Last week turned out to be disappointing for the AUD bulls, despite the gap up opening on Monday after the negotiations between the Chinese and US presidents. What are the reasons behind this slide?

At first, the Reserve Bank of Australia (RBA) did not change its dovish tone since November’s statement and left the cash rate unchanged at 1.5%. The RBA Governor Philip Lowe mentioned the direction of the international trade policy as the main uncertainty, which affected the bank’s decision.

Also, the quarterly GDP released on Wednesday grew only by 0.3%. This is lower level than the excepted 0.6% by analysts. The weak performance of the Australian economy occurred mainly due to the slowdown of private consumption. As a result, the Australian 10-year bond yield fell to the 13-month low. This factor made the aussie to fall further down.

The final shot to the AUD from the economic calendar’s data came with the release of the Australian trade balance. The country’s exports increased by 1%, while imports rose by 3%. This figures made the total trade balance of Australia to drop to 2.316 billion AUD from September’s release, despite the expected rise of 3.2 billion AUD.

Let’s not forget about the market sentiment. During the G20 Summit, the leaders of China and the US have agreed to reach the trade deal within 90 days. In case of the negative outcome, the US will impose the tariffs on the additional Chinese goods. As far as the final agreement has not reached yet, the uncertainties hit the Australian dollar. The recent arrest of the Huawei's chief financial officer and deputy chair Meng Wanzhou in Canada on the orders of the US authorities also exacerbate the relationship between two countries. As a result, the risk-off sentiment increased across the equity markets.

What may bring a chance for the AUD to recover?

At first, we need to look closely at the Fed statement next week. Earlier, some of the FOMC members expressed dovish opinions on the monetary policy by Fed in 2019. If the Federal Reserve indeed slows the pace of rate hikes, the greenback will weaken. In that case, the antipodean currencies will be trading higher against the USD.

The economic calendar next week may also offer trade opportunities for the AUD bulls. On December 20, the level of Australian employment change and the unemployment rate will be published. Last month, the employment in Australia outperformed the forecast. The employment advanced by 32.8 thousand jobs (vs. the forecast of 19.9 thousand jobs). The level of unemployment rate declined to 5.0%, which was also greater, than the expectations.

Finally, any updates on the trade truce between the US and China, the closest Australian trade partner, will provide volatility for the aussie.

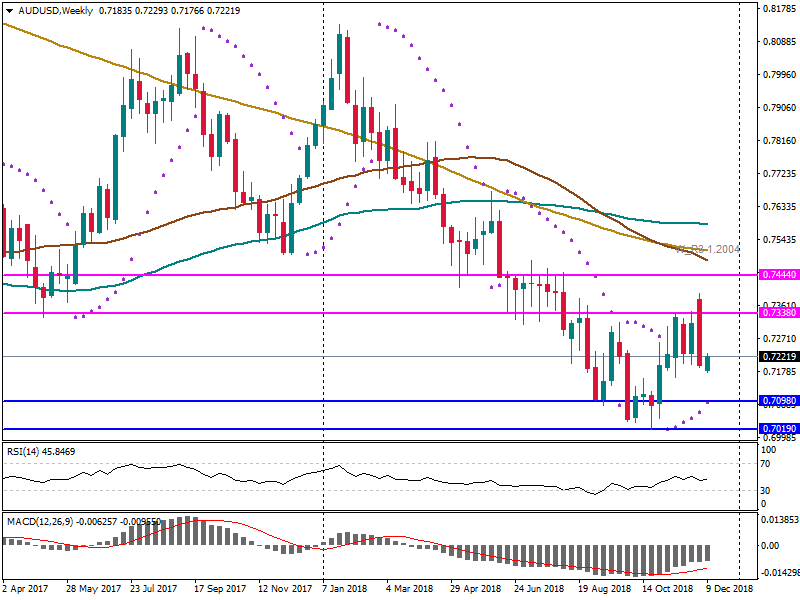

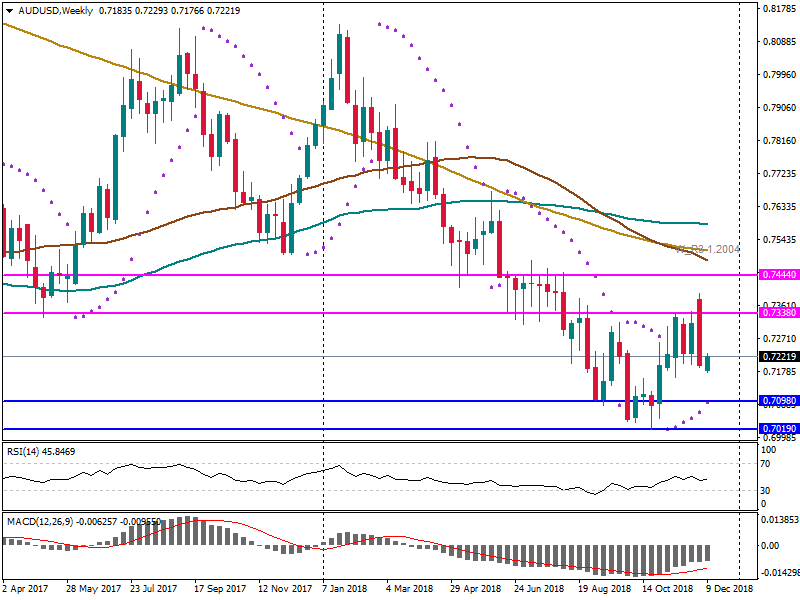

Let’s look at how the Australian dollar has been trading against the USD.

Last week, AUD/USD fell sharply. If the risk-off sentiment continues, bears will drive the pair towards the support at 0.7098. The next support is placed at 0.7019. If the Australia dollar is supported, the pair will rise towards the resistance at 0.7338. If it is broken, the next resistance is at 0.7444. Parabolic SAR formed 6 dots below the chart, which means that the upward trend continues.

RSI is placed in the middle, while MACD moves parallel to its signal line. These indicators do not signal a reversal.

Conclusion

Despite the recent ups and downs of the Australian dollar, the antipodean currency has gained a lot since October 2018. We need to look closely on the news on the trade negotiations between the US and China, as well as on the US monetary policy. Hopefully, the Federal Reserve will make the situation clearer.