Brent oil is currently on a bullish trend, facing resistance near $84 and supported by the 200-day EMA. Breaking above this level could lead to a climb towards $90. Short-term support is observed around $80, backed by the 50-day EMA. As summer approaches and travel increases, crude oil tends to benefit from seasonal patterns. Despite temporary setbacks, buying opportunities are anticipated in a market with declining supply. Traders are also watching for potential economic stimulus from central bank rate cuts, which could lift commodity prices, especially oil. While the oil market is a key indicator of global economic health, its volatility remains a challenge. Overall, there's a bullish sentiment, albeit with lingering challenges.

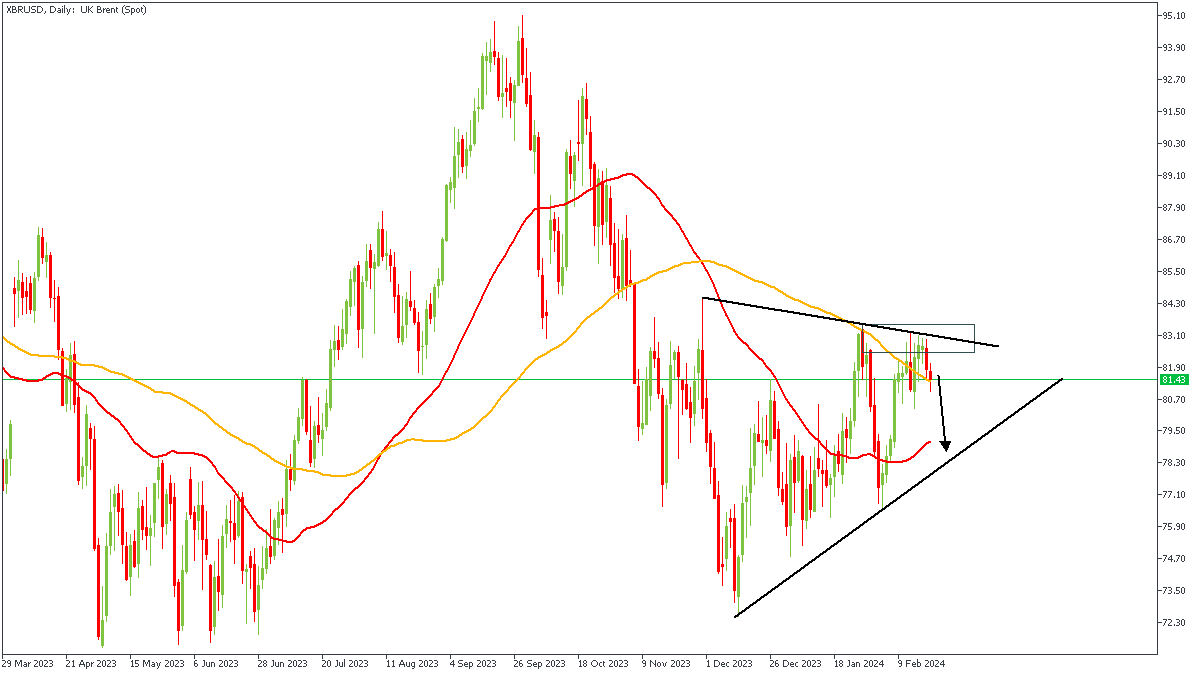

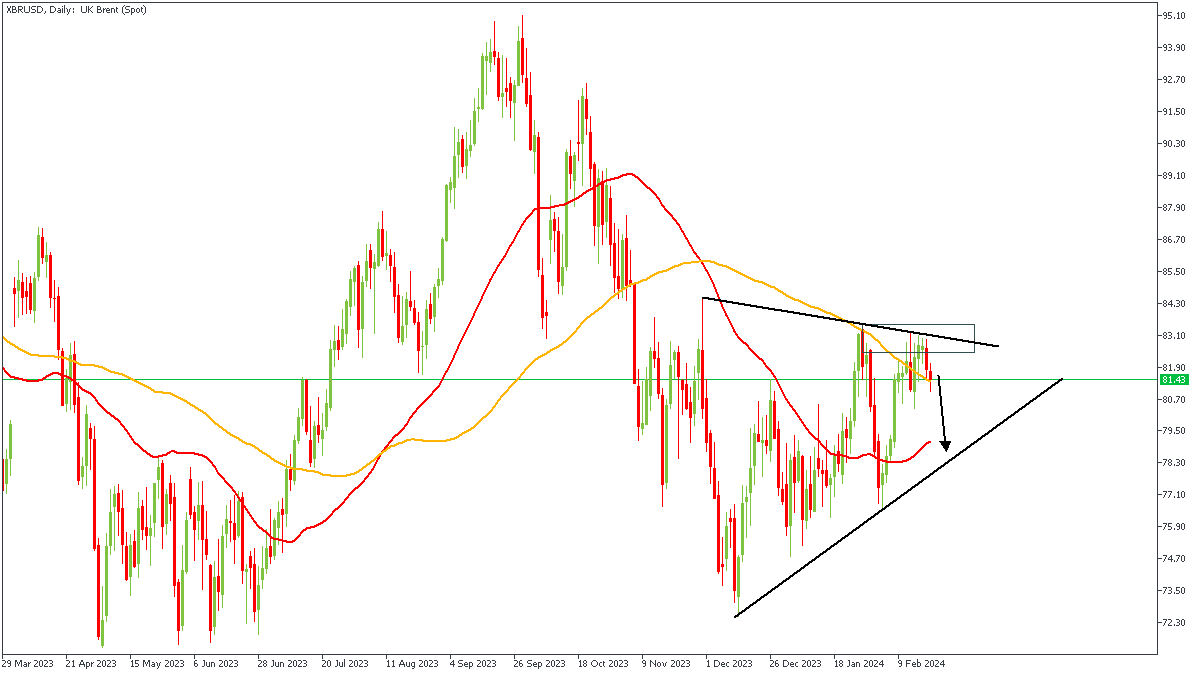

XBRUSD - D1 Timeframe

Brent (XBRUSD) on the daily timeframe has just been rejected off the rally-base-drop supply zone, which is in alignment with the trendline resistance, and the bearish array of the moving averages, as well as the 100-day moving average resistance. In light of these confluences, I will be expecting a continuation of the bearish movement with a target at the confluence of the 50-day moving average and the trendline support.

Analyst’s Expectations:

