XAUUSD: Markets Slow Down Ahead of NFP

Gold prices rose on Monday as the US Dollar weakened amidst speculation about potential Federal Reserve rate cuts starting in June. This weakened Dollar was partly due to improved risk sentiment pushing US Treasury yields lower. Despite facing challenges from declining yields, gold prices recovered to nearly $2,170 per troy ounce, driven by the Dollar's weakness. Federal Reserve Chair Jerome Powell's remarks suggested that unexpected rises in unemployment could prompt interest rate cuts, reassuring markets concerned about inflation. Traders are closely monitoring upcoming US inflation readings, including GDP data for Q4 2023 and the PCE price index report, for insights into inflationary pressures and potential impacts on gold prices.

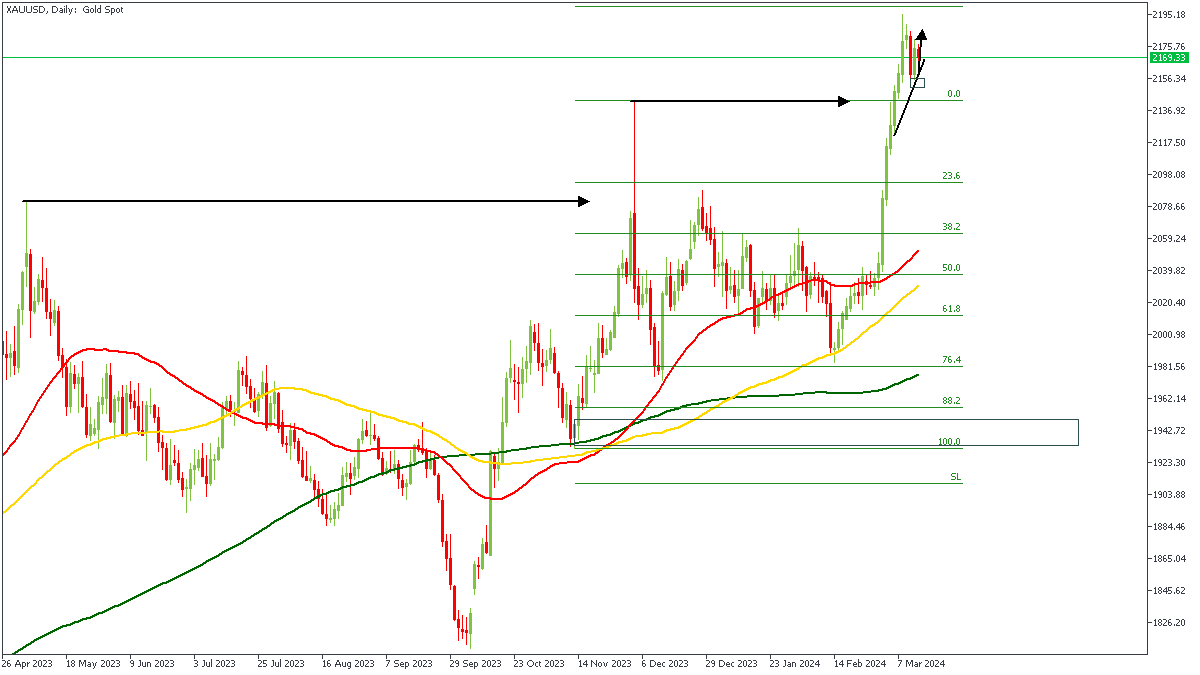

XAUUSD - D1 Timeframe

On the daily timeframe of XAUUSD, we can clearly see that the structure has been broken, with price shooting clear of the previous high. In spite of this, I believe the current price action is gradually slowing down in a search for a crucial pivot zone from which the bullish pressure can resume..

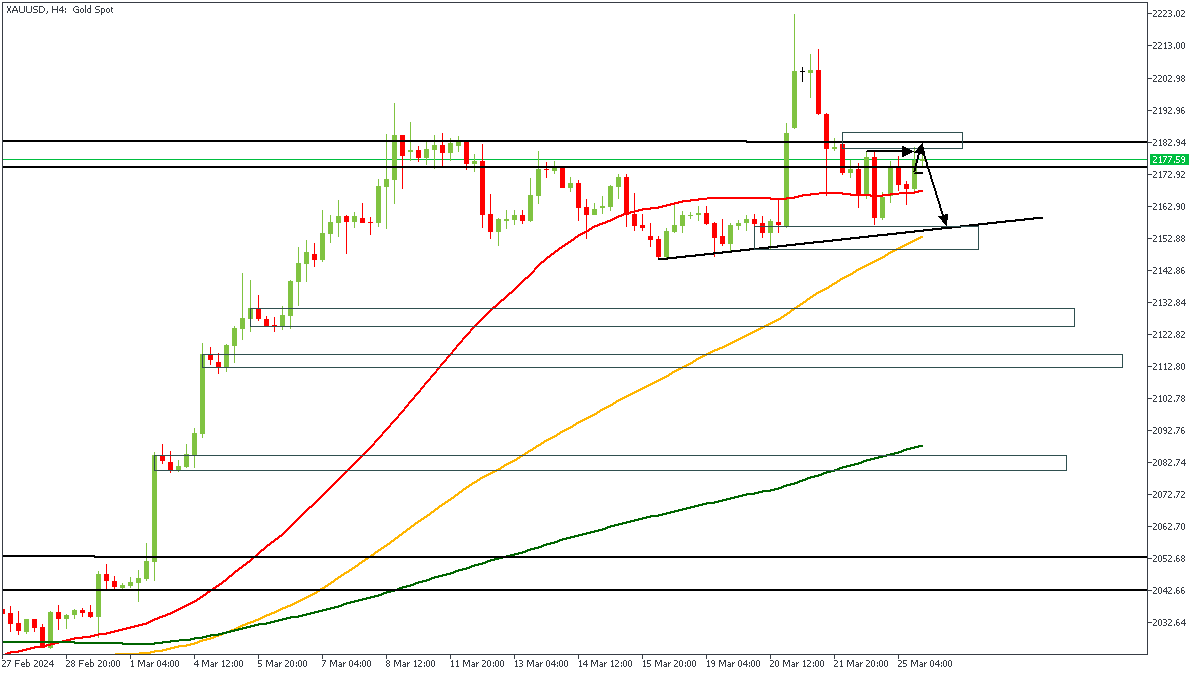

XAUUSD - H4 Timeframe

On the 4-hour timeframe, I believe price intends to make a run for the trendline support as well as the demand zone underneath it. The presence of the 100-period moving average also confirms the possibility of price to run towards the point-of-interest. I hope to see the imbalance (Fair Value Gap) get filled before the bullish price action resumes.

Analyst’s Expectations:

Direction: Bearish

Target: $2,158.77

Invalidation: $2,181.53

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.