We told you a lot about technical trading strategies. But we want to remind you that there is another important part of trading. It’s fundamental analysis. If there is fundamental analysis, there should be fundamental trading strategies too.

Let’s start with the most common and one of the simplest strategies – carry trade strategy.

This strategy is based on interest rates. In our fundamental analysis course, we told you that interest rates are a perfect indicator of economic conditions in every economy of the world. It’s a fast and clear way to estimate which economy is stronger and as a result, what currency will strengthen. A country with a weak economy has a low interest rate. It’s a way of a central bank to encourage credit growth and give business cheap money to pour into the economy. A currency of such country is weak. A strong economy has strong GDP growth and rising inflation. To limit inflation, a central bank has to raise interest rates. This makes a domestic currency go up.

The difference in interest rates gives long-term investors an opportunity to earn.

So what is an idea of the carry trading strategy?

The main idea of the strategy is “buy a currency with a high interest rate and sell a currency with a low one”.

A trader borrows a “cheap” currency (with a low interest rate), for example, the Japanese yen. Then he invests in profitable assets, for example, the Australian dollar. The yen will be a funding currency, the Australian dollar is an investment currency. As a result, capital flows from Japan to Australia increase and demand for the Australian dollar rises. Remember that flows increase when there is a risk-on sentiment, so traders want to invest in more profitable but risky currencies. In the end, AUD/JPY surges.

Another thing that should be mentioned is a swap. A swap is a procedure of moving open positions from one trading day to another. If a trader extends her position beyond one day, she will be dealing with a cost or gain, depending on prevailing interest rates. For example, imagine that the Australian dollar had a higher interest rate than the Japanese yen. If you were to buy AUD/JPY, you would earn the interest difference between the AUD and the JPY or so-called swap on your position every day you held that trade overnight. However, if you sold AUD/JPY, you would pay the swap for your position every day you held that trade overnight.

How to determine a right pair to get a profit?

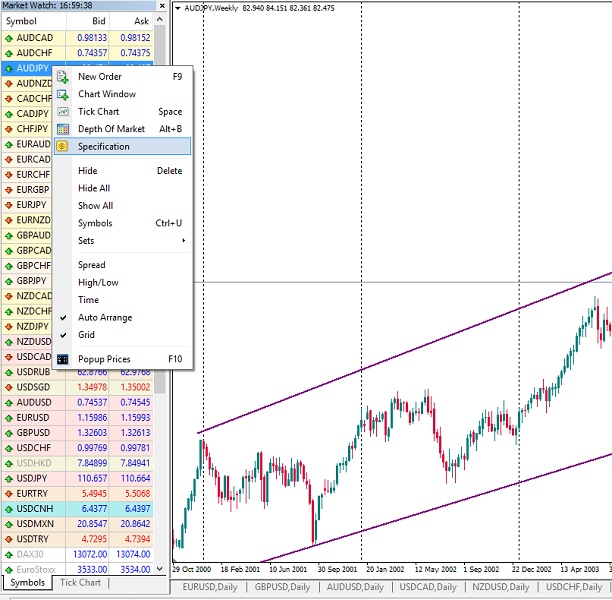

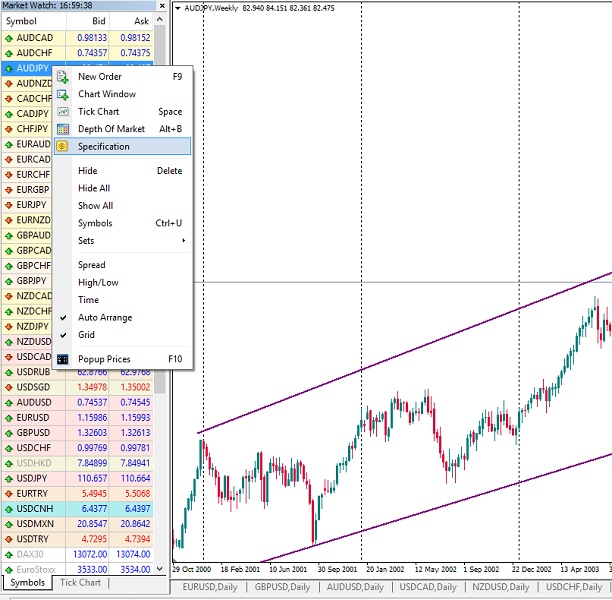

It’s easy to determine a pair that will give you a good chance to earn money. Open your MetaTrader. On the left part of a screen, there is a “Market Watch” window.

