Tradign forecast for June 12

The US dollar index managed to rebound from the psychological level at $93.50. Up to now, it is trading near $93.65. On Tuesday, traders will look at the inflation data at 15:30 MT time. The forecast is not encouraging as its similar to previous data. However, if the actual data are greater than the forecast ones, the US dollar index will go up. The resistance is at $94. Conversely, the index will go down again.

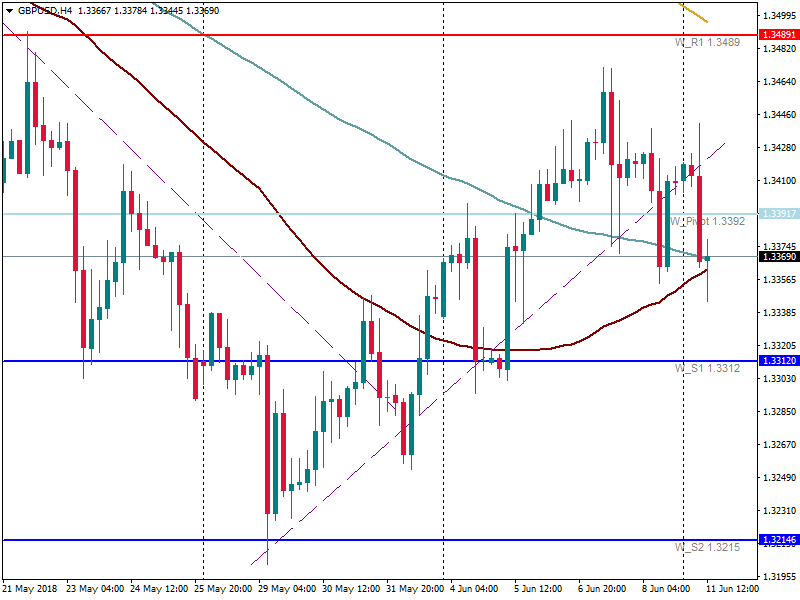

On Monday, the pound fell because of weak economic data. Manufacturing production and goods trade balance data were weaker than the forecast. As a result, GBP/USD broke the support at 1.34 (the pivot point). On the H4 chart, 100-hour and 50-hour MAs are supports for the pair. If on Monday, the pair closes below MAs, the further fall may be anticipated. On Tuesday, a direction of the pair will depend on the average earnings index, claimant count change, and unemployment rate data. The forecast is mixed, however, if the actual data are greater than the forecast, the pair will be able to go up. The resistance will lie at 1.35. Otherwise, the pair will move to the support at 1.33.

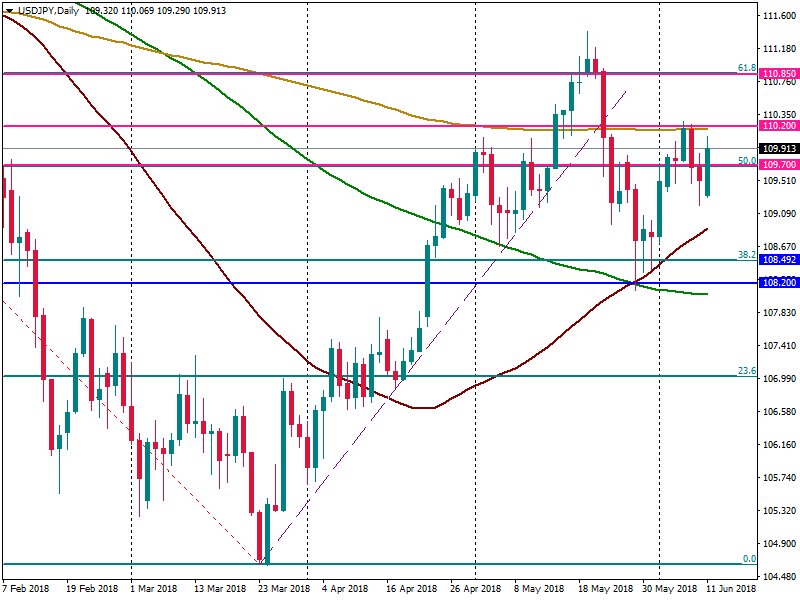

Although trade wars are anticipated to escalate because of comments of US President Mr. Trump after the G7 summit, the Japanese yen don’t react. Monday’s USD/JPY trading is bullish, however, there is a strong resistance at 110.20 (200-day MA). On Tuesday, the important US economic data will be released. If they are encouraging , USD/JPY will go up and will break the resistance. Otherwise, the fall below 109.70 is anticipated.

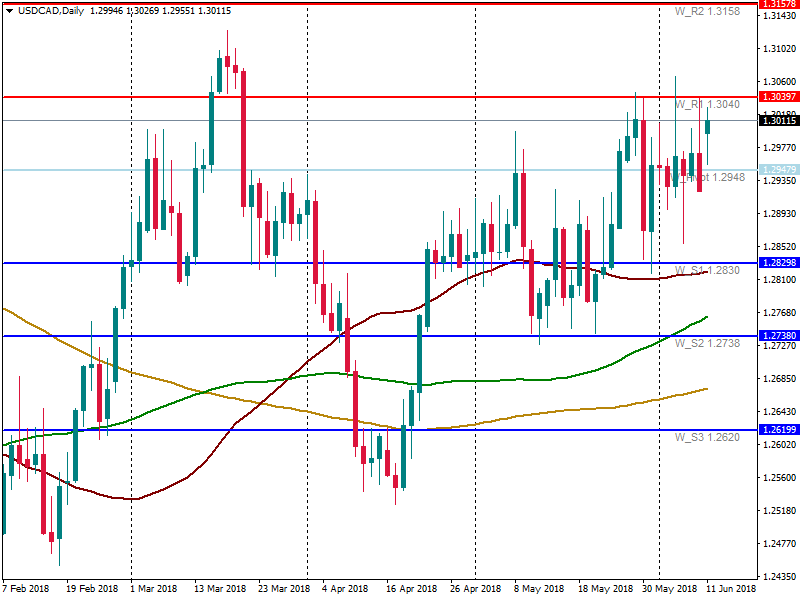

On Monday, the USD/CAD pair managed to change its direction as the US dollar index strengthened and oil fell further. The pair is moving to the resistance at 1.3040. On Tuesday, no important economic data for the Canadian dollar will be out. As a result, there are odds that the pair will break the resistance at 1.3040. If the US dollar does not strengthen, the Canadian dollar will have chances to appreciate. The support will lie at 1.2950.