Ichimoku Kinko Hyo

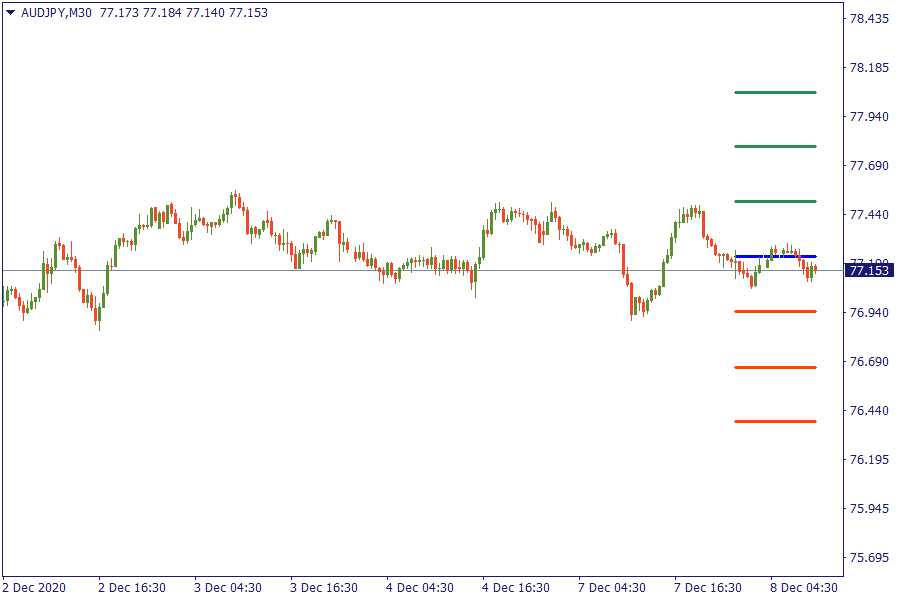

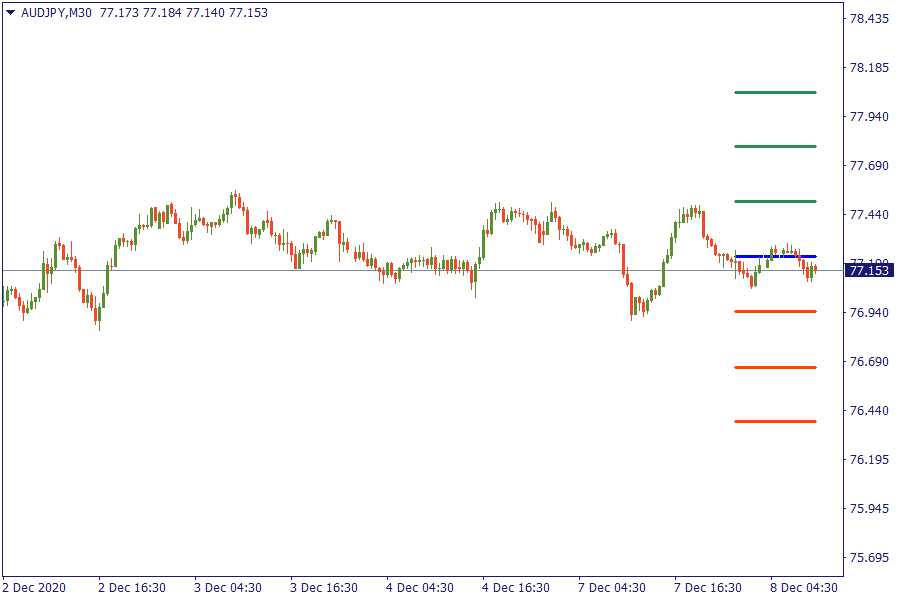

AUD/JPY: The pair is trading below the cloud. Further bearish pressure will lead the currency pair to retest the previous lows.

