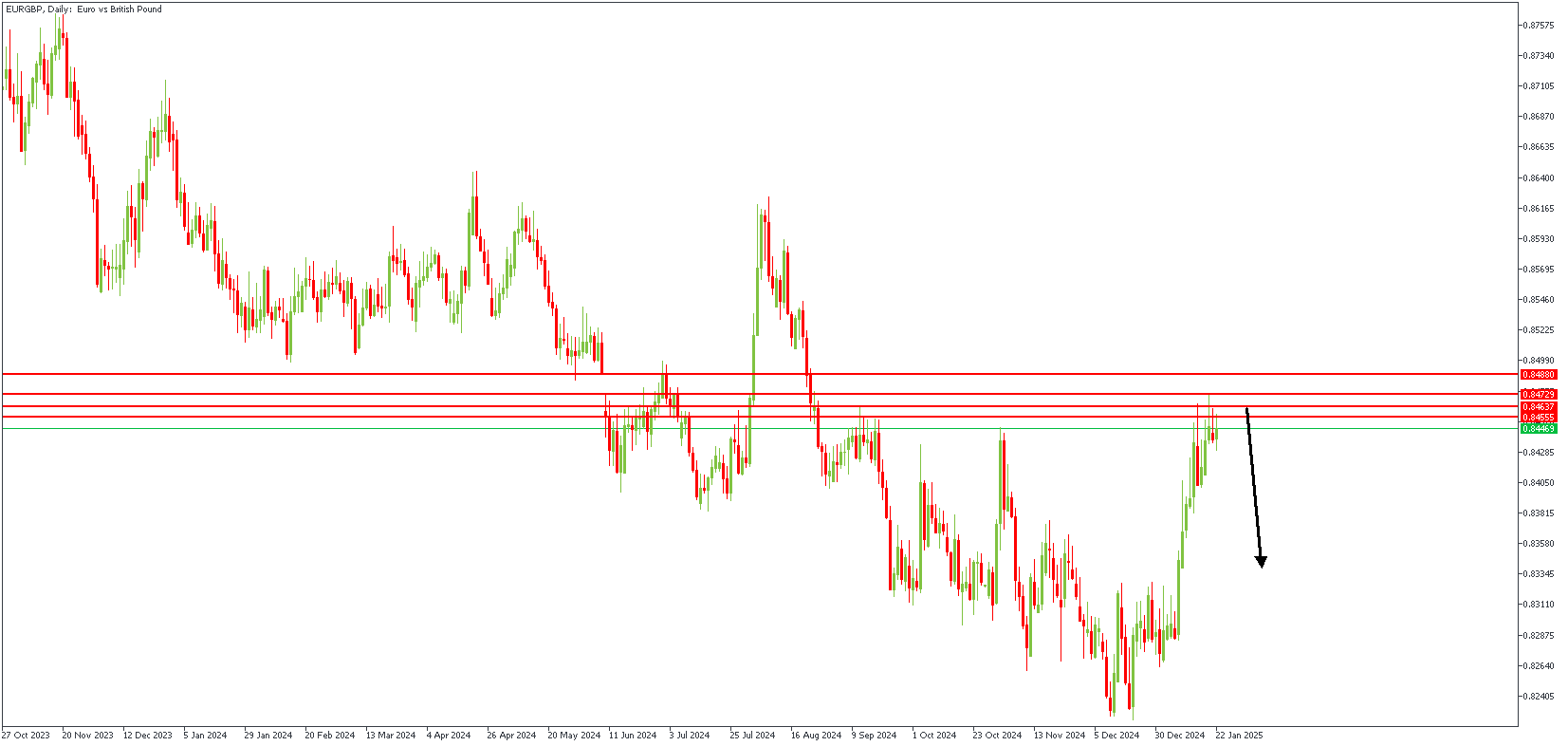

EURGBP – D1 Timeframe

EURGBP on the daily timeframe chart has just bounced off the pivot area right after a liquidity sweep from the previous high. However, this is not expressly clear enough to build a proper sentiment, hence the need for a lower timeframe POV of the price action.

EURGBP – H3 Timeframe

.png)

The trendline break and retest is a critical price action pattern for confirming a reversal. As seen on the 3-hour timeframe chart of EURGBP, we see that the reaction from the daily timeframe pivot region has now gone ahead and broken below the trendline support, holding prices up. In this light, a retest of the trendline often signifies the onset of a reversal – thus confirming the bearish sentiment in this case.

Analyst’s Expectations:

Direction: Bearish

Target: 0.84983

Invalidation: 0.83065

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.