NZD/USD hit the two-year high. Will it keep rallying?

What happened?

Every Monday vaccine news encourages us! Just recently Pfizer and Moderna have unveiled that their vaccines are 95% effective. Today, we have known that the USA is planning to start vaccination in three weeks, while the UK – next week. Therefore, investors anticipate the soon end of the pandemic and stream their capital to riskier assets such as the New Zealand dollar.

In addition, New Zealand published upbeat retail sales. Analysts expected sales would rise by 20.0%, while they increased by 28.0%. That offset all the losses of the previous quarters. As a result, the kiwi skyrocketed to highs unseen since 2018.

Technical tips

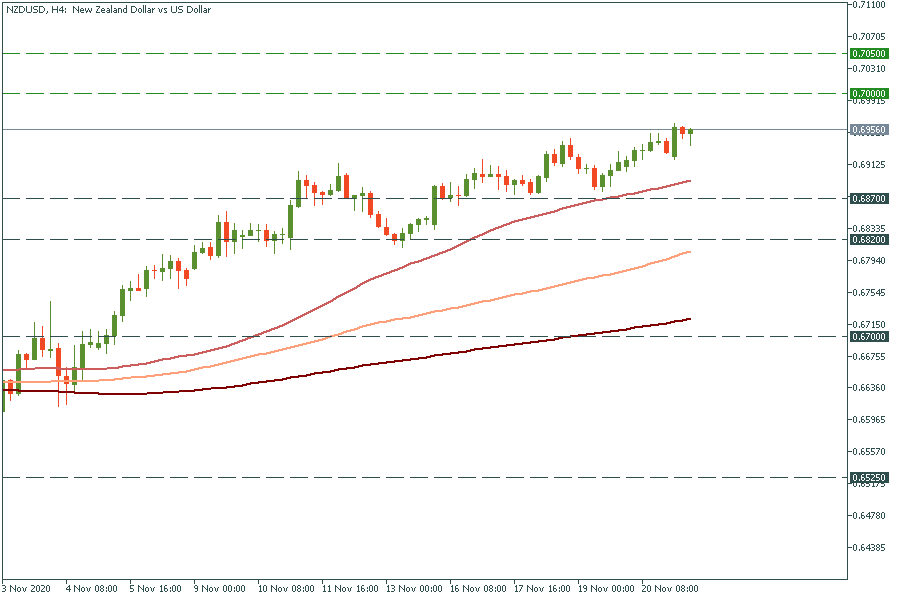

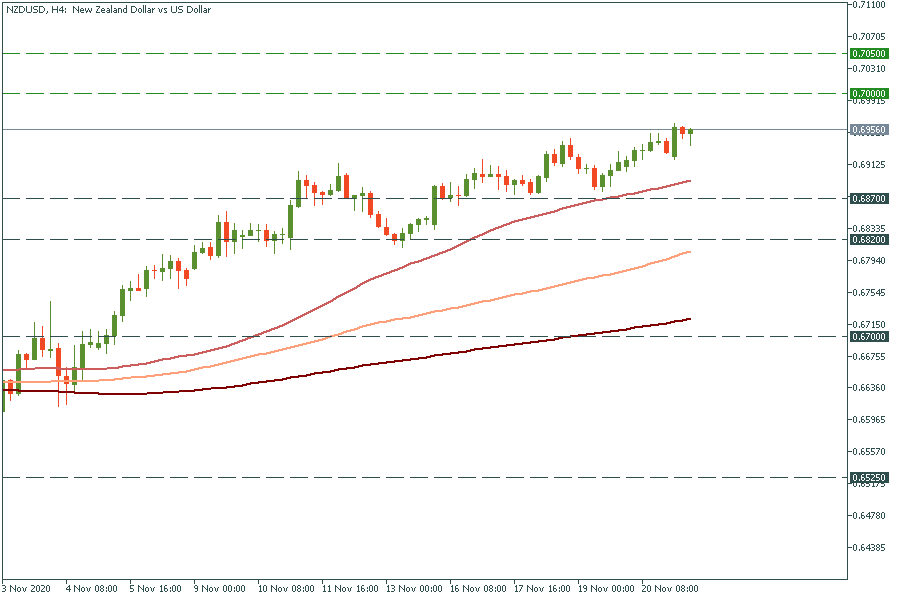

NZD/USD set a strong uptrend. The move above the key psychological mark of 0.7000 will drive the pair to a resistance of the next round number at 0.7050. In the opposite scenario, if it fails to break 0.7000 and reverses, it may fall to Friday’s low of 0.6870, clearing the way to the next support of 0.6820.

TRADE NOW