S&P: back to the future

Time-check

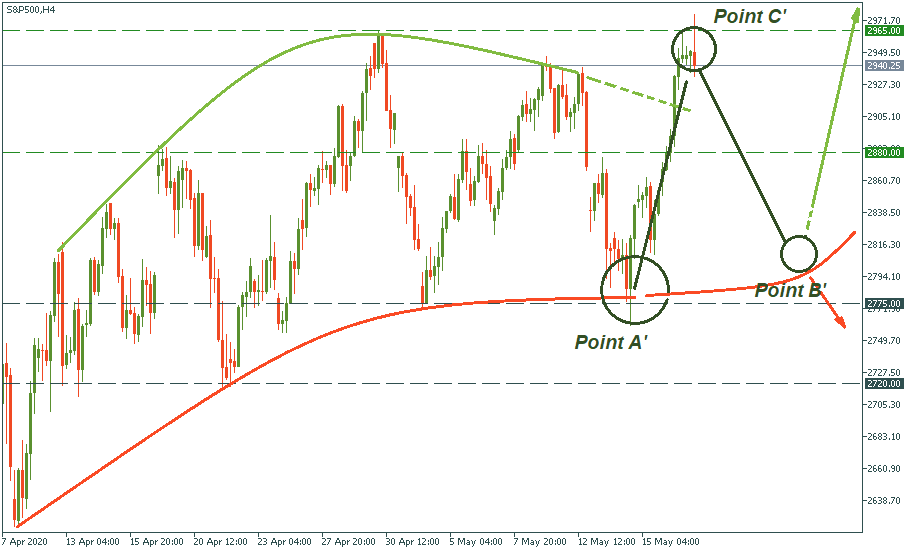

On May 14, we have suggested the following scenario for the S&P. It was clear at that time that the question was whether the index would cross the lower border of the movement channel straight away or would bounce back upwards for a smaller bullish wave.

Previous projections

Scenario 1: crossing the lower border of the trend downwards in Point A.

Scenario 2; part 1: rising to Point C.

Scenario 2; part 2: bouncing downwards to Point B to go further down or reverse upwards.

Eventually, we are witnessing that the stock market turns to be more light-spirited as the bullish trend that has formed was not a smaller one but big enough to break through the resistance of the upper border of the movement channel. Now, peaking at 2,940, the index is at the upper border of the channel market by the support of 2,775 and the resistance of 2,965.

Fulfilled projection

Scenario 2; part 1: S&P rose to Point C' which corresponds to Point C in the previous projection.

Current projection

Scenario 2; part 2: dropping to Point B' for a bullish reversal or a bearish continuation.

Projection

That proves, first, that the market is not that bearish as it could be, despite all gloomy prophecies and hard data that are out there and are really heavy. Second, taking that “heroism” (or, if you like, inadequacy) of the S&P in the current circumstances, it would be erroneous to expect too much enthusiasm of it. That’s why it appears to us that most probably the next move will be bearish: the index will go down for a temporary retreat from the onslaught it has been in lately. The question is, whether the low which will be reached will be the last station before moving up to break the resistance of the channel at 2,965. The fundamentals will show us – and that we will see at the end of this week.