What should the AUD traders expect from the RBA meeting?

What should the AUD traders expect from the RBA meeting?

FOMC's report provided positive feedback on the current domestic US economic dynamics. However, a rather dovish outlook made the US dollar weak, resulting in the USD's plunge in the currency pairs across the Forex market.

The Forex market is volatile and a bit indecisive this Tuesday but we have the S&P finally opening the way to 4000 as it managed to cross the resistance of 3960!

In a few days, primary Forex currencies will hear what their respective central banks think about the future - and we're about to trade it!

The Bank of England will hold a monthly meeting on Thursday, at 14:00 MT time. What should we expect?

The market is cautious ahead of the ECB monetary policy statement at 14:45 MT time, where the regulator may introduce additional stimulus measures based on lockdown actions in France and Germany…

On Thursday, October 16, the RBA governor signaled more stimulus measures at the next meeting on November 3. Will we see the slump of the aussie?

Today at 5:00 MetaTrader time the Reserve Bank of New Zealand will publish the rate statement. What do we need to expect?

Let's find out why the USD has been a mover despite the measures by the Fed

The Turkish Central Bank is on a rate-cutting path; on February 19 it will make another announcement. What's the logic behind?

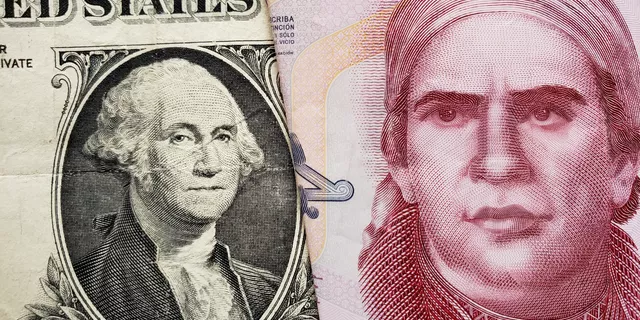

The Bank of Mexico recently reduced the interest rate. The MXN gained against the USD. Isn't it strange?

Your guide into the most important news for this week

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!