Trade ideas

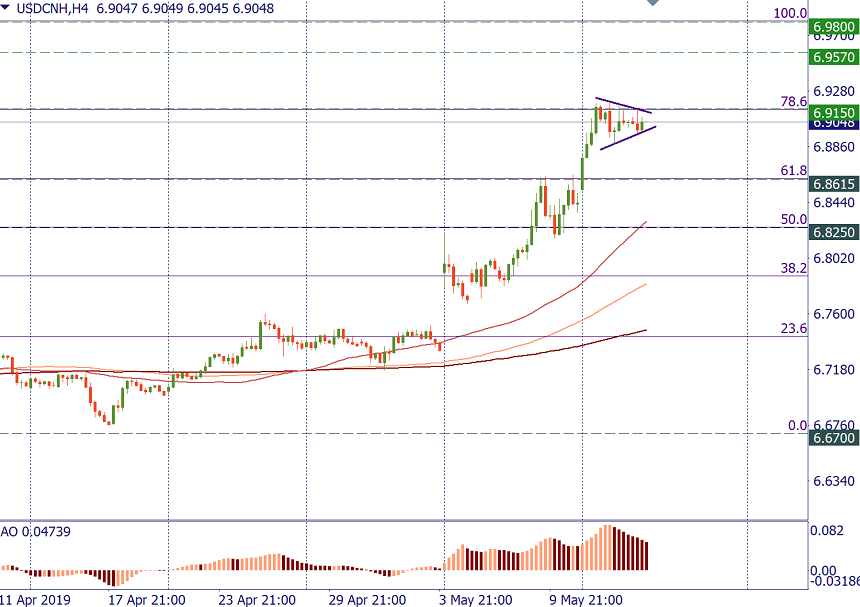

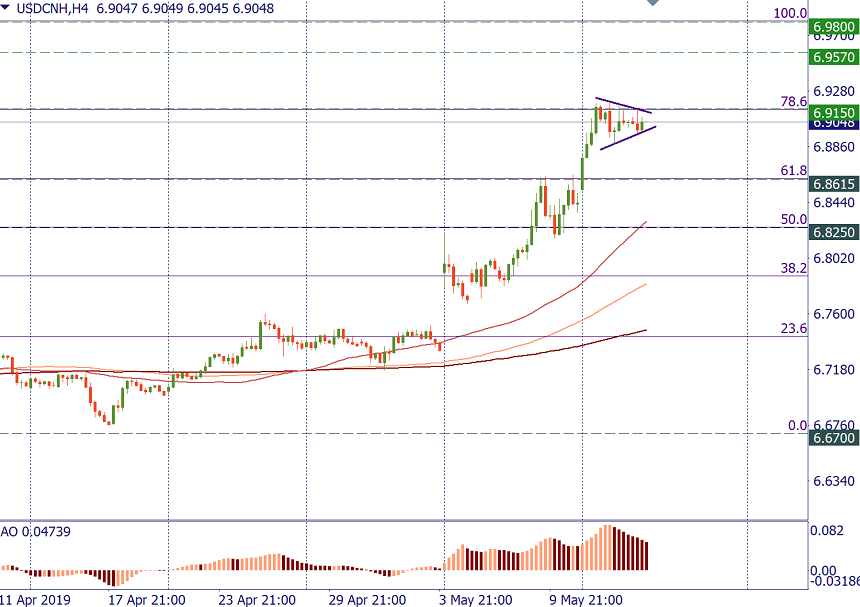

BUY 6.9220; TP1 6.9570; TP2 6.9795; SL 6.90

SELL 6.8860; TP 6.8615; SL 6.8940

USD/CNY retraced 78.6% of the 2018-2019 decline. The US dollar strengthened versus the Chinese yuan as the trade deal between the United States and China met unexpected obstacles.

To put it briefly, America increased tariffs on Chinese imports and China decided to retaliate. In addition, China’s industrial production figures and retail sales for April turned out to be worse than expected. This might mean that Beijing may need to roll out more stimulus measures to support its economy. Comments of the US President Donald Trump that trade talks hadn’t collapsed improved the sentiment a bit, but the uncertainty remains. That means that the USD has more bullish potential versus the CNY.

The outlook for USD/CNY will remain bullish as long as it stays above 6.8250 (200-day MA, weekly pivot). On H4, the pair is consolidating within a symmetric triangle. The direction of a break will determine whether the move to the upside continues straight away or we see a correction.