Fundamental Analysis:

The Bank of Japan (BoJ) meets today, January 23, 2025, at 10:00 PM New York time, expecting a 25 basis point rate hike, bringing the rate to 0.50%, the highest level since 2008. This expectation is based on sustained wage growth, inflation above 2%, and the need to curb the yen’s significant depreciation. Major Japanese banks have also reached valuation levels not seen in nearly a decade, reflecting market confidence in monetary policy normalization.

Bullish Scenario: If the BoJ hikes rates as expected, the yen could strengthen due to higher yields, negatively impacting Japanese exporters like Toyota. This could drive EUR/JPY lower, as a stronger yen reduces Japan’s export competitiveness.

Bearish Scenario: If the BoJ maintains rates at 0.25%, the yen may weaken as investors seek higher yields in other currencies. This could push EUR/JPY higher, favouring Japanese exporters by making their products more competitive globally.

Technical Analysis

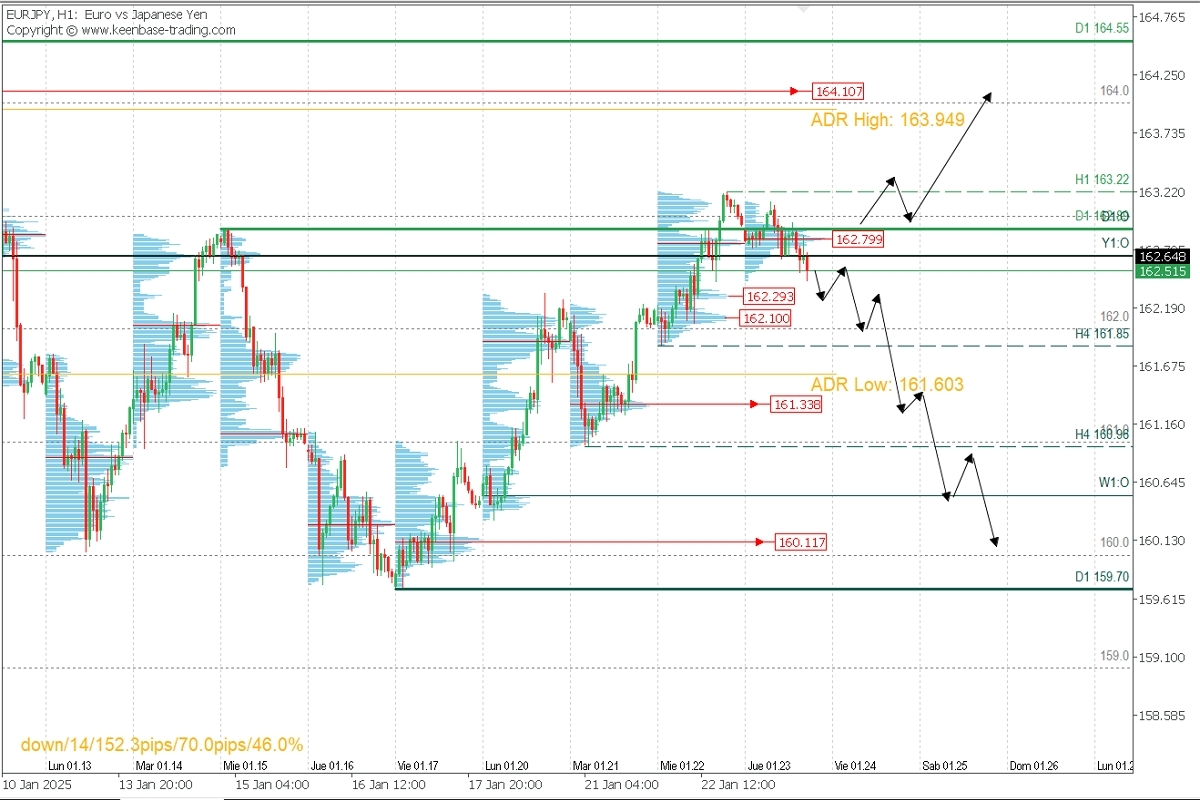

EURJPY (H1)

Supply Zones (Sell): 162.80 and 164.00

Demand Zones (Buy): 162.10, 161.33 and 160.11

The corrective bearish move of January seems to be nearing completion after breaking last week’s resistance at 162.88, validating intraday support at 161.85. As long as this level holds, a bullish reversal is likely.

The bearish open today concentrate volume around 162.80, a supply zone acting as resistance, which may limit upward movement in favour of selling toward yesterday’s buyer volume nodes at 162.29 and 162.10. A breach of 161.85 could drive the price lower, seeking liquidity at Tuesday’s demand zone near 161.33.

This scenario aligns with the BoJ raising rates to 0.50% later today, which could spark volatility and extend the drop to deeper liquidity zones. Conversely, if the bank surprises markets by not hiking, the yen could weaken sharply, breaking above 163.33 toward the supply zone at 164.00.

Technical Summary:

Bearish Scenario: Sell below 162.80/162.50 with TPs at 162.30, 162.10, 161.85, and 161.33, where buy setups may emerge.

Bullish Scenario: Buy above 163.00/163.22 with targets at 164.00. Additionally, short-term buy opportunities may activate at demand zones marked with red arrows.

Always confirm entry setups using an Exhaustion/Reversal Pattern (ERP) on the M5 timeframe before entering trades in key zones.

For more on POCs (Point of Control) and volume strategy: https://t.me/spanishfbs/2258