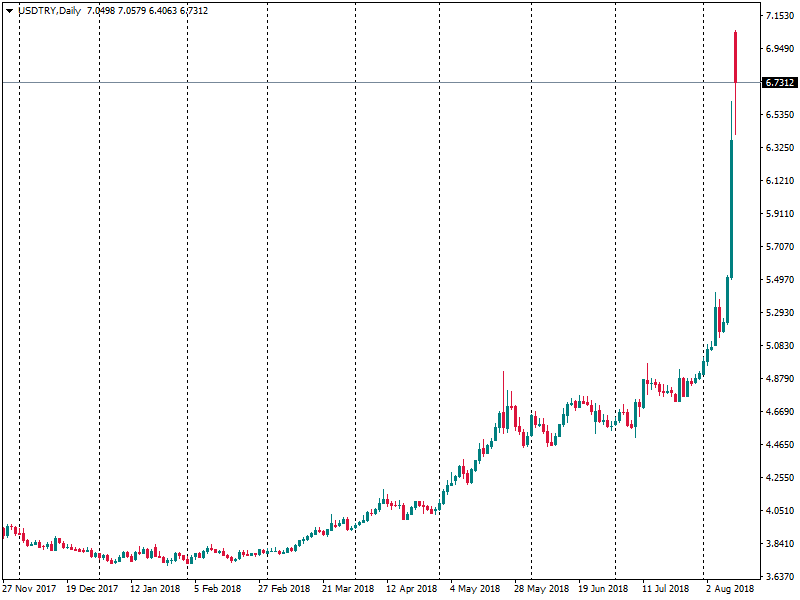

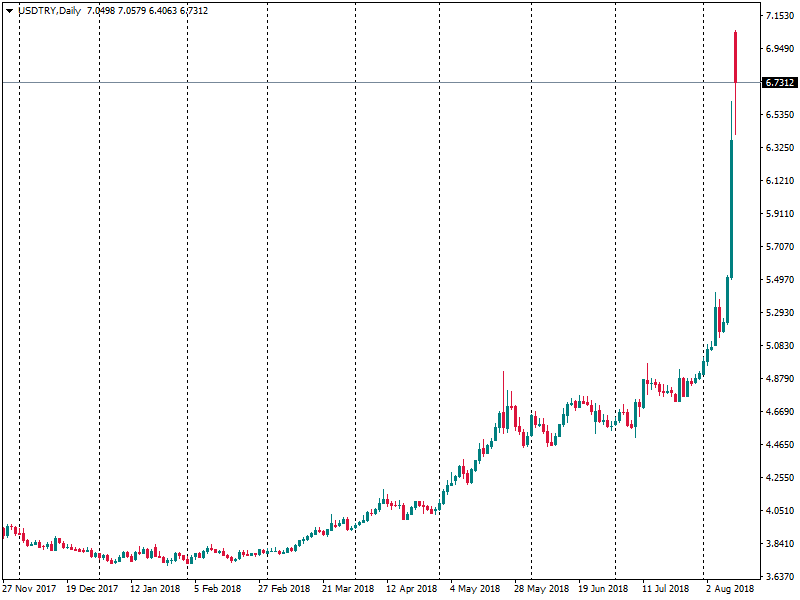

USD/TRY opened the week with the gap up and rose to a new record high abive 7.00. The lira made another leap down as Turkish President Recep Tayyip Erdogan said on Sunday that he was against interest rate increases and that Turkey is in an “economic war.” He also claimed that an agreement with the International Monetary Fund was not an option.

The lira is losing ground versus the US dollar as Erdogan calls himself an “enemy of interest rates” and aims to use cheap money to encourage Turkey’s economic growth. At the end of July, the nation’s central bank didn’t raise interest rates. It means that Erdogan has a great influence on Turkey's monetary policy. In addition, the Unites States imposed sanctions on Turkey over the detention of an American priest.

Turkish central bank had to step in to stem the lira’s collapse. It announced that it would add 10 billion liras ($1.5 billion), $6 billion, and $3 billion equivalent of gold liquidity to the financial system. The measure is aimed to facilitate the success to lira and foreign exchange liquidity for lenders. Turkish Finance Minister Berat Albayrak said authorities would start implementing an economic action plan on Monday morning.

Never the less, it’s clear that the lira is under the impact of multiple negative factors. Turkey has a large current account deficit, and that makes the TRY decline. Add the political trouble and it gets really hard to see any ability for the currency to come out of the downtrend. USD/TRY, on the contrary, should continue trading in an uptrend. It’s clear that Turkish central bank will have to do more to stabilize the situation, but there are no signs that the situation may improve in the short-term.

Negative spillover to the EUR

Economies of the euro area and Turkey are closely tied together. As a result, Turkish turmoil makes the euro decline. Traders in general turn to refuge currencies like the USD and the JPY.