The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

2021-02-02 • Updated

Ford will publish its Q4’2020 earnings on the night of February 4-5. What to expect?

Ford and Google shares rose on Monday after the companies signed a partnership to produce connected vehicles powered by Google's Android operating system. “As Ford continues the most profound transformation in our history with electrification, connectivity, and self-driving, Google and Ford coming together establish an innovation powerhouse truly able to deliver a superior experience for our customers and modernize our business,” Ford President said.

Jim Cramer, CNBC's journalist, and hedge fund manager, recommended buying the dip Ford Motor Company after earnings. Ford is now one of the stocks to consider buying after Tesla under Biden’s green energy boom. The President pledged to fight climate change and support the development of zero-emission vehicles. His goal is to reach a carbon-free energy sector in the US by 2035. Ford should benefit due to its approach to its "digital transformation".

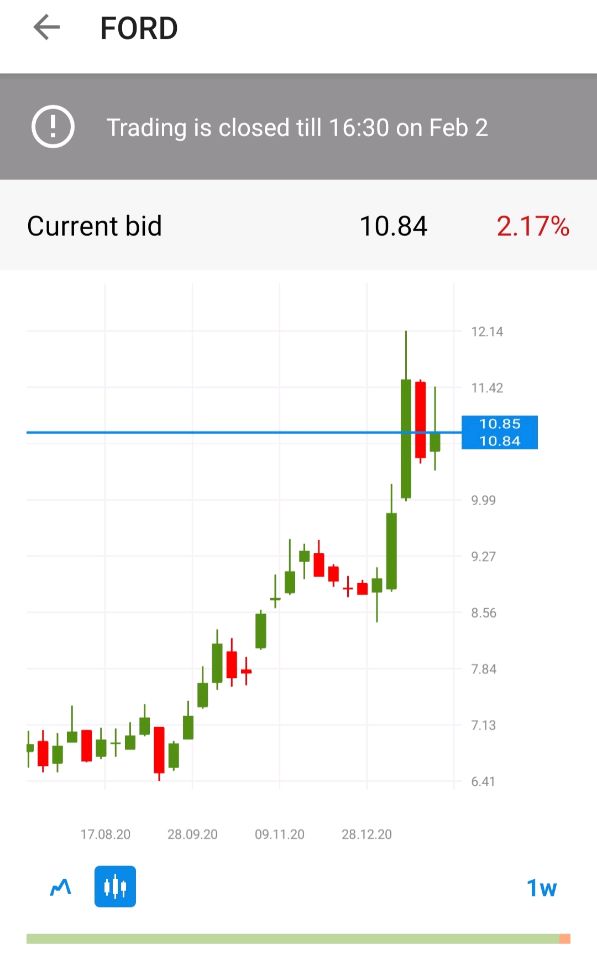

There’s an interesting situation on the Ford weekly chart. We can notice the basic case of retracement. The key level is $10.50 as the price has failed to cross it many times when this level was both support and resistance. Retracement to a key level creates the optimal situation to enter the market. In the chart below you can notice that the price has pulled back to the key level after it closed above it. Since the stock is moving in an uptrend, this pullback should be a natural sell-off ahead of the further rally upwards. The move above the high of January 17 at $12.00 will push the price up to the record high of $13.50 unseen since 2018. Support levels are $8.75 and $7.50.

You can also trade Ford stock with FBS Trader mobile app. Remember that stock trading starts as the US session begins (at 16:30 MT time).

Don't know how to trade stocks? Here are some simple steps.

The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

The past two years have seen the biggest swings in oil prices in 14 years, which have baffled markets, investors, and traders due to geopolitical tensions and the shift towards clean energy.

After months of pressure from the White House, Saudi Arabia relented and agreed with other OPEC+ members to increase production.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!