USDCHF traders brace for action — key data on the horizon!

The USDCHF pair, commonly referred to as the "Swissie," represents the exchange rate between the US dollar and the Swiss franc. The US dollar is heavily influenced by US economic indicators, such as inflation, employment, and Federal Reserve policy decisions. Meanwhile, the Swiss franc is known as a safe-haven currency, often appreciating during periods of global uncertainty or economic instability. Swiss economic indicators, such as inflation and interest rate decisions by the Swiss National Bank, also impact the franc’s value.

Switzerland Consumer Price Index (CPI) MoM, Oct 3, 8:30 (GMT+2)

The Swiss Consumer Price Index (CPI) is forecast to be unchanged at 0.0% for the month, indicating a stable price level in the country. If the actual CPI data is better than expected and shows an increase in inflation, this would indicate rising consumer prices and a potential overheating of the Swiss economy. This could prompt the SNB to take a tougher stance, possibly holding rates longer without a cut, which would cause the Swiss Franc to rise and push the USDCHF lower.

Conversely, if the Consumer Price Index comes in worse than expected, indicating lower inflation or even deflation, this would indicate weakening economic conditions in Switzerland. This could force the SNB to maintain or even loosen monetary policy, likely weakening the Swiss franc and causing the USDCHF to rise.

US Nonfarm Payrolls, Oct 4, 14:30 (GMT+2)

The US non-farm payrolls report is expected to show an increase of 130,000 jobs, down from the previous reading of 142,000. If the actual number exceeds expectations, indicating stronger job growth, it will indicate the resilience of the US labor market. This could lower expectations of a rate cut by the Federal Reserve, as the need for monetary easing will seem less urgent, leading the USDCHF pair to rise.

However, if the non-farm payroll data is worse than expected and shows weaker job growth, it could raise concerns about the health of the US economy. This will likely increase speculation that the Federal Reserve may cut interest rates and cause the USDCHF pair to fall.

