Escenario bajista: Ventas por debajo de 80.00 con TP1:79.60... Escenario alcista anticipado: Compras intradía sobre 80.70 con TP: 81.50...

2022-08-12 • Actualizada

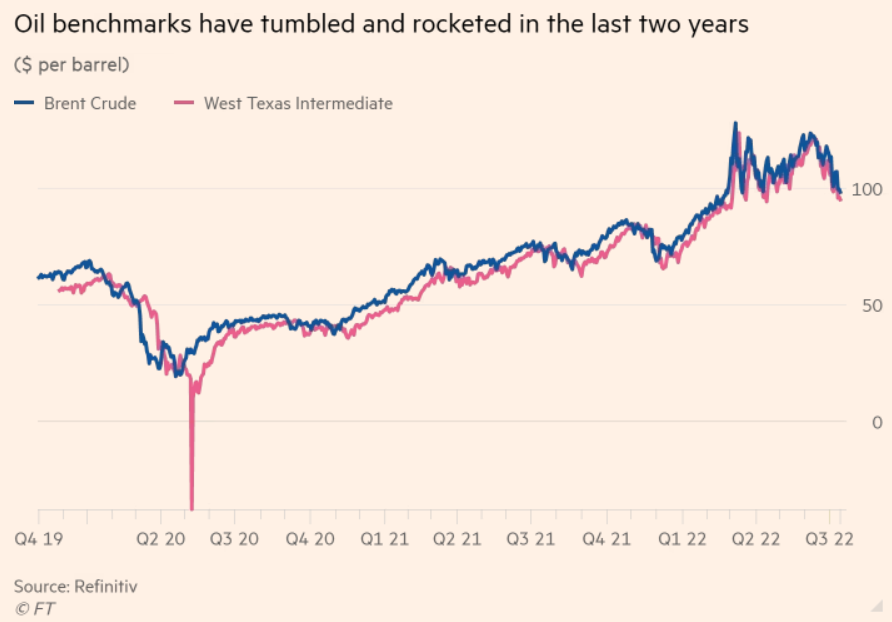

The past two years have seen the biggest swings in oil prices in 14 years. This rollercoaster has baffled markets, investors, and traders. The main reasons for such dynamics were geopolitical tensions and the shift towards clean energy. In the last two years, oil traded as cheaply as $19 a barrel - or at minus levels if you're looking at WTI futures - and it went up to $139.

We haven't seen such huge swings in oil prices since the 2008 financial crisis when oil collapsed from $150 to less than $40. The collapse was due to the fears of a global recession, which led to a drop in oil demand as in our current situation.

The result was a sharp rise in inflation amid sluggish demand, slowing economic growth, and growing recession fears.

Oil prices may drop to $90 a barrel if the world's largest oil consumers continue to struggle with high inflation and low growth.

Oil may drop below $90 and stay around this range for a while. Economic woes in the world's two largest economies will affect oil demand. The effects will, of course, be seen on Brent and US WTI prices.

At the same time, oil demand may find some support from record high natural gas prices, especially in Europe. That will prompt consumers and factories to switch to oil-fueled generation to survive the brutal winter ahead. In addition, the oil supply is not expanding and may even face problems in the coming period as oil demand increases in the winter.

Supply concerns are expected to escalate as winter approaches, as EU sanctions banning sea imports of Russian crude and oil products are set to take effect on December 5. The modest increase approved by the OPEC+ of 100,000 barrels per day in September will not be enough to meet the increased demand.

Technically, Brent (XBRUSD) may drop to 80.00 if it breaks below $90 and settles below that level.

Escenario bajista: Ventas por debajo de 80.00 con TP1:79.60... Escenario alcista anticipado: Compras intradía sobre 80.70 con TP: 81.50...

Escenario Bajista: Ventas por debajo de 78.99 con TP1:77.93, TP2: 77.45 y tras su rompimiento TP3:76.56 y TP4: 75.70. Escenario Alcista: Compras sobre 78.00(esperar pullback a esta zona) con TP1: 1679.00 (POC descubierto*), TP2: 79.33 y TP3: 79.66 en intradía.

Escenario bajista: Ventas por debajo de 80.00 con TP1:79.34, TP2: 78.94,TP3: 78.55 y 78.00 Escenario alcista: Compras sobre 78.00 (esperar retroceso hacia zona) con TP:79.34 TP2:80.00 y TP3: 81.00

Escenario bajista: Ventas por debajo de 1.0820 / 1.0841... Escenario alcista: Compras sobre 1.0827...

Escenario bajista: Ventas por debajo de 2200 / 2194... Escenario alcista más próximo: Compras sobre 2197... Escenario alcista tras retroceso: Considera compras en torno a cada zona de demanda...

Escenario bajista: Ventas por debajo de 5220 ... Escenario alcista: Compras sobre 5225 (Si el precio falla en romper por debajo con decisión)

FBS mantiene un registro de tus datos para ejecutar este sitio web. Al presionar el botón "Aceptar", estás aceptando nuestra Política de Privacidad .

Su solicitud ha sido aceptada

Un gerente le contactará pronto

La próxima solicitud de devolución de llamada para este número telefónico

estará disponible en

Si tienes algún problema urgente, contáctanos a través del

Chat en vivo

Error interno. Por favor, inténtelo nuevamente más tarde

¡No pierdas tu tiempo – mantente informado para ver cómo las NFP afectan al USD y gana!