Trading plan for July 2

- The US dollar index couldn’t stick above $95 again. On Friday, US economic data were mixed. The index weakened and tested levels below $94.50. The index needs additional support from the economic data. On Monday, traders will take into consideration ISM manufacturing PMI data (17:00 MT time). The forecast is weaker than the previous data, however, if the actual data is greater than the forecast, the index will be able to recover. The resistance lies at $95. The trendline will become a support for the index. If it’s able to break it, the further support is at $94.

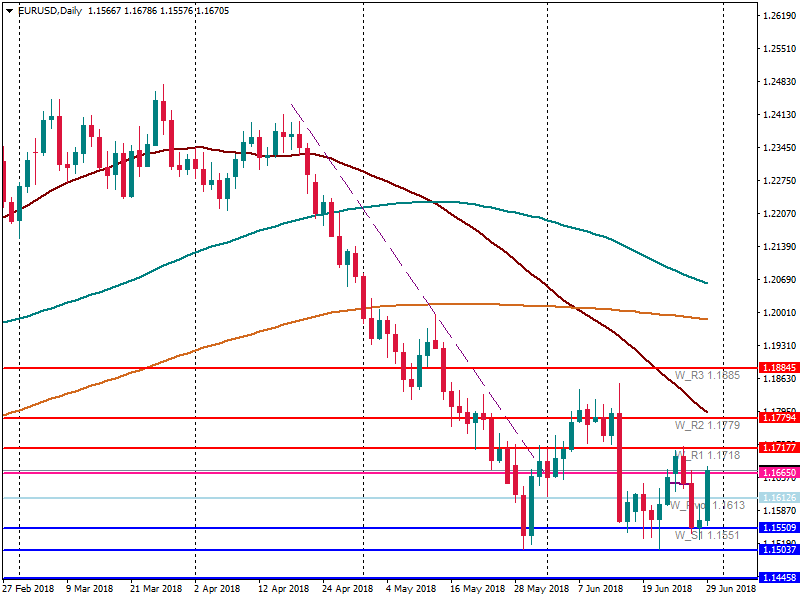

- The euro significantly rose on Friday after an agreement on the migration deal that was achieved by European countries during the EU Economic Summit. EUR/USD broke the resistance at 1.1615 (the pivot point) and tested the next one at 1.1665. The euro needs additional support to reach highs of the first quarter of June. On Monday, no important European economic data will be released. As a result, there are risks of the fall to 1.1615 (50-hour MA). However, if the US dollar index is weak, the pair will have chances to stay around 1.1665.

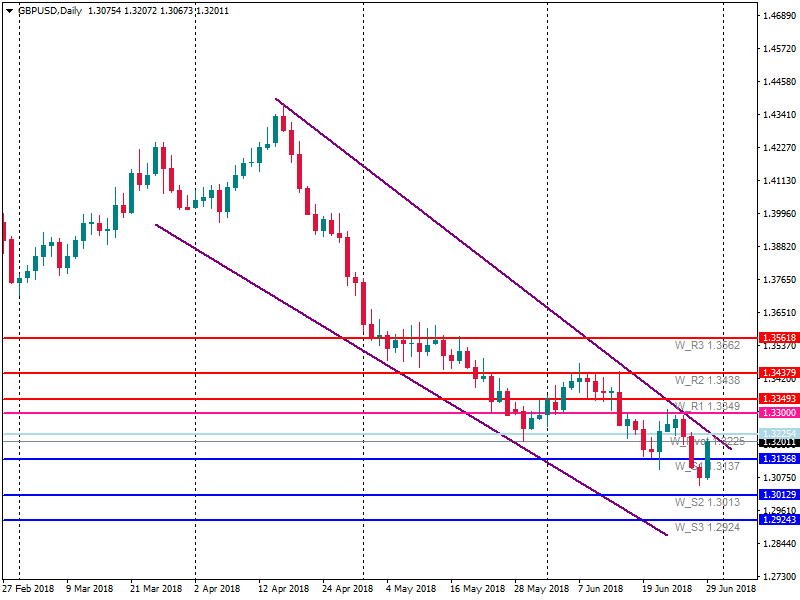

- On Friday, GBP/USD managed to recover after a 3-day fall. The pair tested the resistance at 1.3140. The next one lies at 1.3225 (trendline). The same as the euro, the pound needs an additional support to climb further. On Monday, traders should pay attention to manufacturing PMI data (11:30 MT time). The forecast is weaker than the previous figure. If the actual data is greater than the forecast, the pound will be able to strengthen. Moreover, on Monday, the EU and the UK are anticipated to hold a new meeting on the Brexit deal. If there is a progress, the pound will be able to break the resistance and move further to 1.33.