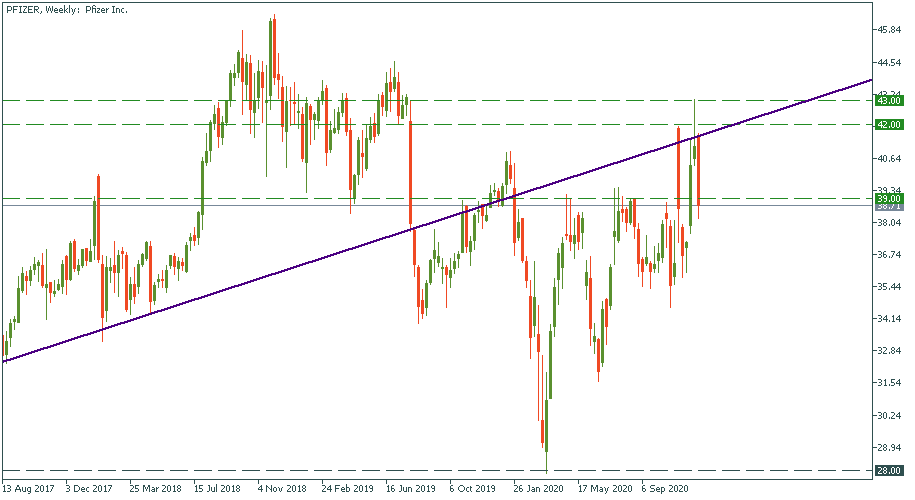

PFIZER: cooling off... good to buy long-term!

Well, as expected, Pfizer’s stock price fell. Why? Because the emotional wave that pushed it up is exhausted. It went to $43 on the vaccine news. But what was the news? That the vaccine is ready, that has more than 90% of efficacy, that it is to be distributed, etc. And that’s good enough. But the virus is still there, right? In the US and in Europe, the rates are as high as ever in certain regions, restrictions are double-enforced in some cities. Therefore, the joy of knowing that the vaccine is coming couldn’t have had but a temporary effect. In the meantime, the fundamental layout doesn’t offer any specific reason why Pfizer’s stock would leap and stay too excited. Is that a bad investment option then?

No, not at all. By releasing the vaccine, Pfizer confirmed that they are a solid pharma company – as they’ve been until now - able to deliver when needed. Probably, they needed this opportunity to shine again and spur its market capitalization back to the upside, and it happened exactly this way. In a downtrend since the second part of 2018, Pfizer’s stock recovered well from the virus hit and reached $40 – a level it last visited a year ago. Now, even with a local cooling off, this stock seems to be well set for the upside. Therefore, the suggestion to trade it is the following: go mid-term, give a while to cool off and reach a local bottom, the buy when you see a bullish reversal from the current downturn. If you reserve a month or so to hold it, it may well reach $42 again – that’s the recommended Take Profit for a position trading strategy. Don’t forget to put the Stop Loss: $36 appears to be appropriate to guard the downside.

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you’ve downloaded Metatrader 5.FBS allows you to trade stocks only through this software.

- Open the MT5 account in your personal area.

- Reveal all trading instruments by clicking “show all” at the “Market Watch” window.

- Start trading!