Fundamental

Previously, we were basing our projections of the S&P on the assumption that the third wave up was just about to launch at 3000. Eventually, the fears of the second virus wave took over and pressed on the S&P and dented into it below 3000. Does it change the tactical outlook? No.

First of all, factoring in the possibility of the wide-scale virus re-appearance cannot carry on forever unless and until it actually takes place. So far, there are few cities with a surge in infections, but it is way too early to panic again.

Second, even if the second wave hits the globe, it is being technically factored in now, hence the impact will be smoothed and contained, if not absorbed.

Third, psychologically, if there are two consecutive and equally damaging disasters, the first one is always perceived as more hurtful and dramatic, while the following one comes as “well, that’s bad, but we’ve seen that already”.

That’s from a purely market reaction standpoint. From the phenomenological standpoint, a real hit to the economy caused by the second wave is also quite unlikely for various reasons such as the following.

First, imposing additional lockdowns is simply not affordable. Of course, different reasoning will be called to arms, but eventually governments will make their way to make sure that economies keep running even despite the raging virus. The logic is quite straightforward: there will be those who die because of the virus without a lockdown, but there will be many more who eventually die if economies get halted again. The latter will not only affect the current but also the future generations that will be struck down to poverty. No one wants that – neither the rich nor the poor.

Second, a lot of businesses already adjusted their activities as per the guidelines of remote functioning. Some of them will actually stay in many ways “virus-configured” because sometimes it is even more efficient. In other words, whatever happens next, people are more prepared and experienced.

Third, even without the vaccine (but hopefully with it), the medical treatment and organization is now much more advanced against the virus re-appearance compered to its unprepared state before.

So overall, whatever comes from the virus side, it will not be as scary as it has been until now.

Technical

For this reason, we still maintain that the S&P will be gradually growing even if it falls to yet another local lower. It will eventually pick. The question is – how?

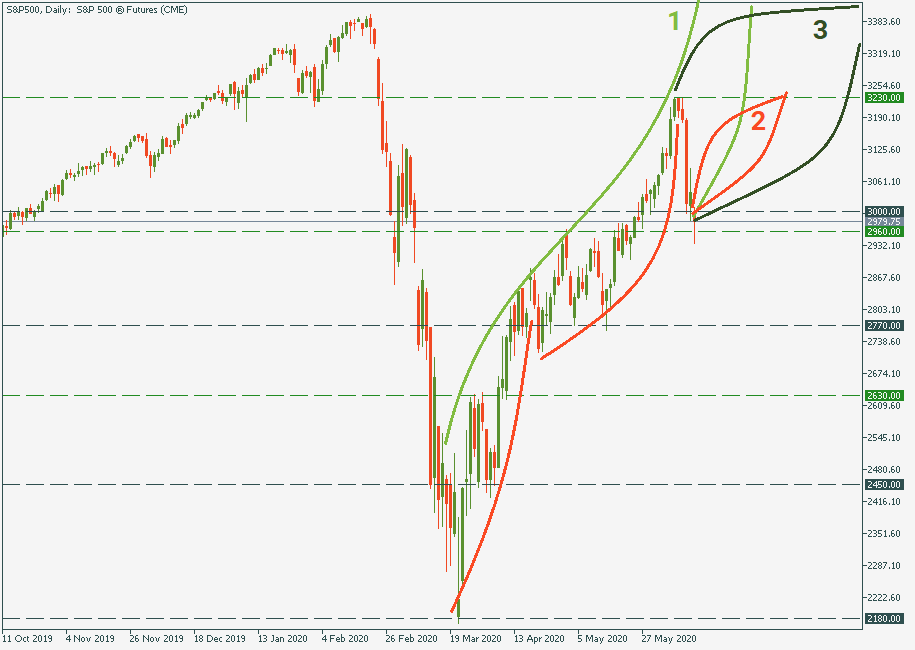

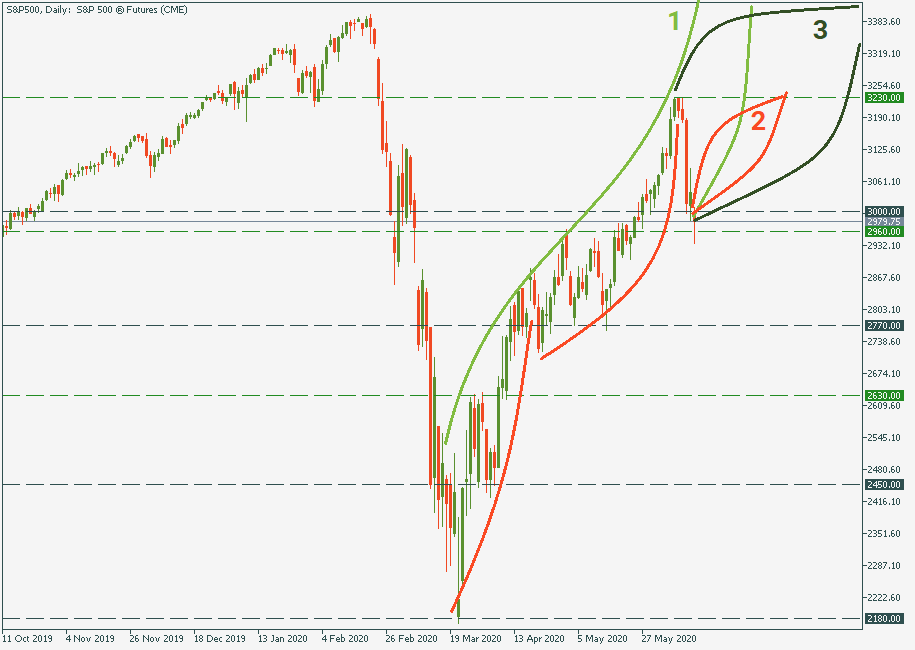

The first scenario marked as a light green zone as number “1” is a direct graphic continuation of the growth trajectory S&P was in until recently. The current drop, although notably larger than previous ones, falls well into a potential beginning of another wave up. That may be too optimistic a scenario though.

A more realistic and general suggestion is that the S&P will move somewhere within zone 3, which gives large room for possible chart maneuvers, the most probable of which is marked by zone 2.

That’s why 3,230 is still a likely bullish target for the end of this week-beginning of the next week.

LOG IN