The Reserve Bank of New Zealand surprised the markets again by refraining from raising interest rates a day after the country announced a nationwide lockdown due to multiple covid19 cases in the country. The lockdown should last for three days only, while some cities might last for seven days, which might be an understandable decision by RBNZ.

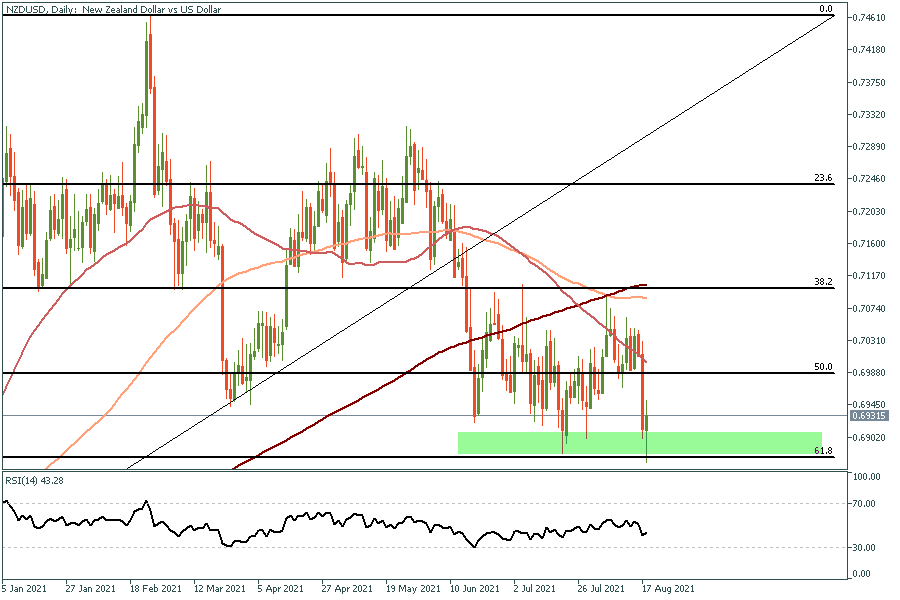

The kiwi declined sharply after the announcement all the way to 0.6870’s but managed to recover, trading around 0.6950 by the time of writing this note. Such rally comes after the RBNZ kept the door open for tightening soon.

The statement says: ”The Committee agreed that their least regrets policy stance is to further reduce monetary policy stimulus to reduce the risk that inflation expectations become unanchored. However, in light of the current Level 4 lockdown and health uncertainty the Committee agreed to leave the OCR unchanged at this meeting”

In the meantime, with tightening and tapering are still on the table despite the lockdown, NZDUSD remains a good candidate for another long position despite the recent decline and covid19 outbreak.

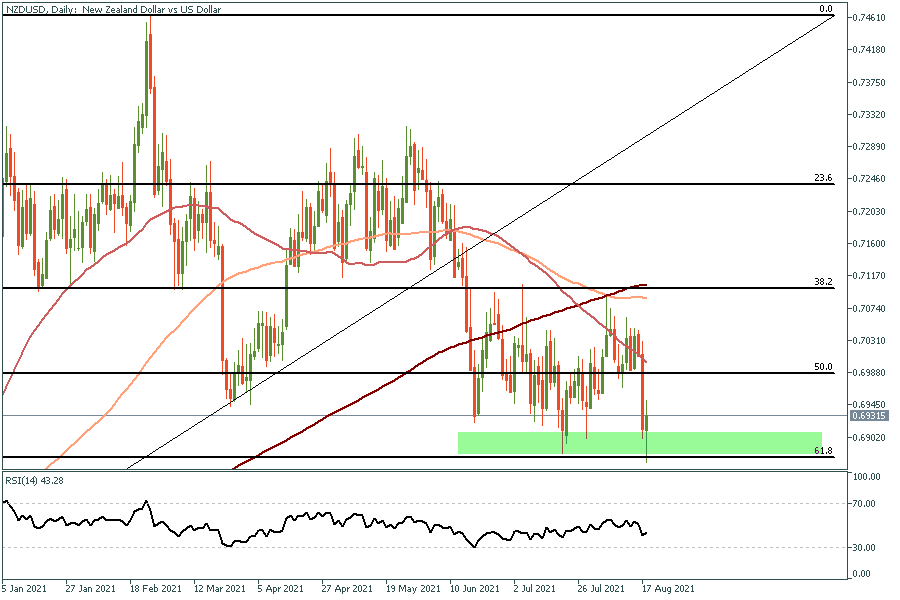

NZDUSD is trading within a buying zone stands between above the 61.8% Fibo which stands at 0.6876, while stops should not exceed today’s low, with a possibility to regain above 0.70 in the coming days.