A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

2023-08-11 • Updated

Sometimes a chart or a candlestick pattern may provide a decent entry signal if it is located at a certain level. A pin bar is one of the most reliable and famous candlestick patterns, and when traders see it on the chart, they expect the price to change its direction soon. If you understand how to recognize this pattern and use it in trading strategies, it will serve as an excellent instrument for making reasonable decisions.

A pin bar is a type of candlestick that signals the reversal of prices. It consists of a long shadow, a small shadow, and a body between them. Fun fact: this pattern’s name is short for Pinocchio, as it has a long wick similar to Pinocchio’s nose.

However, besides a long shadow, there are also special market conditions to call a candlestick pattern a pin bar.

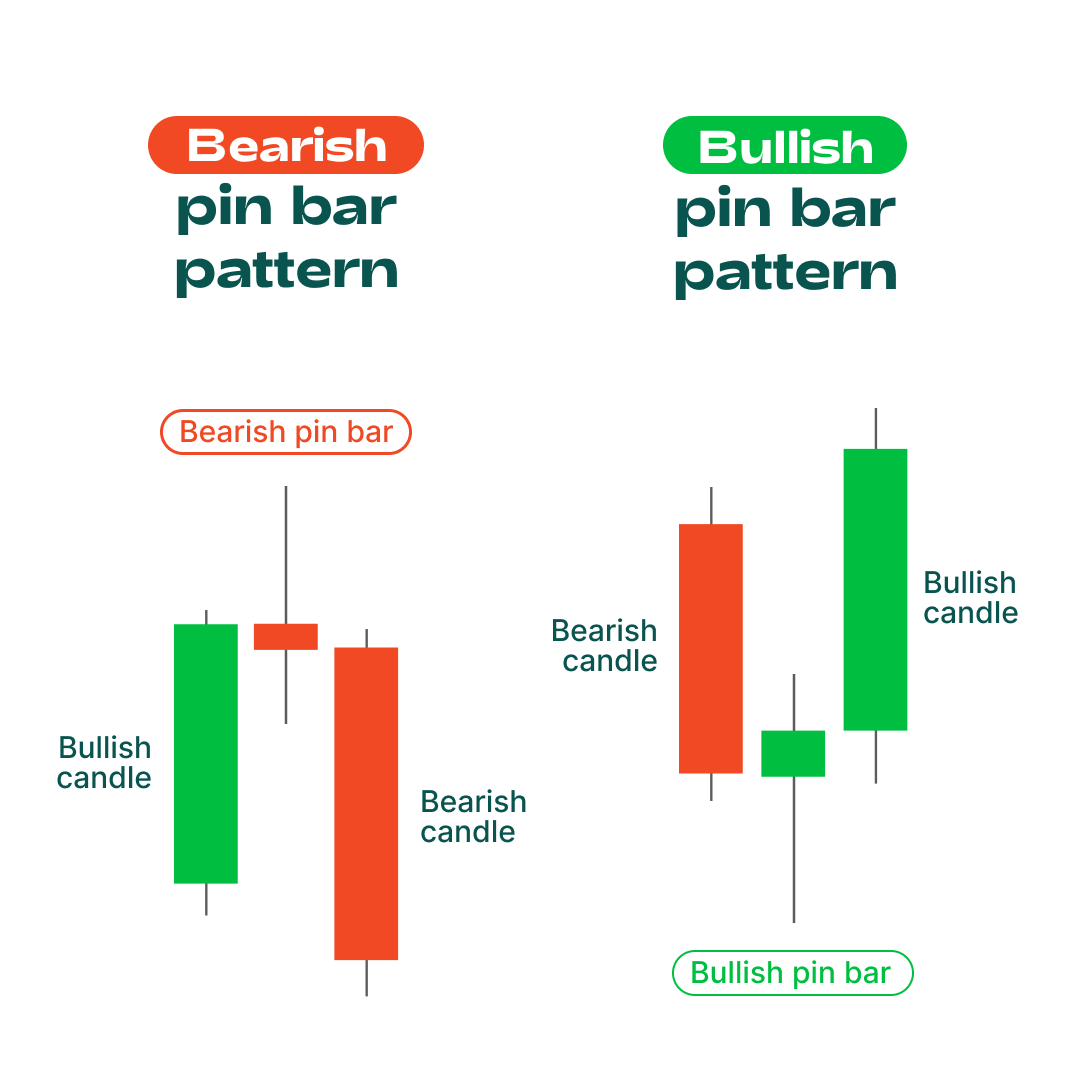

In the picture above, you can see two types of pin bars: bearish and bullish.

A bearish pin bar is formed after a solid movement upwards or at the end of an uptrend. Its body is entirely contained within the body of a previous bullish bar. It has a long upper tail that could be three or more times longer than the body size. It can be either bearish or bullish, but the bearish one is believed to provide a stronger signal. The pattern should be confirmed by the bearish candle that opens below the body of the pin bar. This signal shows that bulls tried to push the price higher, but their attempts got rejected.

A bullish pin bar appears at the end of the downward movement or downtrend. It opens within the body of the previous bearish candlestick and has a long lower tail and a small body. The pattern must be confirmed by the bullish candlestick that opens above the closing price of the pin bar.

Now, as you know the main element of the strategy, let’s move on to the setups.

Instruments: Major currency pairs with tight spreads and high liquidity available on a Standard account. Since we will talk about a scalping strategy, we must be attentive to this detail.

Timeframe: M15 or M30.

Technical setups: key levels, trend lines, pin bar formation.