Click on the pair you want to check. As we used AUD/JPY in the example, we will click on this pair. In the pop-up window, you will see a “Specification” line.

Click on it and you will see a new window. There you should find “Swap long”. As you can see from our example, AUD/JPY has a small positive swap for long positions (0.81). It’s the first good signal.

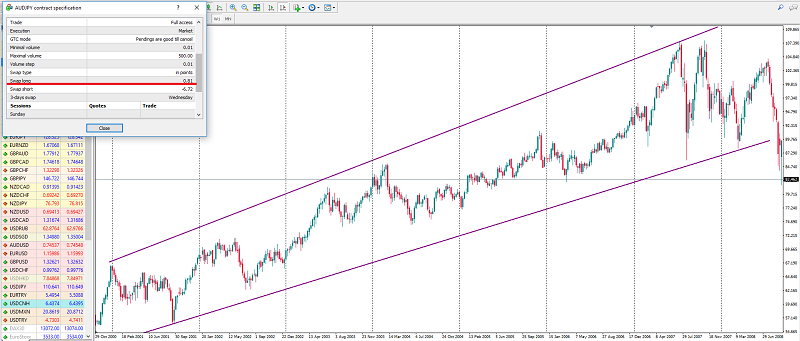

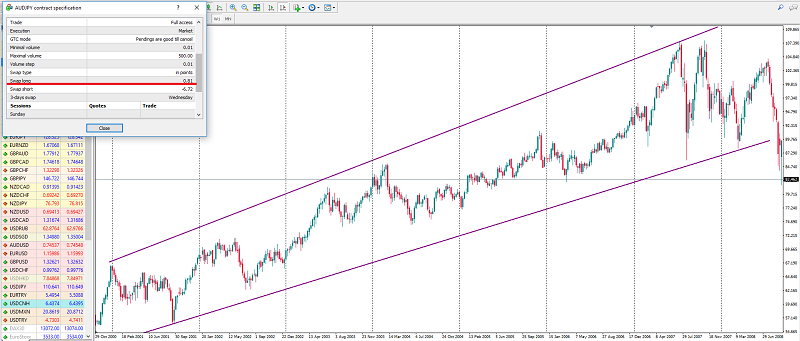

Then you should check a weekly chart of the pair you want to trade. A long uptrend signals a good possibility to trade the pair. Let’s study an example. On the weekly chart of AUD/JPY, we see an uptrend from the beginning of 2000 to the beginning of 2008 (the financial crisis happened). The fact that a trend lasted for 8 years showed that the pair is safe enough to use the carry trade strategy.

