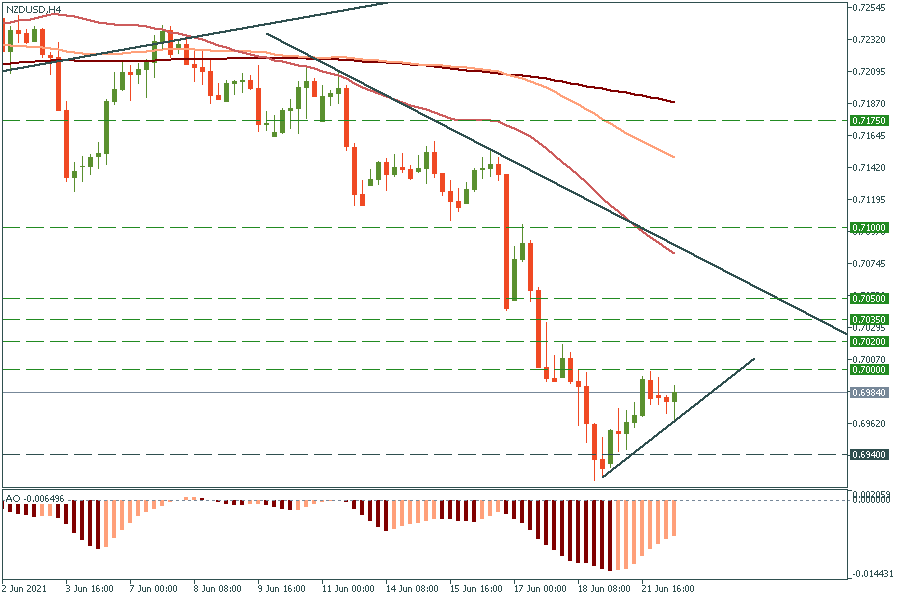

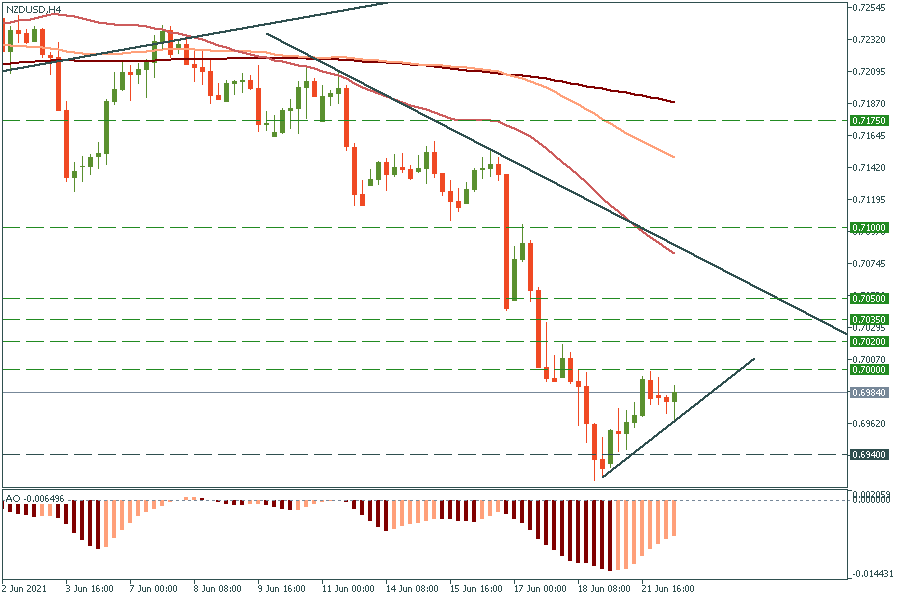

NZD/USD: a short-term spike

NZD/USD has returned above the 50-week MA at 0.6940. An “Inside bar” was formed on the D1. There’s space for recovery to the 0.7020/7035 area.

Trade idea for NZD/USD

BUY 0.7000; TP 0.7025; SL 0.6885

NZD/USD has returned above the 50-week MA at 0.6940. An “Inside bar” was formed on the D1. There’s space for recovery to the 0.7020/7035 area.

BUY 0.7000; TP 0.7025; SL 0.6885

During the Asian session on Wednesday, the USD/CAD pair rebounded after two days of losses, reaching around 1.3590. This uptick is fueled by a stronger US dollar and lower crude oil prices, which put pressure on the Canadian dollar. The decline in Western Texas Intermediate (WTI) oil prices to approximately $80.70 is attributed to...

The Australian Dollar (AUD) rebounds on Monday, despite a slight dip in the US Dollar (USD) and higher US Treasury yields. Investors are eyeing Australian monthly Consumer Price Index (CPI) data for February and US Gross Domestic Product (GDP) for Q4 2023. The AUD gains momentum as the ASX 200 Index rises, especially in mining and energy sectors. Additionally, the Aussie...

Gold prices rose on Monday as the US Dollar weakened amidst speculation about potential Federal Reserve rate cuts starting in June. This weakened Dollar was partly due to improved risk sentiment pushing US Treasury yields lower. Despite facing challenges from declining yields, gold prices recovered to nearly $2,170 per troy ounce, driven by the Dollar's weakness. Federal Reserve Chair...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

The website is operated by FBS Markets Inc.; Registration No. 000001317; FBS Markets Inc. is registered by the Financial Services Commission under the Securities Industry Act 2021, license number 000102/31. Office Address: 9725, Fabers Road Extension, Unit 1, Belize City, Belize.

FBS Markets Inc. does not offer financial services to residents of certain jurisdictions, including, but not limited to: the USA, the EU, the UK, Israel, the Islamic Republic of Iran, Myanmar.

Payment transactions are managed by НDС Technologies Ltd.; Registration No. HE 370778; Legal address: Arch. Makariou III & Vyronos, P. Lordos Center, Block B, Office 203, Limassol, Cyprus. Additional address: Office 267, Irene Court, Corner Rigenas and 28th October street, Agia Triada, 3035, Limassol, Cyprus.

Contact number: +357 22 010970; additional number: +501 611 0594.

For cooperation, please contact us via support@fbs.com.

Risk warning: Before you start trading, you should completely understand the risks involved with the currency market and trading on margin, and you should be aware of your level of experience.

Any copying, reproduction, republication, as well as on the Internet resources of any materials from this website is possible only upon written permission.

The information on this website does not constitute investment advice, a recommendation, or a solicitation to engage in any investment activity.