The British pound gained on a possible compromise between the EU and the UK.

What happened?

According to The Sun newspaper, the EU’s Michel Barnier is ready to soften his position on a Brexit deal. The goal is to reach an agreement over coming weeks. Thus, now the outcome highly depends on the British Prime Minister Boris Johnson. He should make concessions too. The mere possibility of a soon Brexit agreement pushed the pound sterling upward.

There are three main sticking points between two sides: fishing rights, the level of EU courts’ control and the future obeying EU standards. Reports proved that the EU and the UK had almost reached a deal on the ‘landing zones’ issue. There hasn’t been any official proof of that information yet. Besides that, last week the GBP rose on rumors of compromise on fishing rights.

What does it mean?

Any development towards the Brexit agreement will drive the GBP higher. However, Brexit also goes along with risks for the UK, which may weigh on the pound in the long run. Negotiations will continue during the next week in Brussels. Analysts anticipate some news on Thursday or Friday, which will define the further GBP movement.

How to trade GBP now?

This morning the positive data on the British CPI came out. It was 0.6%, while the forecast was 0.4%. It gave an additional stimulus for the pound growth. Also, positive vaccine tests improved the market sentiment and underpinned the risk-sensitive GBP. However, not everything is so good as it seems. The UK followed US sanctions over Hong Kong on China and phased out its dependence on Huawei. Huawei claimed that the move was "bad news for anyone in the UK with a mobile phone" and mentioned that this decision will "move Britain into the digital slow lane, push up bills and deepen the digital divide."

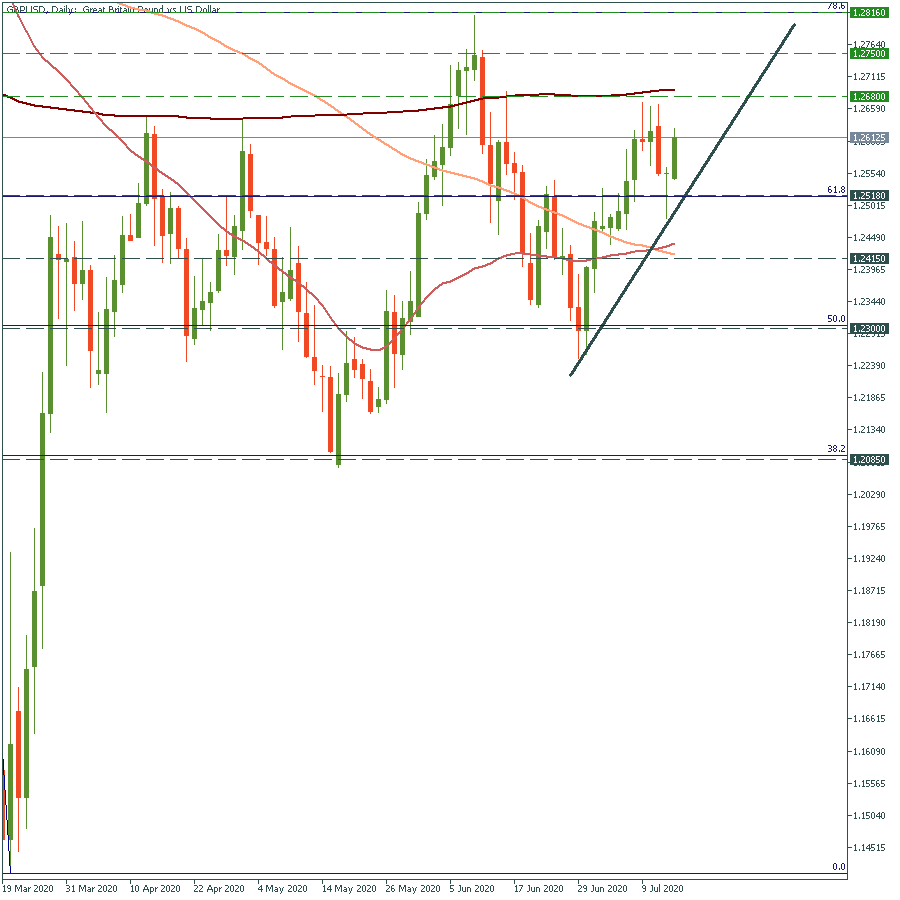

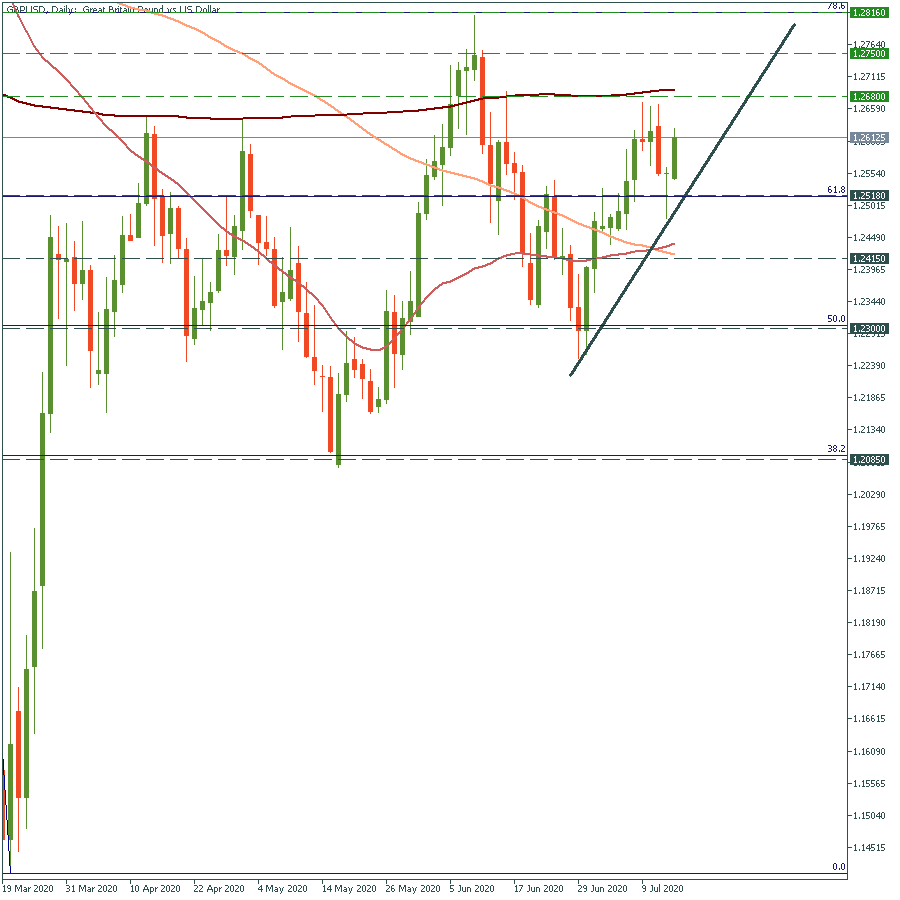

Anyway, the GBP keeps rallying. Positive factors outweighed. GBP/USD is heading towards the resistance at the 200-day moving average at 1.268. If it crosses it, it may surge higher to 1.275. Moreover, it’s trading above the 61.8% Fibonacci level, that means it’s likely to reach the 78.6% Fibo level at 1.2816. Support levels are 1.2518 and 1.2415.

LOG IN