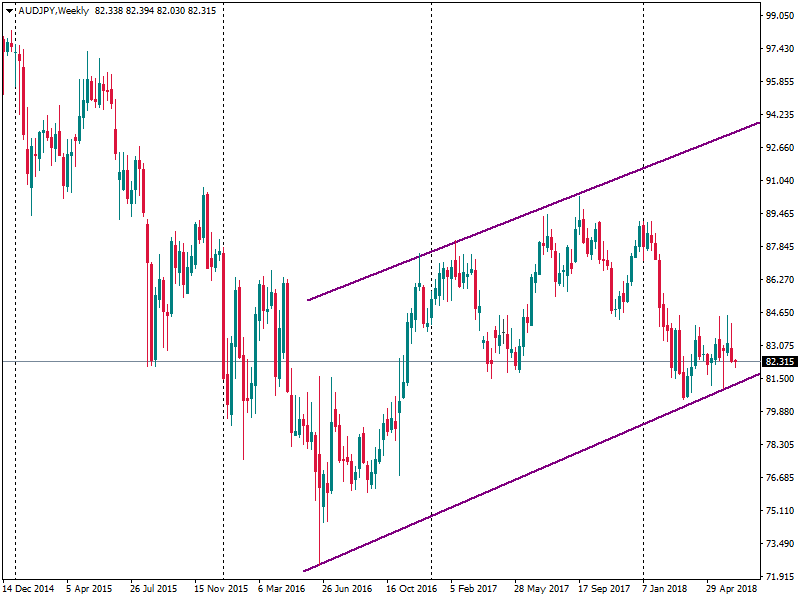

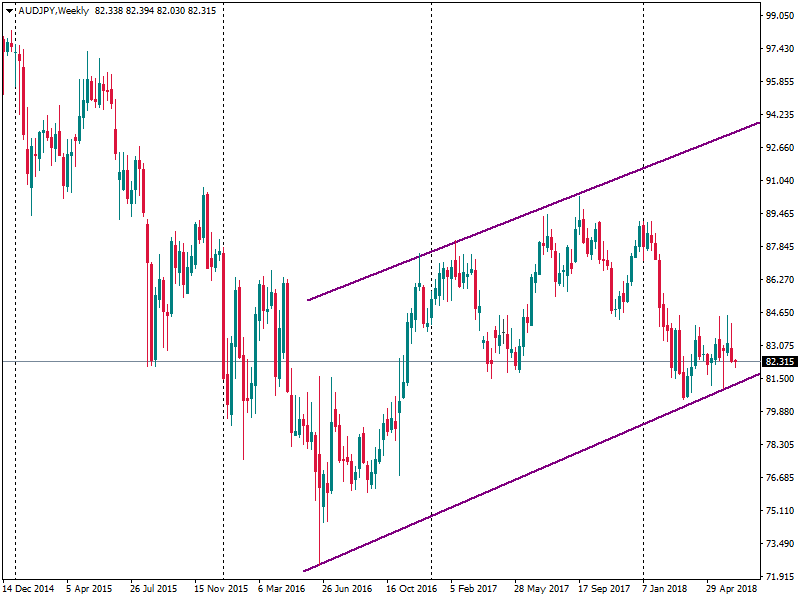

Let’s have a look at the present moment. You should remember that any long uptrend isn’t constant. After it ends, it’s important to wait until the next one will be formed. Since January 2016 a new uptrend started forming. It’s a good signal to pay the pair.

As you can see, it’s very simple to find a pair that will give you profit in the long period. As a result, carry trade strategy is an easy way to earn money. However, you should keep in mind some features of it.

Three strategy’s features you should remember about:

- This strategy corresponds only to a long-term trading. As a result, you should know how to work on big timeframes. It’s important to know how to differ a correction of the pair that can last for several days from a global trend reversal. This strategy won’t give you a profit if you are used to active trading. You should be calm and confident in your strategy. Open a position for several months, and you will earn.

- Remember that the carry trading strategy is a low-risk strategy. It means that your profit isn’t anticipated to be very high as well. (A rule: higher risk - higher profit, lower risk - lower profit). If you want to use this strategy and have a greater profit, you need to have a bigger deposit.

- Don’t forget about the fundamental analysis. If you opened an order based on this strategy, it doesn’t mean that you can leave the trading without your attention. You should check interest rates and a possibility of their change permanently as even market expectations of a rate hike or decline affect a currency rate. Moreover, there are other factors that can affect a pair’s direction. As we could see in our example, after an 8-year uptrend the pair plunged because of the financial crisis. In the environment of instability, traders started investing in the Japanese yen (that is a safe-haven).

Making a conclusion, we can say that the carry trading strategy is a simple strategy that doesn’t require special financial knowledge. All you need is to know an interest rates’ difference of currencies you want to trade. However, you should remember the features of the carry trading. If you have enough patience to wait for months to get a good profit, you should definitely use it!