Watch EURGBP closely—key data could drive a big move!

The EURGBP pair, also known as the “Chunnel” by traders, is a widely traded currency pair that reflects the economic relationship between the Eurozone and the United Kingdom. The euro is mainly influenced by economic data from the major Eurozone countries such as Germany, France, and Italy, as well as the European Central Bank's interest rate and monetary policy decisions.

Conversely, the British Pound is shaped by UK domestic economic indicators such as inflation, employment, and GDP data. The Bank of England plays a key role in setting interest rates, and its decisions significantly impact the strength of the Pound.

UK Consumer Price Index (CPI) YoY, Oct 16, 8:00 (GMT+2)

The UK CPI is forecast to remain unchanged at 2.2% year-on-year. If the actual figure exceeds expectations and is higher, it will indicate that inflationary pressures in the UK are growing. This may prompt the Bank of England to consider keeping the rate at the current level, which will probably strengthen the GBP, and as a result, the EURGBP pair will decline.

On the other hand, if CPI data comes in worse than forecast and shows lower-than-expected inflation, this could indicate a slowdown in the UK economy, leading to a weaker Pound. This is likely to lead to an upward movement of the EURGBP pair.

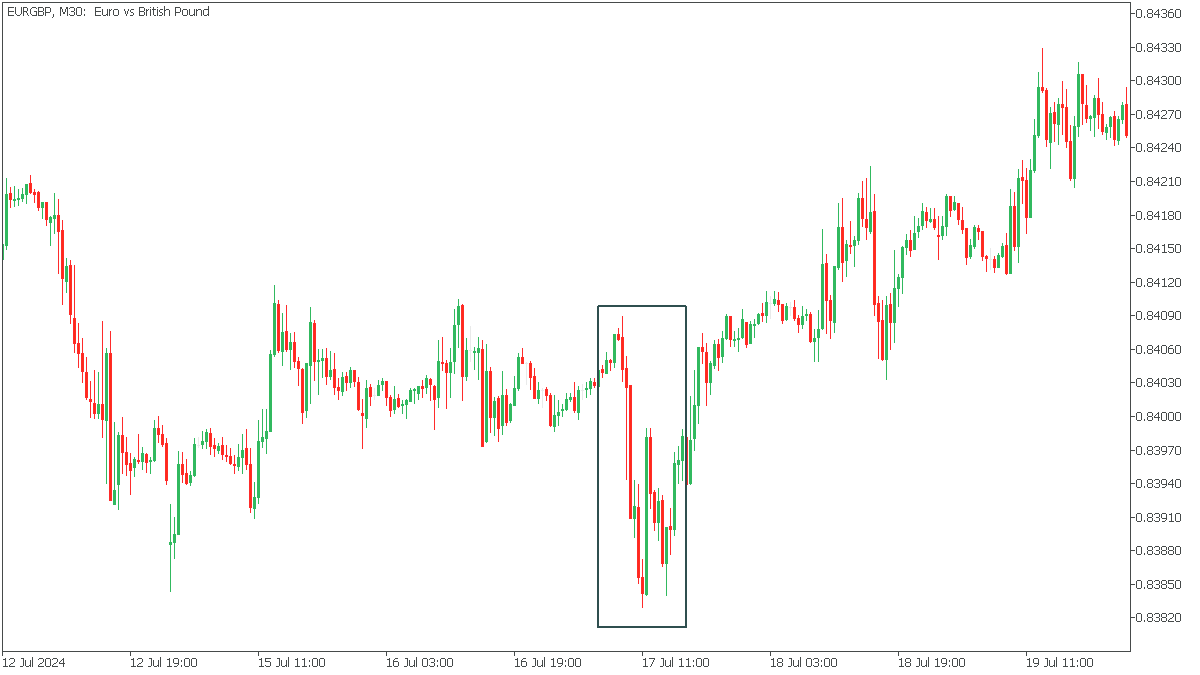

The last time UK inflation beat analysts' expectations was July 17, 2024, causing EURGBP to fall sharply.

Eurozone Interest Rate Decision, Oct 17, 14:15 (GMT+2)

The upcoming Eurozone interest rate decision will result in a small cut from 3.65% to 3.4%. If the ECB cuts rates more than forecast, it could signal a cautious approach to economic recovery, signaling that the central bank is more concerned about the risks of stagnation or deflation. The euro will likely weaken in such a scenario, pushing the EURGBP pair lower.

However, if the ECB decides to cut rates less than expected or not at all, this could signal confidence in the resilience of the Eurozone economy. In this case, the euro could strengthen, leading to a rise in EURGBP.

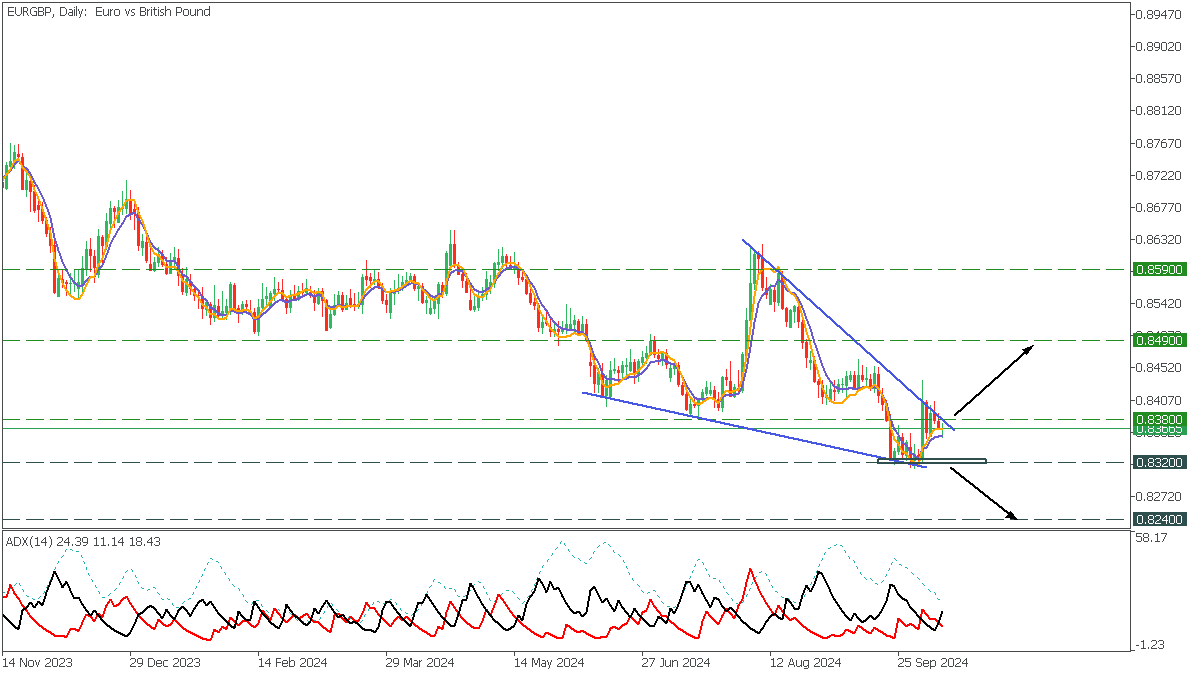

In the daily timeframe, the EURGBP formed a falling wedge pattern with a long-term bearish trend. The price reached crossed DEMA and TEMA but bounced off the upper trend line. At the same time -DI crossed +DI on the ADX Indicator, which is a bearish signal.

If the price breaks the upper trendline above 0.8380, the upside will be to 0.8490;

However, in case of a break below 0.8320 support, EURGBP will fall to 0.8240;