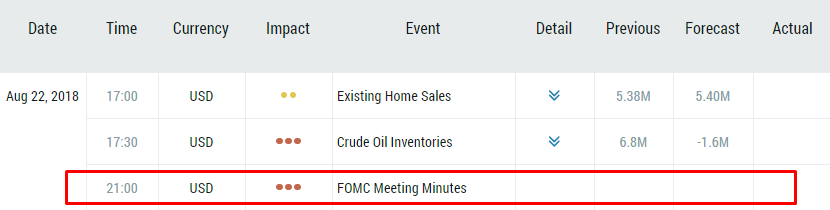

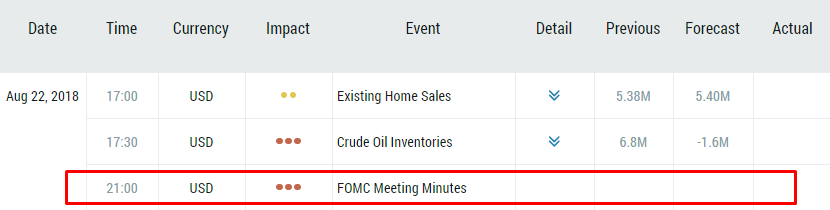

The US Federal Reserve will release the minutes of its August meeting today at 21:00 MT time. You can find this event in the economic calendar:

The event is market with highest importance, and it will have an impact on the USD.

Most traders expect the Fed to raise rates 2 more times this year – in September and in December. According to the futures on the federal funds rate, the market is pricing in a 93.6% probability of a rate hike next month and 59% chance of a rate increase at the end of 2018.

The minutes will tell us more about the Fed

The document released today may offer traders an insight into the central bank’s plans for 2019. The question is how many hikes are planned next year. The minutes of the June meeting showed that the FOMC members did express their views about this. However, no details were revealed to the markets. As a result, traders and investors do not have clear expectations about the Fed’s policy in 2019. There’s talk about the possibility of 2 rate hikes next year, but everything looks uncertain. This means that this isn’t priced in the USD exchange rate yet. If the Federal Reserve provides some information about the future path of rate increases, it will have a great impact on the USD exchange rate.

The US President Donald Trump is also trying to intervene. He has recently repeated that he didn’t approve rate hikes. Such words hurt the USD. At the same time, it’s necessary to remember that the Fed is independent. It’s not likely that the central bank will be influenced by Trump. The reasons behind the actions of the Fed are economic. According to Morgan Stanley, “Trump’s comments may even harden instead of soften the Fed’s current hawkish policy stance.”

Analysts at Nomura and Goldman Sachs think that the minutes may mention trade policy and the uncertainties that are related to it. This hasn’t been the part of the central bank’s statement which was released right after the meeting. If there expectations come true, the USD will suffer.

Friday is also important

Another hint from the Federal Reserve will come on Friday as its Chair Jerome Powell speaks at Jackson Hole symposium. In July, Powell said that “for now” the Fed plans to “keep gradually raising the federal funds rate.” Analysts at Standard Chartered Bank think that if Powell repeats the words “for now”, then traders would think that he’s giving a rebuff to Trump. In this case, the expectations of a rate hike in December will go up and so will the USD.

So far, the American currency managed to find some support ahead of the event. You can see the important levels marked on the chart.