The oil prices rally and world central banks’ dovish monetary policy caused by the Covid-19 pandemic were the main reasons for current inflation growth…

2019-11-11 • Updated

It is not a news the JPY is considered as a safe haven during the periods of uncertainty. The latest high-risk aversion and weakness across most of the global equity indexes motivated investors to buy the Japanese yen, which made it the best-performing currency in October. However, the global economic outlook and the trade tensions between the US and China may affect the JPY strength.

Let’s look at how the key currencies are trading against the JPY.

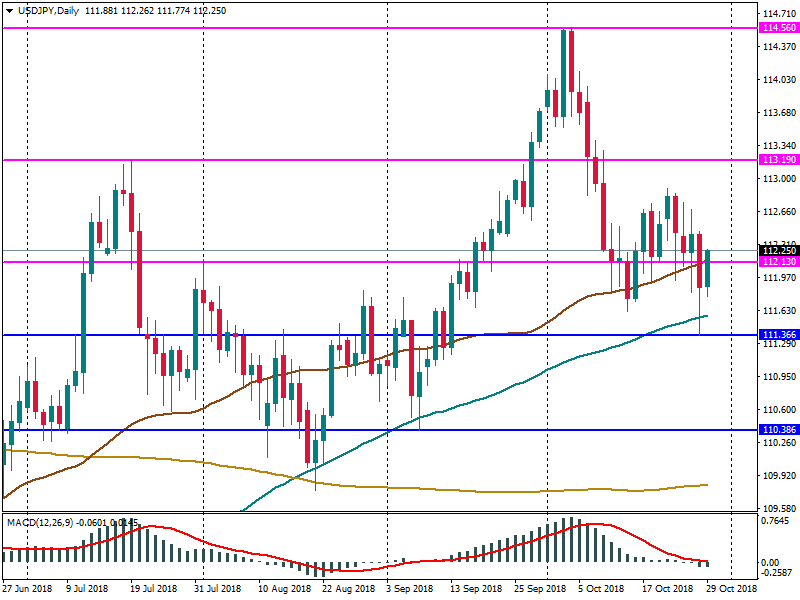

USD/JPY

As you may know, the US dollar, as well as the Japanese yen, is considered a safe haven during the market turbulence. However, high volatility of the USD increased uncertainties among the investors and made the JPY stronger.

For now, the price for the pair is mostly driven by the situation on the US equity market. The levels of the S&P 500 futures index which represents the market fears of the global risks, shows a correlation with the price of USD/JPY. On Wednesday, the fall in the stocks during the American session increased the risk-off sentiment among the investors. It weakened the USD and made USD/JPY to fall below the pivot support at 112.291 and to test the next support at 112.08 (50-day MA) on a daily chart.

On Thursday the index increased by nearly 20%. At the same time, USD/JPY rose above the 112.291 level targeting the resistance at 112.970. However, the high equity market volatility and the global economic picture added uncertainties for the future direction of the price. As a result, on Friday the price tested the support at 112.080.

In a short-term period, analysts predict the bearish momentum for the pair referring to the daily MACD, which is moving lower to its median line.

As we can see on a daily chart, the pair is trading in a range-bound market since the middle of October. The further direction of the price depends on the external factors which can occur in near future. The most significant events for the JPY this week is the Bank of Japan (BOJ) press conference on Wednesday. Analysts predict the BOJ Governor Mr. Kuroda to change the tone of the monetary policy to hawkish. On the other hand, the week is full of important releases for the USD. The level of CB consumer confidence – one of the leading indicators of consumer spending – will be published on Tuesday. On Friday we expect the non-farm employment change (NFP) and the unemployment rate. We will see how the actual data will affect the greenback.

If the JPY is supported by hawkish BOJ statement or the sell-off in the equity markets continues, JPY/USD can fall below the support at 111.366 to the next support at 110.386. Positive news for the USD will help the pair rise above the resistance at 112.130 to the next resistance at 113.190.

