Is Ross Hook the Most Powerful Price Action Pattern?

As you know, technical analysts rely on the past of the price to predict its future. Some traders try to prove this way of trading to be wrong and unprofitable. But we want to show you the Ross Hook, the pattern, that is proven to be profitable for 32 years already.

Introduction?

The Ross Hook (RH) trading strategy is a 100% price action strategy based on the retest of 1-2-3 pattern breakout. If you haven’t read about the 1-2-3 reversal pattern, be sure to check it out first!

Also, I must warn you, if you are new in trading, trying to find a ross hook pattern on your chart may be quite difficult at first. Why? Because you need to identify 1-2-3 pattern correctly, and after that wait for Hook to emerge. That can be confusing at first but I’m sure you can deal with it!

How to find a Hook?

I don’t want you to get confused here because RH pattern is really useful, so I’ll explain everything as simply as I can. Look at the ordinary 1-2-3 pattern, and then at the Ross Hook.

Now, look closely at the RH.

Do you see it? The Ross Hook is just a smaller 1-2-3 pattern that is formed after the bigger one!

Now, everything you need to do is to find this “double 1-2-3 pattern” (that’s not an official name, but simplicity is the key).

Ross Hook Trading Strategy

To trade the RH pattern, we need to follow several steps:

- Find a 1-2-3 pattern.

- Wait for violation candlestick to emerge (it is considered to happen at the breakout of point 2 of the 1-2-3 pattern).

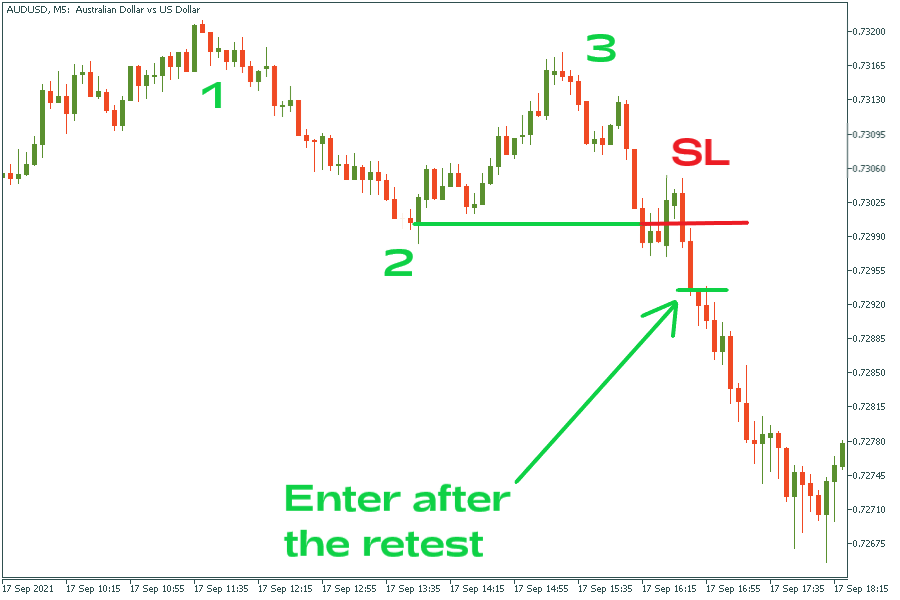

- Open a trade after the point 2 retest.

Look at the picture to get it right. We have waited for the 1-2-3 pattern to emerge, then we opened a trade after the retest and put stop loss (SL) below the retest level.

