The markets have definitely awakened from the sleeping mode, in which they have spent the most part of 2019. These days we see great moves in currency pairs, commodities, and indexes. Let’s review the most interesting topics and instruments that will be in the center of traders’ attention this week.

USD is out of favor

The solid gains of the US nonfarm payrolls on Friday, March 6, did not prevent the USD from the broad decline in most major pairs. The yield on the US 10-year Treasury briefly touched an all-time low of 0.3469% in overnight trading. Last week the Federal Reserve has made an emergency rate cut by 50 bps. Traders now think that the next actions of the Fed will be even more aggressive. According to the futures on the federal funds rate, the market is pricing in a 75 bps reduction at the meeting on March 17. Such expectations will limit the ability of the greenback to make a bullish correction.

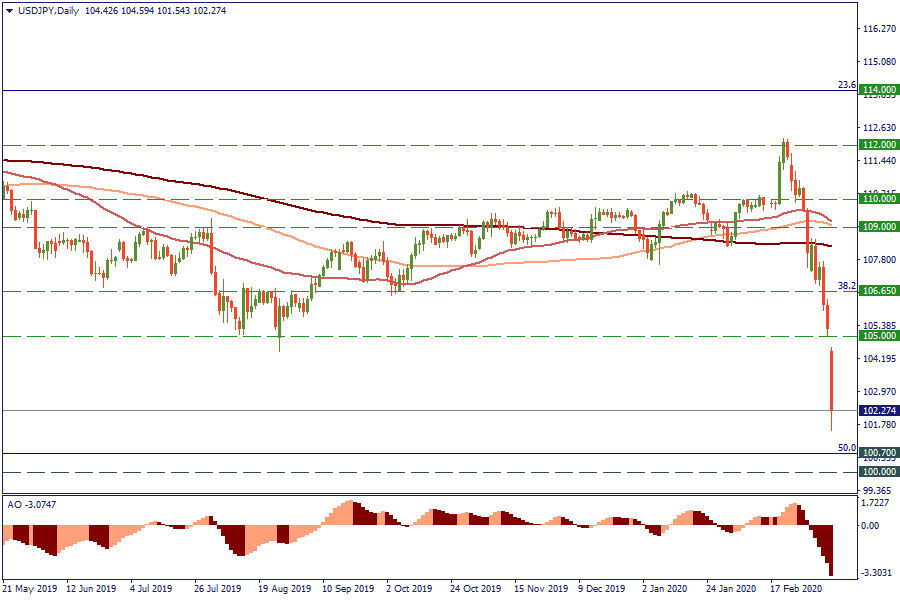

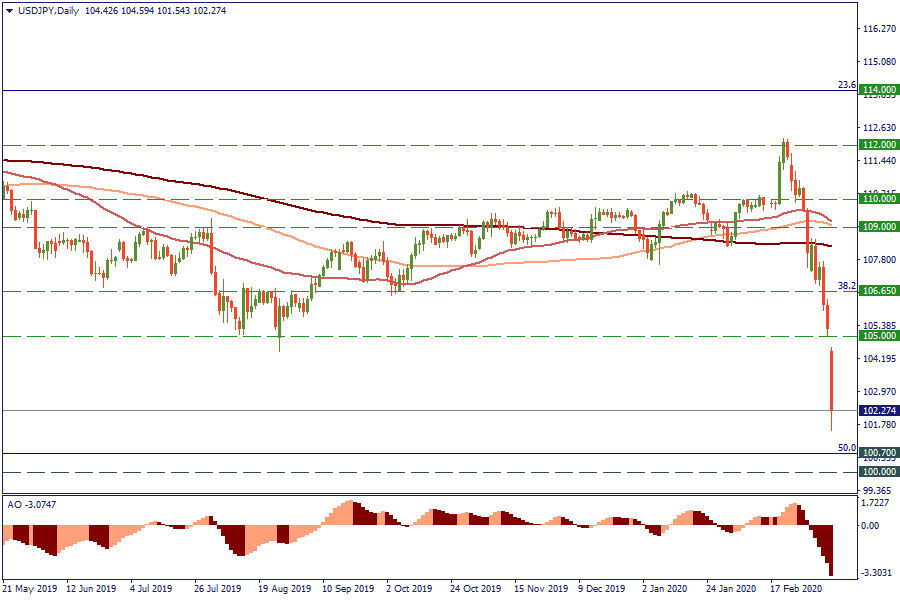

The USD is especially vulnerable versus the CHF and the JPY. USD/JPY is currently around 102.50, at the lowest levels since 2016 and may still visit the 100.70/00 area. The previous support at 105.00 will now act as resistance.