Direction: Bearish

Target: $79.13

Invalidation: $83.60

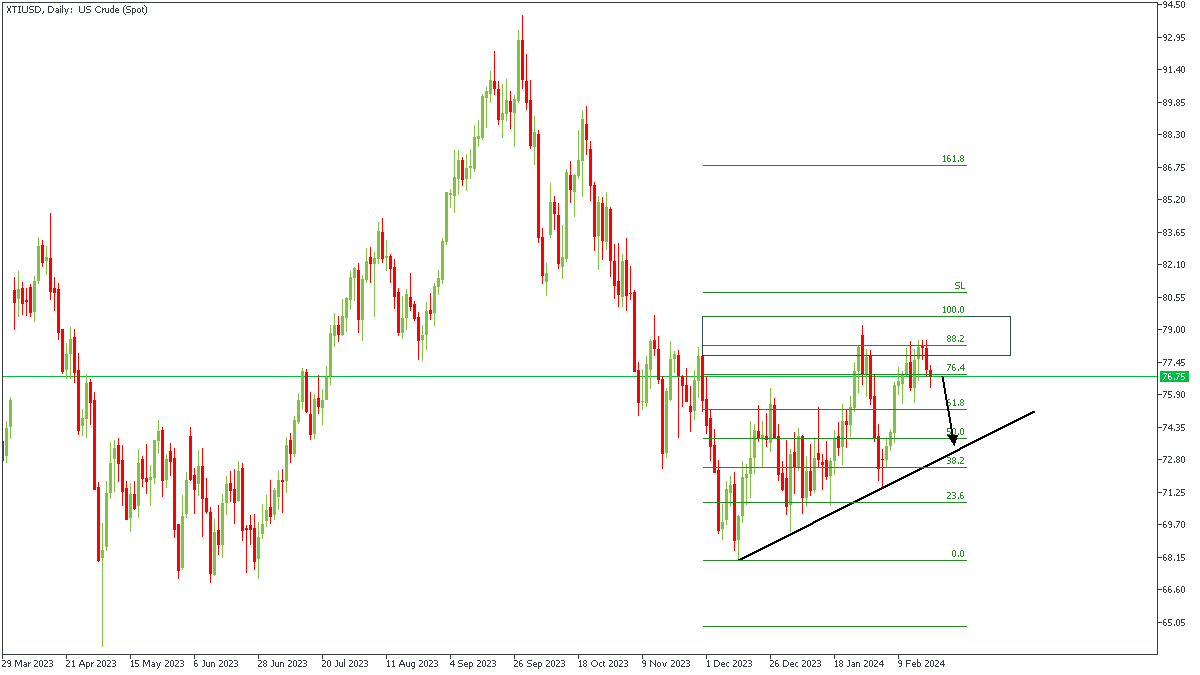

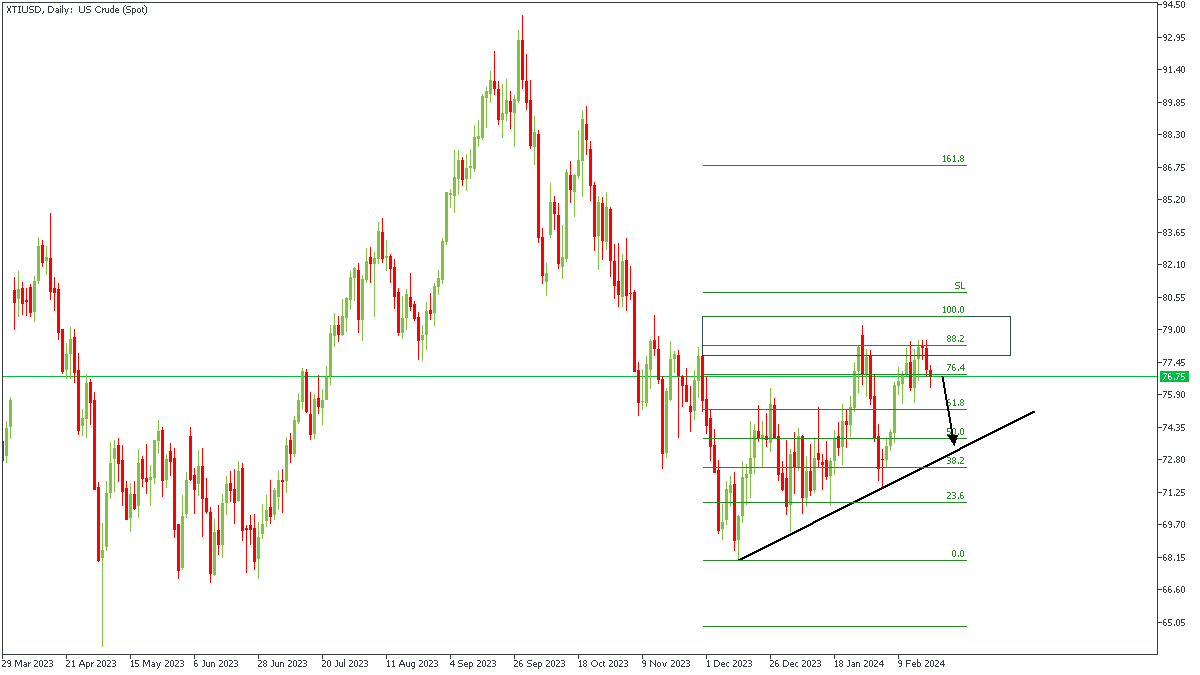

XTIUSD - D1 Timeframe

XTIUSD (USOIL) has recently reacted to the bearish pressure from the rally-base-drop supply zone around the 88% Fibonacci retracement level. In light of this, I perceive that price could slide further down till it reaches the trendline support, before we get to see a possible continuation of the bullish pressure.

Analyst’s Expectations:

Direction: Bearish

Target: $73.83

Invalidation: $79.65

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.