The New Zealand dollar has been suffering during the previous week, trading at November's levels. What did result in such a bad performance of the currency?

The slump happened due to both internal and external factors.

To begin with, Wednesday’s GDP release for the third quarter came out lower, than expected. Despite the anticipated +0.6% growth, the official figures showed an increase of 0.3% only. The disappointing level of economic growth raised concerns about the possible rate cut by the Reserve bank of New Zealand (RBNZ). Earlier in August, the RBNZ had already warned about the cut of the interest rate, if the economic growth outlook does not improve in the second part of the year. For now, the central bank of New Zealand has been holding its interest rate at the lowest level of 1.75%. The uncertainties about the future path of the interest rate as well as the slow economic growth have been pulling the kiwi down.

In addition, the shaky sentiment in the market also affected the NZD. Renewed tensions between the US and China drove the price for Antipodean currencies lower. According to last week’s news, the US authorities accused Chinese officials of coordinating a campaign to steal intellectual property and other data from American companies. As the countries are expected to reach the deal within 90 days after US president Donald Trump and Chinese president Xi Jinping meeting on December 2, such news increases the risk-off sentiment. Also, the news on the US government shutdown caused risk aversion in the equity market and made the high-yielding currencies fall.

The recent Chinese figures turn out to be disappointing for the market, too. The release of the level of industrial profits for China showed a decline by 1.8%. To compare with, last time the indicator increased by 3.6%. Thus, the bearish pressure affected the New Zealand dollar negatively.

What may help the NZD to get the positive momentum in the upcoming weeks?

As the end of the year approaches, there is no significant data for the currencies until January. We need to wait for more updates on the trade truce between the US and China. China has already announced more trade negotiations with the US in the next month. Moreover, the Asian country anticipates the Office of the US Trade Representative to postpone the effective date for possible additional tariffs until March. This fact may bring positivity to the NZD traders as China is one of its key trade partners.

Also, the recent negative comments by Donald Trump on the Federal Reserve and rumors about the Fed Chair Jerome Powell possible dismissal by the US president weakened the USD. This fact may help the NZD to appreciate against the greenback.

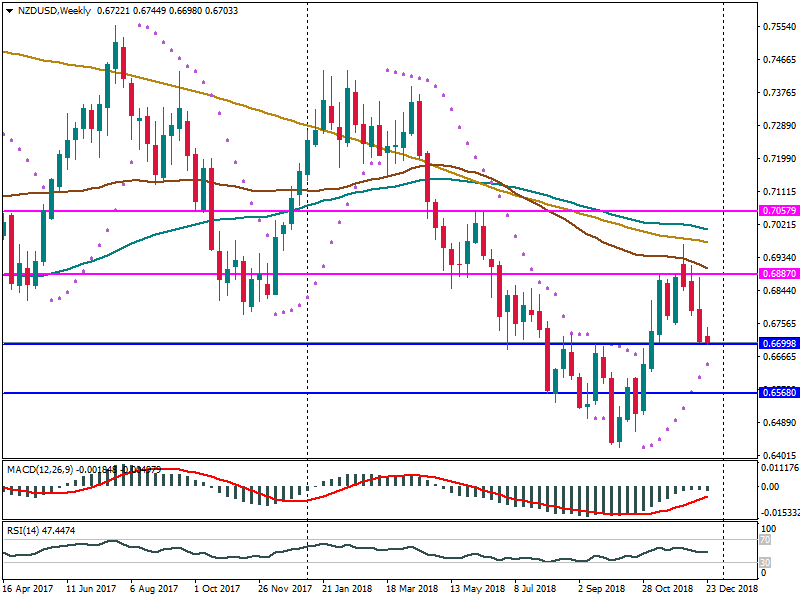

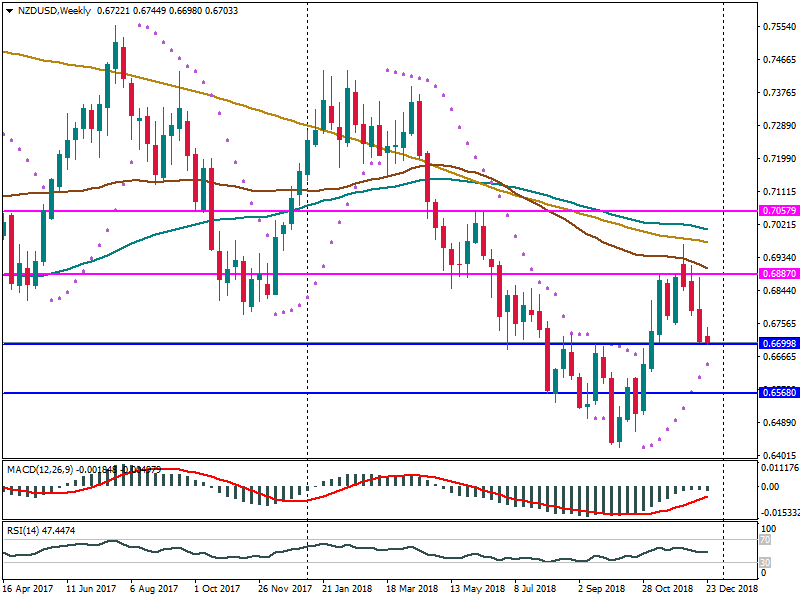

Let’s look at the weekly chart of NZD/USD and determine the key levels to look up to in January.

On the weekly chart, we see that the pair has been falling for the three weeks in a raw. If the bearish pressure continues, the kiwi may test the support at 0.6687. If this level is broken, the next support for the pair lies at 0.6568. However, the parabolic SAR shows an uptrend for the pair. That means that the kiwi may recover soon. If the New Zealand dollar is supported, NZD/USD will rise to the resistance at 0.6887. The next resistance is placed at 0.7058.

Conclusion

Despite the negative December for the New Zealand dollar, the current trend for the pair is still bullish. At first, we need to follow the updates from the White House on the decision concerning the Federal Reserve. Secondly, any positive news on the trade negotiations between the US and China will result in the correction for the pair.