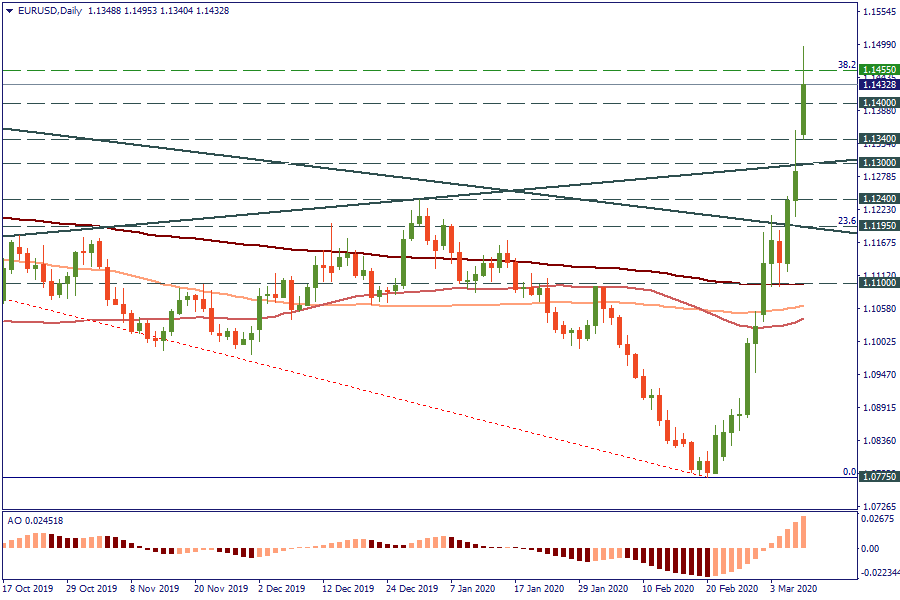

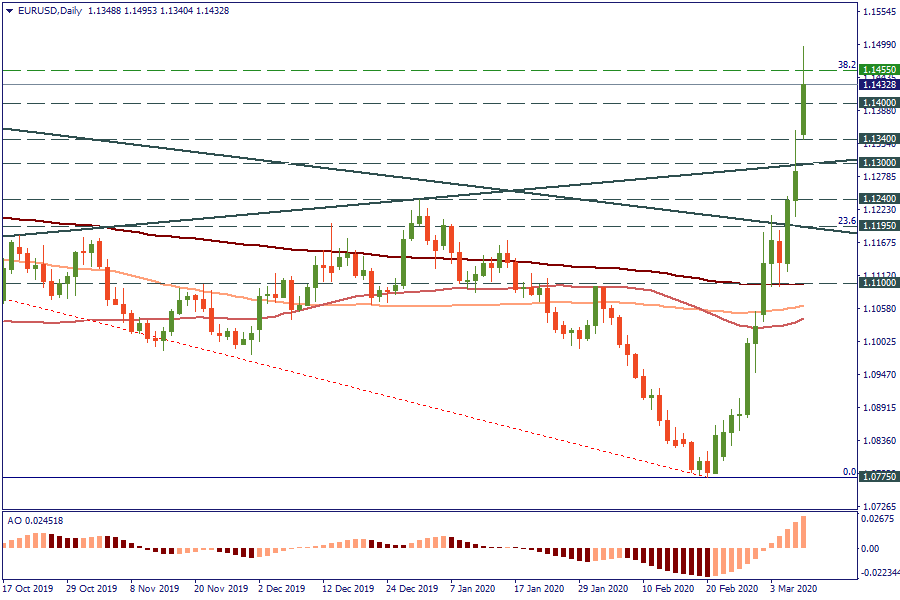

EUR/USD will also be one of the key focuses of the market in the upcoming days. The European Central Bank will meet on Thursday, March 12. The regulator faces a big challenge: it should support the euro zone’s economy, but its resources are limited. As a result, everyone will want to see whether the ECB manages to stop the advance of the EUR, which isn’t actually good for the region’s exporters. So far, EUR/USD faces resistance at 1.1455 (38.2% Fibonacci of the 2018-2020 decline). The daily close above this point will open the way up to 1.1570 (2019 high) and 1.1660 (50% Fibo).

Selloff in commodity currencies

Although the USD is under pressure versus the EUR, the GBP, the JPY, and the CHF, it spiked against the commodity currencies, for example, the CAD, and emerging market currencies such as the MXN.

Bad fundamentals for the CAD, in particular, the slide in oil, are most visible in CAD/JPY. The pair tested the 2016 low at 74.80. We are currently witnessing an attempt of the CAD to correct higher. Still, if oil keeps suffering, the pair will be bound to slide to 72.00 and 70.00.

The Mexican peso is extremely vulnerable to risk aversion. When investors are in fear (this time, of coronavirus), they don’t want to hold the MXN. As a result, USD/MXN came really close to the all-time high at 22.00. Now we see some indecision at the market. The return below 21.00 will give bears a chance to try to close the gap. As long as the pair is trading above this point, however, it can launch another attack on the upside.

Baseline

Stay tuned for more news that will bring the market in motion. Volatility offers lots of opportunities to active traders, just remember to keep the proper risk management in place.

LOG IN