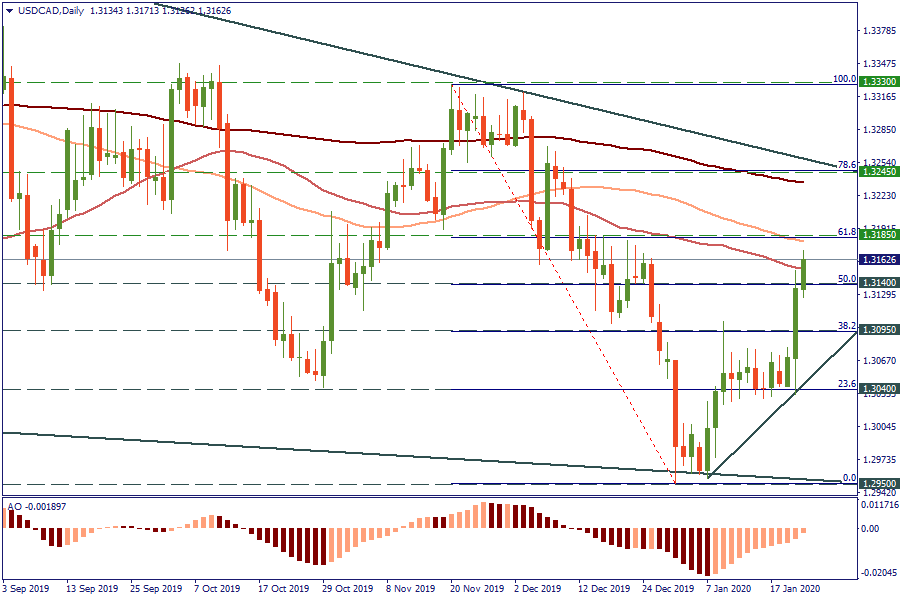

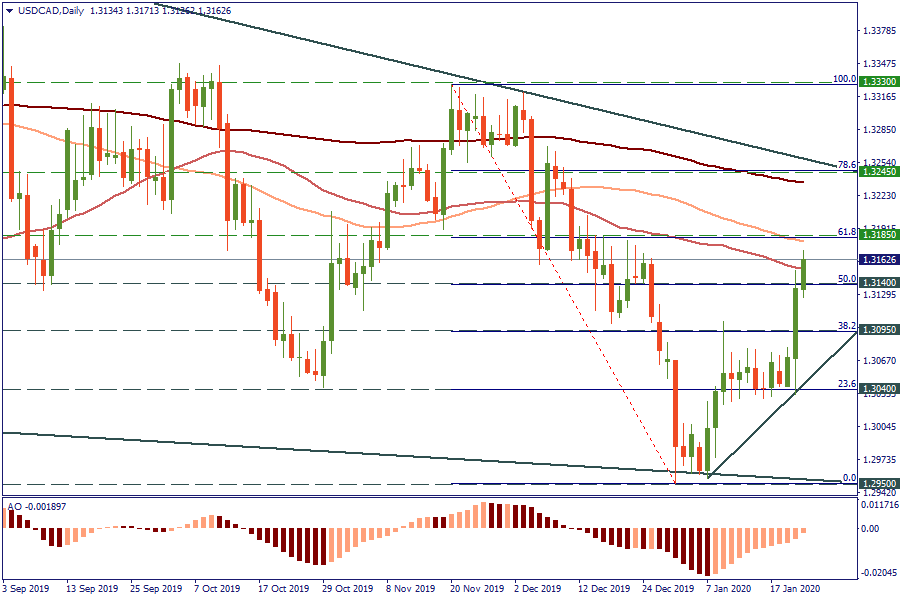

USD/CAD made big moves during the Bank of Canada’s meeting yesterday. Still, the rally may not be over yet. Canadian central bank has given the market a lot of negative fuel, so the CAD may keep losing versus the USD. This means upside for USD/CAD.

The pair has formed a bottom in the 1.2950 area earlier this month (2019 support line). This week it has made a big advance above the 200-week MA and is currently testing the 100-week line in the 1.3160 area. Another resistance is at 1.3185 (61.8% Fibonacci retracement of the November-January decline). In the short term, corrections are possible, but the declines should meet support at 1.3140 and 1.3095 offering buy opportunities at these levels. Upside targets lie in the 1.3245 and 1.3300 areas.

Trade ideas

BUY 1.3100; TP1 1.3170; TP2 1.3235; SL 1.3080

BUY 1.3195; TP 1.3235; SL 1.3180

TRADE NOW