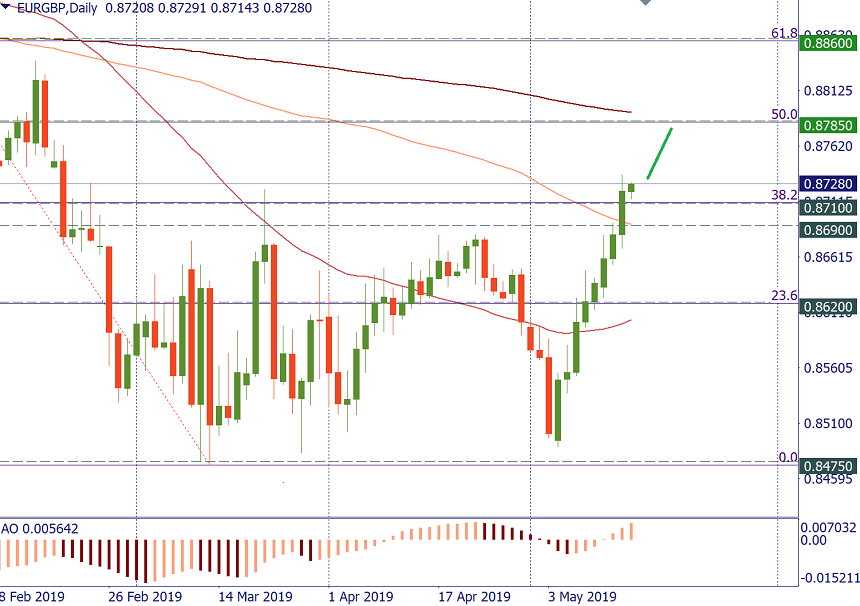

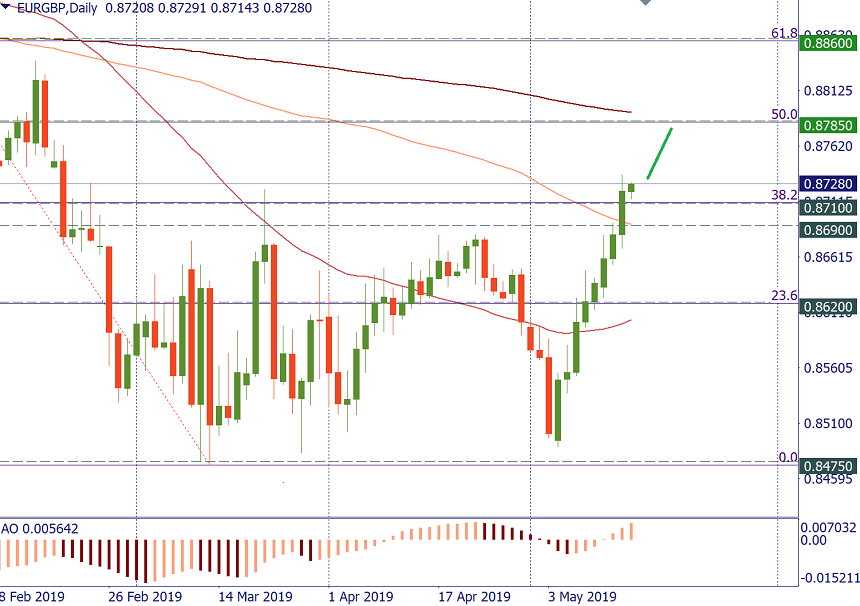

Trade idea

BUY 0.8740; TP 0.8780; SL 0.8720

The euro is steadily strengthening versus the British pound. A week ago EUR/GBP formed a "bullish engulfing" pattern as it rebounded from nearly 2019 lows. Yesterday it closed above 100-day MA and 38.2% Fibo retracement of this year’s decline.

The euro is up on the news that the US would delay its decision about imposing tariffs on EU cars, while the pound is pressured by a continued impasse in Brexit talks between the UK’s major political parties.

It seems that EUR/GBP has finally broken out of the range within which it was trading in March and April. Support will now be in the 0.8710/0.8690 area. The way up implies an advance to 0.8785 (50% Fibo and the 200-day MA nearby). In the absence of overly negative news from the euro area, an advance to 0.8860 (61.8% Fibo) will also be possible.