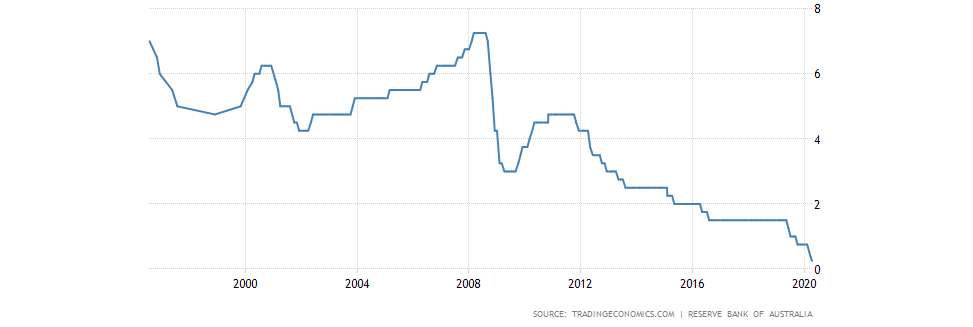

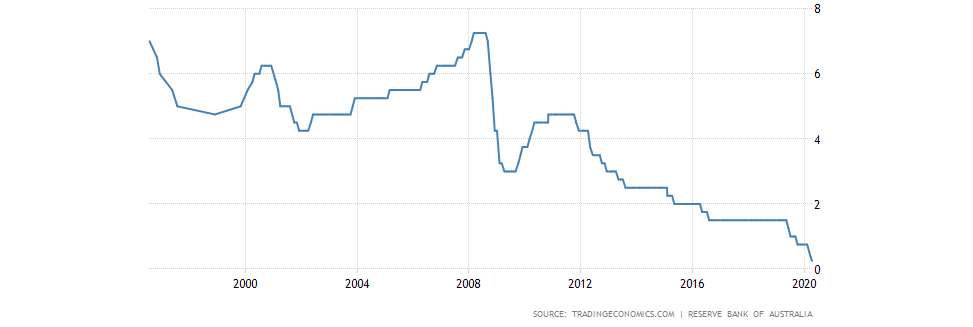

Interest rate

The RBA left the interest rate at 0.25% today. As such, it is a record low level. In the context of the situation, it is natural as seen as a response to the damage inflicted by the virus. In fact, given the severity and uncertainty of the economic fallout still yet to evaluate, it may come as a sign of strength that the rate was not decreased further.

Greater context

China reports no new mortal cases and is clearly on the way out of the pandemic. Consequently, it’s economy is gradually recovering and gaining the moment it lost three months ago. For Australia, that is vital given the close trade relationship it has with China. Although Australia itself is not yet through the crisis, the improved position of its main trade partners improves its own economic outlook and bring some positive notes to its currency.

The best contrast

As we have seen before, the best barometer for the mood of the AUD is the JPY. Generally, AUD behaves in a similar manner to all its counterparts in the Forex market, but the Japanese yen makes it much more visible than, say, against the USD, in many cases. So as we have said, the improving position of the AUD is clearly visible on the chart. However, the upward dynamics should also be ascribed to the weakening of the JPY. Will the resistance of 68.81 be crossed? Very possibly, especially given the recent announcement of a state of emergency in Japan. That doesn’t change the strategic layout though. That’s why keep in mind that the current picture of the AUD climbing further is merely an effort of this currency to inch above the 10-year low it is in. In other words, the outlook for the AUD is positive in the short-term. In the long-term, there are miles to go to reverse a heavy outlook for the Australian dollar.

Technical levels

Resistance: 68.81

Support: 64.75