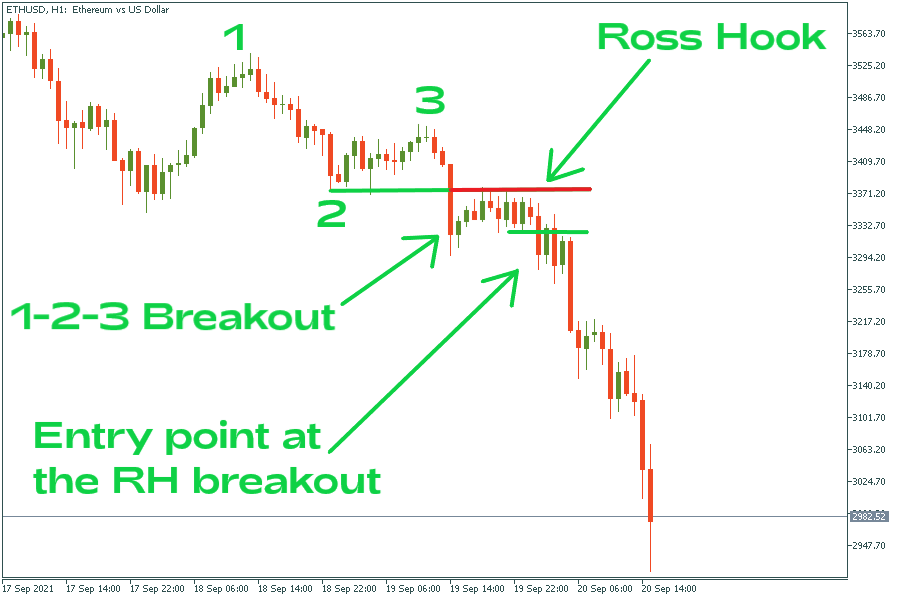

Now, let’s analyze a short trade:

We have identified a pattern, waited for Ross Hook to form, and entered after the retest.

You can measure your take profit differently:

- Measure the distance between point 1 and RH and use that as your take profit.

- Multiply the distance from the entry point to stop loss by 2 or 3 and put your take profit here. You can put several take profits and move your stop loss after the price will hit the first target. This way you will get less unprofitable trades.

- Do not set take profit. Instead of it move your stop losses behind each peak or low point that forms as your trade moves. In a good trending market, this will allow you to ride the trend most of the way and capture way more profit.

Why Ross Hook?

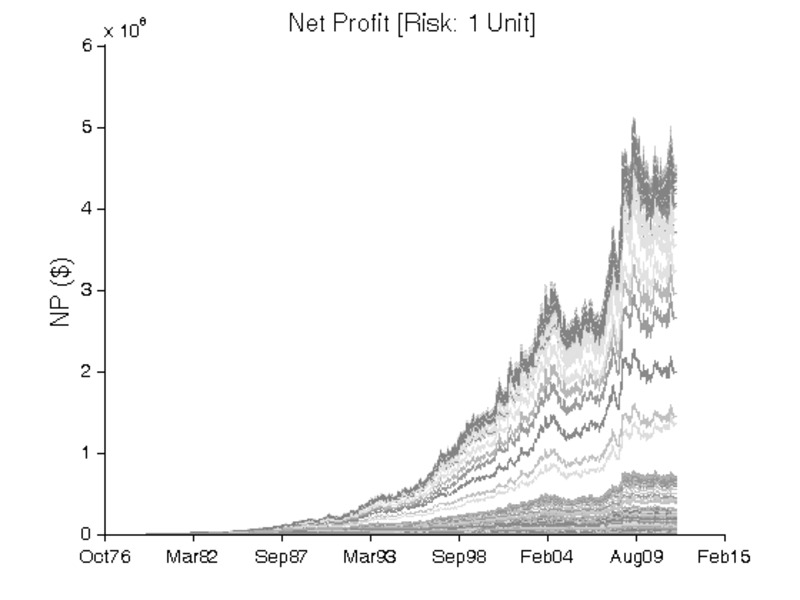

First of all, I want to prove the usability of the pattern. Analysts from Oxford University have tested this strategy on 42 different assets (including forex pairs, futures, and stocks) over 32 year period. Starting with $1 million and having a risk of 1% per trade the strategy has proven to be profitable. If you have traded with this strategy, you would have made more than $5 million net profit.

Let’s sum up:

Pros:

- Price-action based. You don’t need anything except a chart.

- Tested on vast periods and have proven to be profitable for decades.

- Good risk-to-reward ratio (up to 1:3 or even more, which is amazing).

- You can trade on a 1-2-3 pattern while waiting for the RH to emerge.

Cons:

- Entry points aren’t so often as on some other strategies.

- You need to identify 1-2-3 and RH patterns and filter false price movements.

- Nothing is ever perfect in trading, there will be false breakouts of RH and your stop loss can get hit.