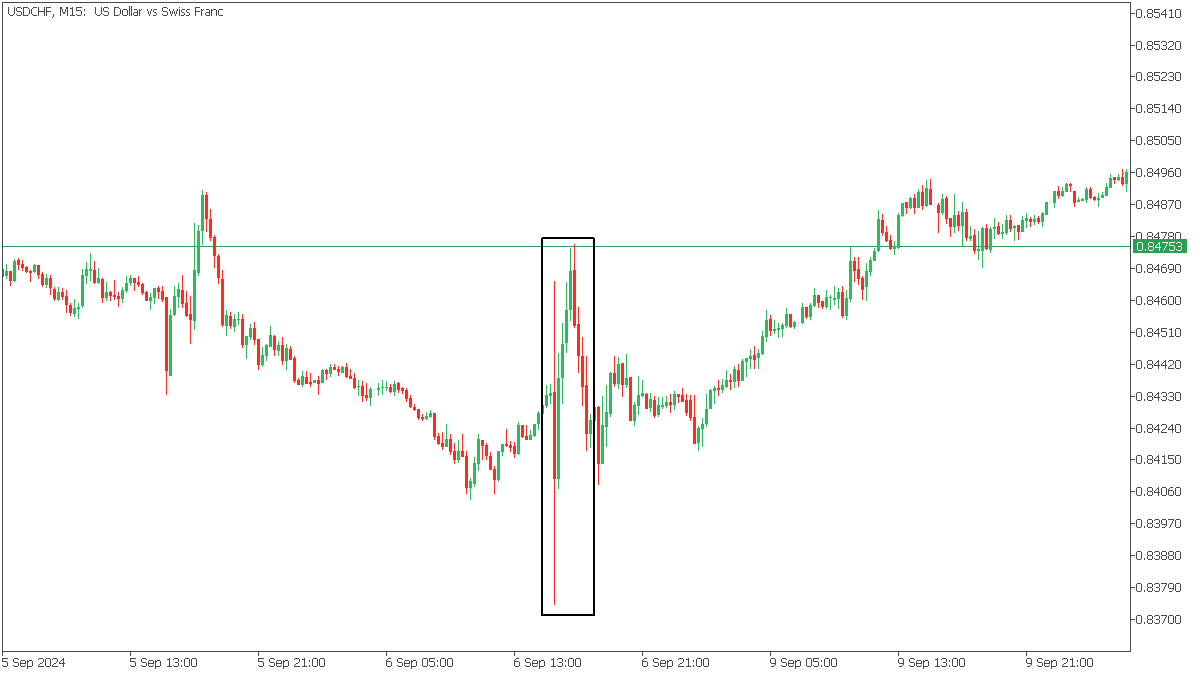

The last time NFP data was released on September 6, it came in well below expectations, leading to a lot of volatility in the market.

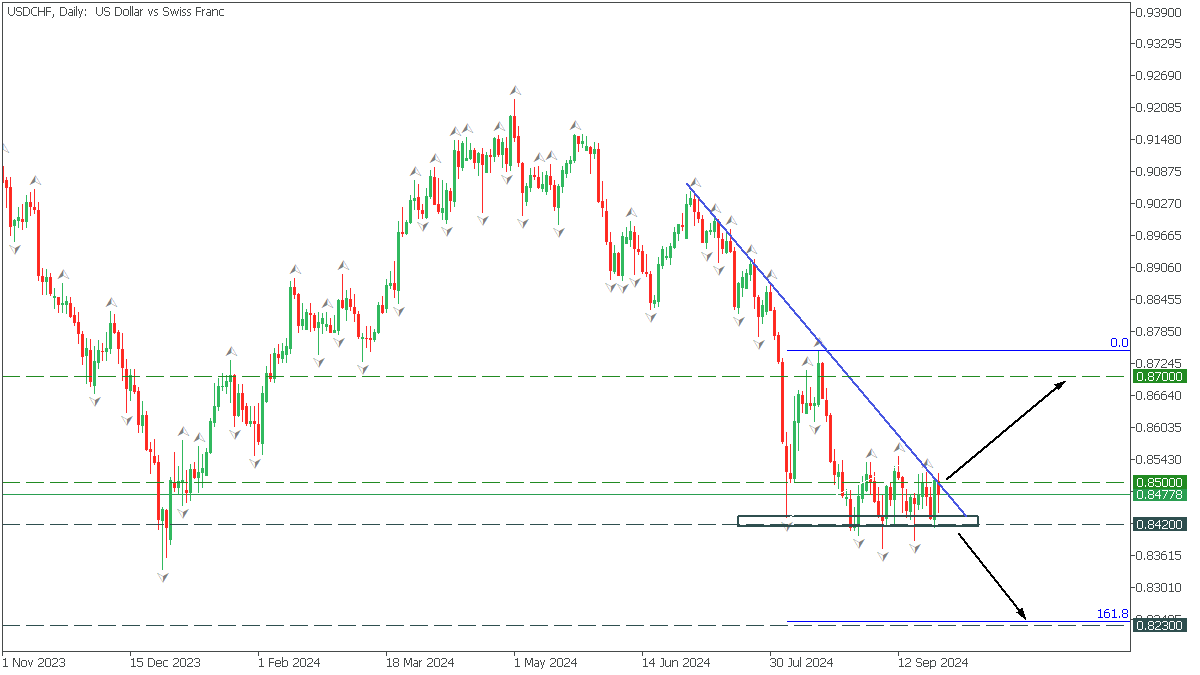

In the Daily timeframe, USDCHF formed a descending triangle in a long-term bearish trend. The price is squeezed between two levels, which makes two scenarios possible:

If the bears push the price below the 0.8420 support, the downside target will be 0.8230, corresponding to 161.8 Fibonacci;

However, if the price breaks the trend line and rises above 0.8500 and the nearest fractal, the upside would be 0.8700.