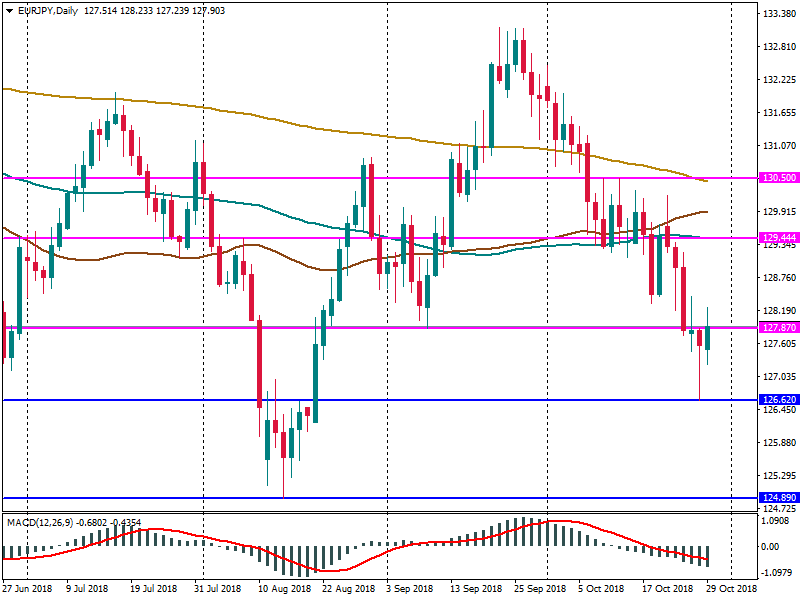

EUR/JPY

The pair has been falling since the release of the Italian budget deficit in September and a drop in the European equity market. In addition, the current uncertainties around the future of Angela Merkel as a German chancellor added negative sentiment among the investors. The bearish momentum can continue to develop with the daily MACD trending below its median line. If the EUR extends falls, the pair will move to the next support at 124.890. If the European stocks gain or the proposal on the Italian budget is suggested, the pair will rise above the resistance at 127.870 to the next resistance at 129.444 (100-day MA).

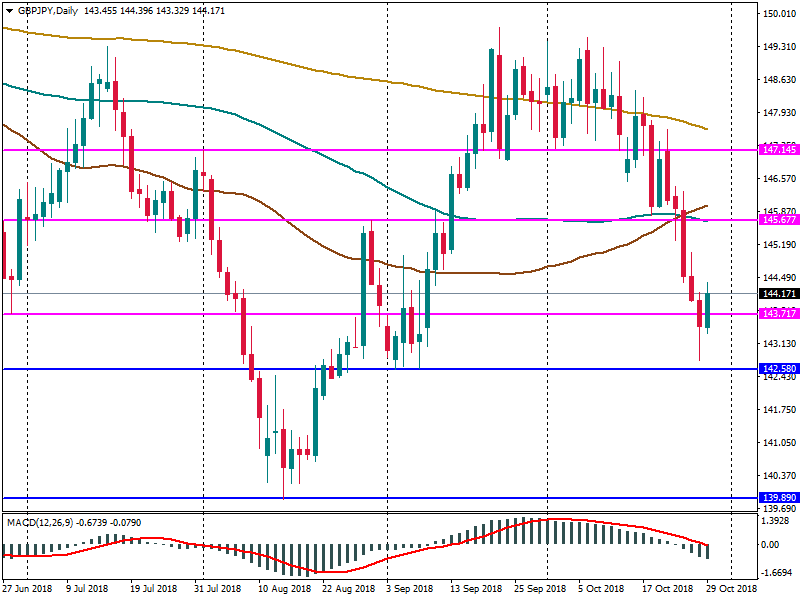

GBP/JPY

The British pound, in its turn, suffers from the unsolved Northern Ireland border backstop. Hawkish comments during the monetary policy report by the bank of England on Thursday can support the GBP.

If bearish momentum develops, the pair can fall below the support at 142.580. Otherwise, the pair can go upwards crossing the resistance at 143.717 to the next resistance at 145.677.

To conclude with, the direction of the price for the Japanese yen is connected with a lot of external factors in the global market. Therefore, the situation on the equity market and the anticipated rate hike by the Fed in December are at the spotlight for the JPY traders.

The oil prices rally and world central banks’ dovish monetary policy caused by the Covid-19 pandemic were the main reasons for current inflation growth…

How may the USD be impacted by the impeachment process? Read and prepare.

The USD has started the day on a positive footing and pushed USD/JPY upwards. What's next?

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!