How Will FOMC Meeting Affect the Markets

As expected, the Federal Reserve hiked the key US interest rate by 25 basis points for the second straight time during its two-day meeting ending March 22. The unanimous decision of the FOMC came amid major central banks' commitment to fighting inflation while maintaining economic growth. The decision coincides with turmoil in banking stocks due to the Credit Suisse and SVB crises. What is the technical outlook to all these? Please continue reading below.

US Dollar

The US Dollar (DXY) on the Daily timeframe has arrived at the Demand zone with an initial reaction away from the zone. However, I expect that price will return to the area before we see the major bullish impulse play out; the reason for this is the obvious gap created by the drop. Based on this analysis, a stronger Dollar would mean a bearish move on most major pairs.

Analysts’ Expectations:

Direction: Bullish

Target: 103.870

Invalidation: 100.700

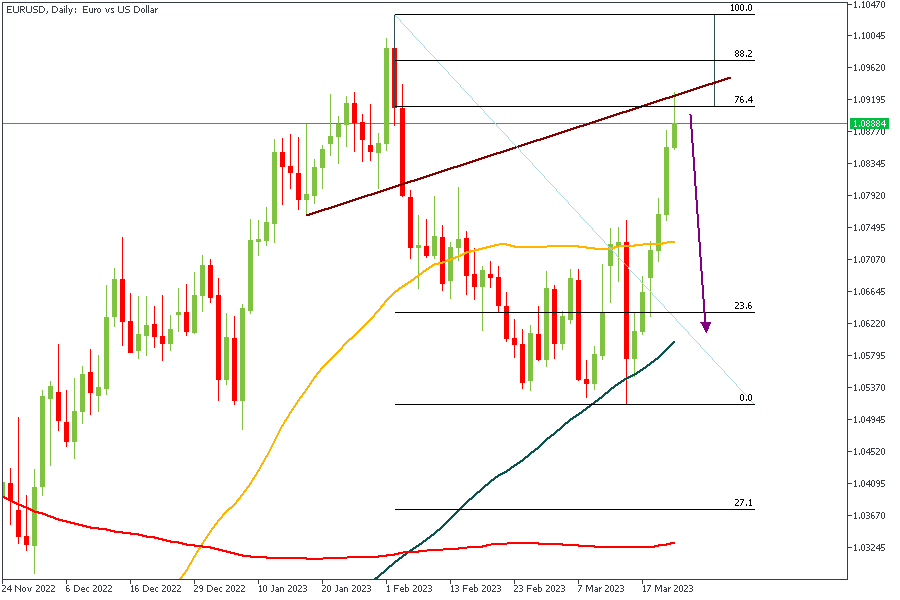

EURUSD

EURUSD is my favorite setup from today's analysis. Here we see the price reacting to the 76% Fibonacci retracement level and a supply zone overlapping the area. There is also a trendline pivot, which acts as resistance in this case. Despite the Moving Average alignments, I believe this setup will do quite well based on the correlation with the US Dollar's analysis.

Analysts’ Expectations:

Direction: Bearish

Target: 1.07495

Invalidation: 1.10300

GBPUSD

GBPUSD is currently trading within a channel and has reached the resistance trendline of the channel. The same area also has the confluences from the 88% Fibonacci retracement zone and the rally-base-drop supply zone. 1.21650 is my initial target for this trade.

Analysts’ Expectations:

Direction: Bearish

Target: 1.21650

Invalidation: 1.24000

XAUUSD - Weekly Timeframe

Similar to EURUSD, we're seeing a reaction of price to the 88% of the Fibonacci retracement and a retest of trendline resistance. There is also a note-worthy rally-base-drop supply zone and a gap around the $1873 area. These are my confluences in favor of a bearish trade from this area.

Analysts’ Expectations:

Direction: Bearish

Target: $1873

Invalidation: $2061

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.