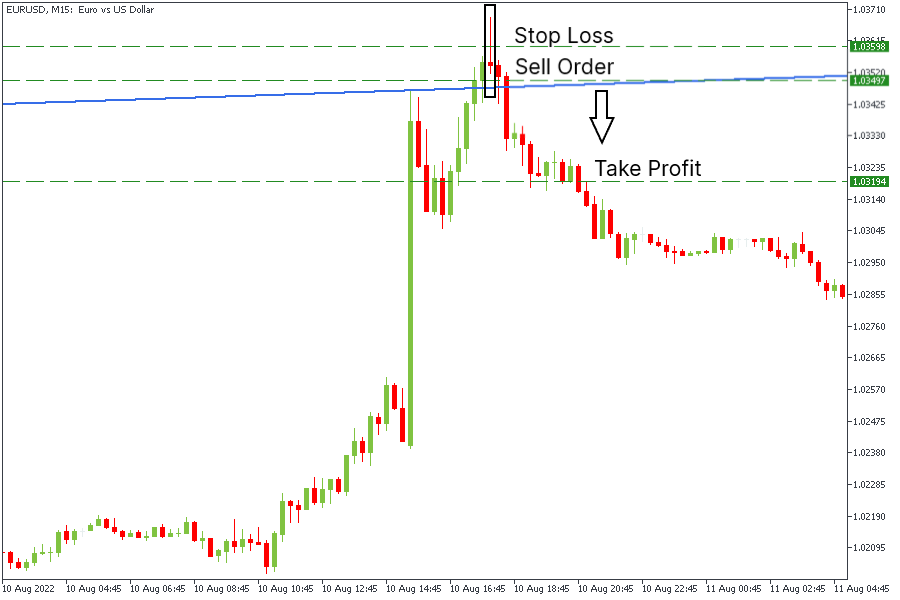

The chart above shows that EURUSD tried to spike higher after it reached a local trend line on the M15 chart. However, bulls could not hold the positions for a long time. As a result, the pin bar was formed. After confirming it, we placed a sell order below the low of the pin bar at 1.03497 and a Stop Loss above the recent resistance line at 1.03598. We put a Take Profit level at 1.03194. As a result, we earned 302 points.

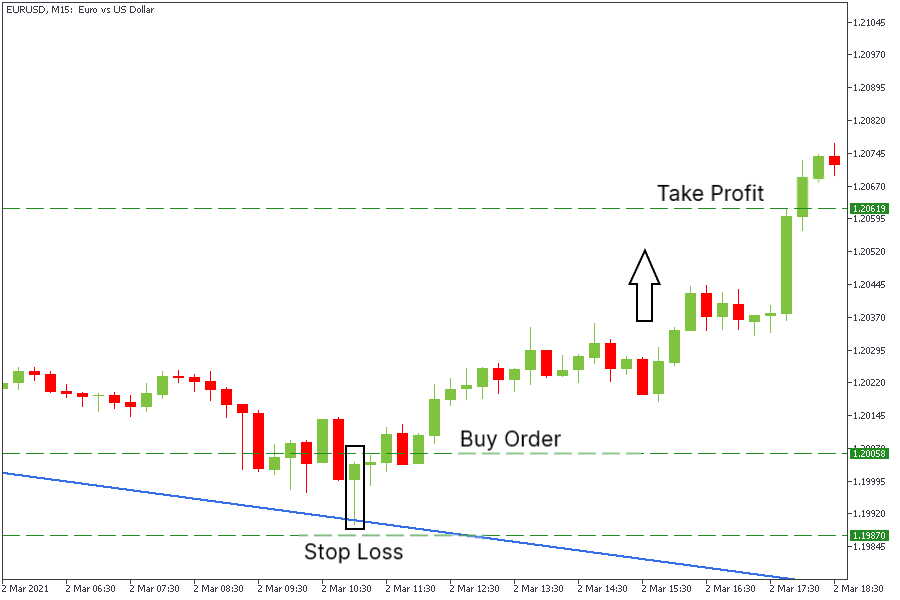

On the same chart of EURUSD, we considered a buy scenario. After the price slid below the psychological level of 1.2000 and tested the area near the 1.1900 support zone, the pin bar pattern was formed. We opened a buy order above the high of the pin bar at 1.20058 and placed a Stop Loss at 1.19870. With a 1:3 risk-reward ratio, we set a Take Profit at 1.20619. With this strategy, we earned 560 points.

Now you know a new scalping strategy for trading. To test the strategy first, you can try it out with a Demo account.

A triangle chart pattern is a consolidation pattern that involves an asset price moving within a gradually narrowing range.

Among hundreds of different indicators and technical tools for traders, the relative strength index (RSI) is one of the most popular due to its simplicity and, at the same time, its power in various trading cases. In this article, we want to tell you about another powerful tool similar to RSI but with some cool tweaks.

There are a lot of valuable strategies that require the knowledge of candlestick patterns and oscillators. However, not of them are profitable. When you start trading with them, you can face situations when the strategy is not moving your way.

If you are 18+ years old, you can join FBS and begin your FX journey. To trade, you need a brokerage account and sufficient knowledge on how assets behave in the financial markets. Start with studying the basics with our free educational materials and creating an FBS account. You may want to test the environment with virtual money with a Demo account. Once you are ready, enter the real market and trade to succeed.

Click the 'Open account' button on our website and proceed to the Trader Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

The procedure is very straightforward. Go to the Withdrawal page on the website or the Finances section of the FBS Trader Area and access Withdrawal. You can get the earned money via the same payment system that you used for depositing. In case you funded the account via various methods, withdraw your profit via the same methods in the ratio according to the deposited sums.

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!