Fibonacci Levels

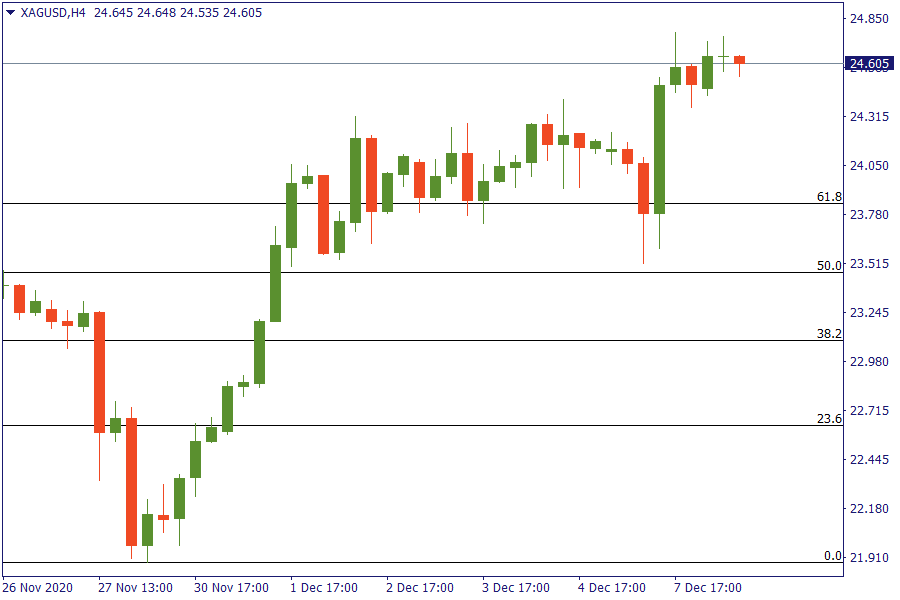

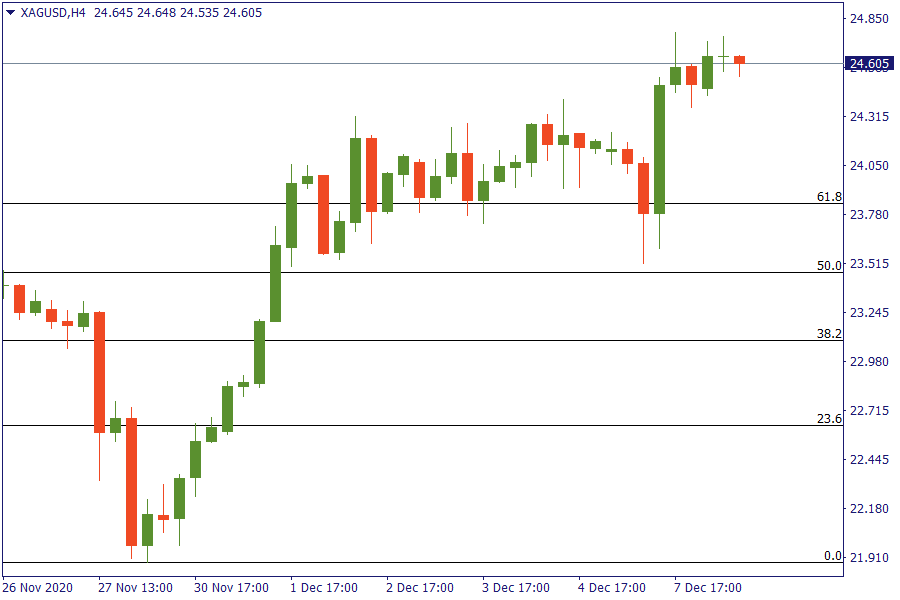

XAG/USD: Silver bulls return aggressively and send price above the 61.8 % retracement area. It seems that further bullish rally is possible.

European Market View

Asian equity markets were mixed after an uninspiring handover from the US where stocks pulled back from record levels. In the US, the House will conduct a vote on a 1-week continuing resolution on Wednesday to provide lawmakers more time to work on government spending and virus relief. Looking ahead, highlights from the macroeconomic calendar include German ZEW, EZ GDP (final). The dollar slid against most currencies as investors eyed potential stimulus and vaccine development. Sterling clung to hopes of a meeting between British Prime Minister Boris Johnston and European Commission President Ursula von der Leyen salvaging a Brexit trade deal. Oil prices fell, extending losses from the previous session

EU Key Point

- France's Beaune: There is still room to negotiate on Brexit

- Germany reportedly to discuss tighter virus measures sometime this week

- Pfizer tells US officials that it cannot provide substantial additional vaccine doses until late June

- Germany reports 14,054 new coronavirus cases in the latest update today

- Gold extends gains to a fresh two-week high.

TRADE NOW