Market Environment

Tesla has experienced a strong rally over the past week, with a nearly 39% gain, standing out among large U.S. companies. This surge is due to overall market optimism following Donald Trump’s recent election victory and the Federal Reserve's increased willingness to cut interest rates. This macroeconomic context has particularly benefited Tesla, as Elon Musk’s close relationship with the president-elect could potentially pave the way for policies favourable to the electric vehicle industry.

However, market volatility remains high, and Tesla has pulled back by 2% today, likely as a result of profit-taking after a week of substantial gains. Despite the pullback, analysts maintain an average price target of $225.35, with estimates as high as $400, reflecting long-term optimism in Tesla’s growth potential.

Technical Analysis

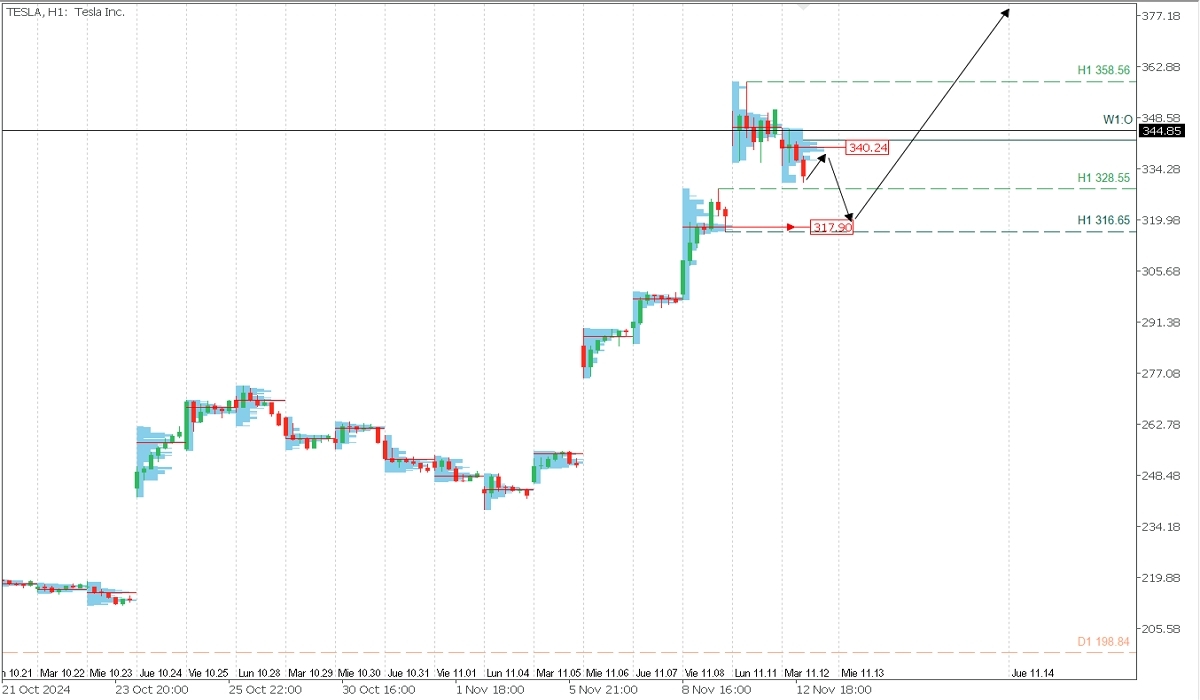

TESLA, H1

- Resistance at $358.56: On Monday, November 11, Tesla reached a high of $358.56, a resistance level that could pose a challenge for further upward movement. Today, November 12, the price has decreased by 2%, covering the opening gap of the week. This drop suggests that the stock may face some consolidation in the short term.

- Volume Concentration at $340.24: This price level has shown a significant amount of trading volume, forming a supply zone that may attract selling pressure. Traders should keep an eye on this area as it could serve as a barrier to any recovery attempts.

- Support at $328.55: The price has now reached this level, which was previously a resistance and is now acting as support. If this support level holds, it may indicate potential for a continuation of the uptrend in the short term. However, if it breaks, it could signal a further decline.

- Key Support Level at $316.65: This level is crucial, as a break below it could shift the intraday trend. It is also close to another significant level, the Point of Control (POC) at $317.90, which represents a high trading volume area and potential support.

Conclusion

Tesla maintains a strong technical structure despite today’s pullback. The levels of $340.24 and $358.56 act as key resistances, while $328.55 and $316.65 are important supports to watch. Fundamentally, the company continues to benefit from the post-election macroeconomic environment and optimism, although investors should remain cautious of profit-taking and market volatility in the coming sessions.

@2x.png?quality=90)