How Will BOJ Statement Affect the Yen?

The Bank of Japan is expected to release a statement regarding its monetary policy for the second time this year. This statement, due on the 10th of March, usually has a very high impact on the outlook of the Japanese Yen as it ties in closely with the short-term interest rates and overall strength of the currency.

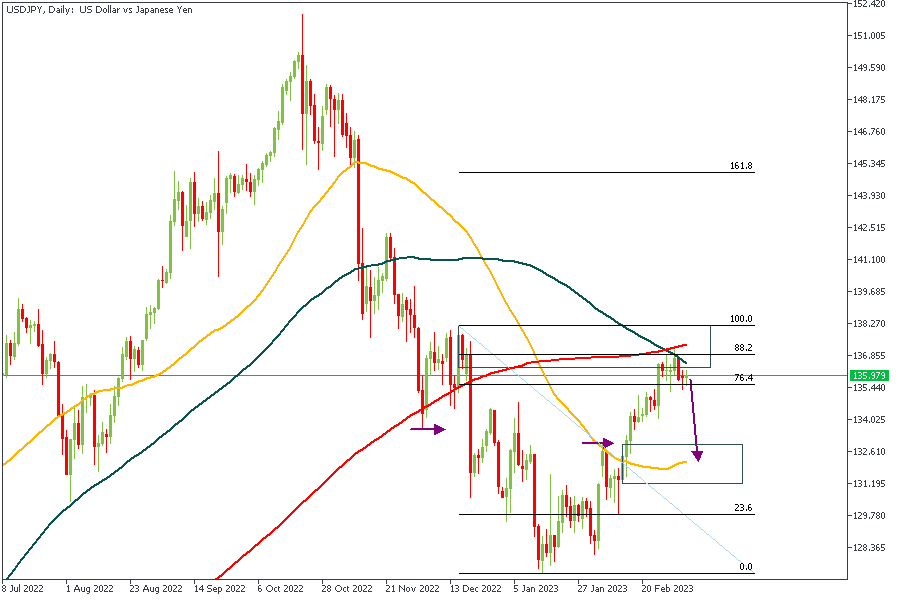

USDJPY

The Daily timeframe chart of the USDJPY already looks like the onset of a downward move. We can see the 100- and 200-period moving averages have successfully rejected prices from going higher. Also, looking at the fact that the rejection occurred from the supply zone overlapping with the 88% Fibonacci retracement level, it is quite safe to sustain a bearish sentiment.

Analysts’ Expectations:

Direction: Bearish

Target: 131.7

Invalidation: 138.3

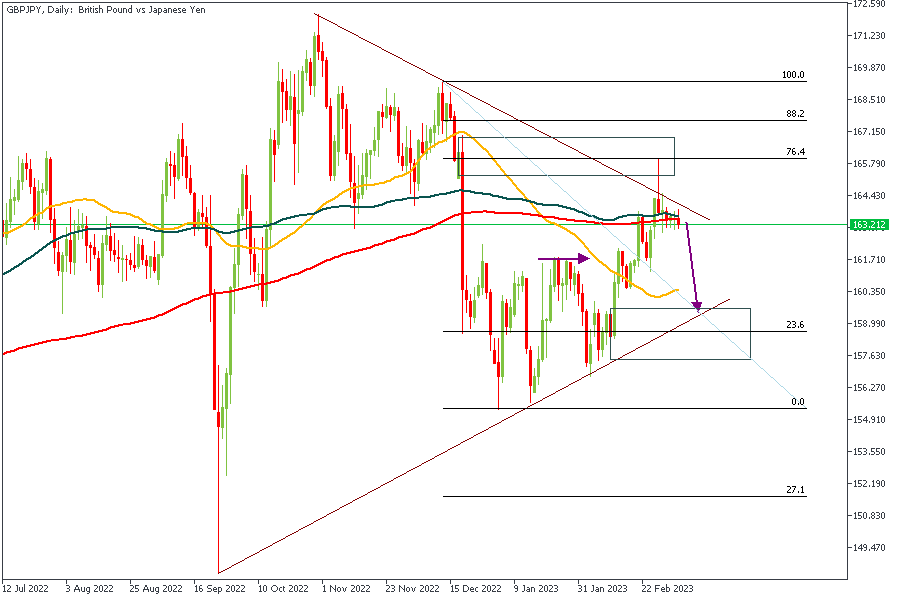

GBPJPY

Here we have a large wedge constricting price movement on the daily timeframe of GBPJPY. Price has also recently bounced off the supply zone above the trendline resistance of the wedge. Based on this, the position of the moving averages, and the 76% of the Fibonacci retracement zone, it is safe to expect a further price decline.

Analysts’ Expectations:

Direction: Bearish

Target: 158.9

Invalidation: 168.9

CADJPY

CADJPY is reacting within the highlighted supply zone, and we also have a bearish alignment from the moving averages. As a result of these confluences, I have a bearish sentiment. However, it is less confident than I would like.

Analysts’ Expectations:

Direction: Bearish

Target: 97.9

Invalidation: 101.8

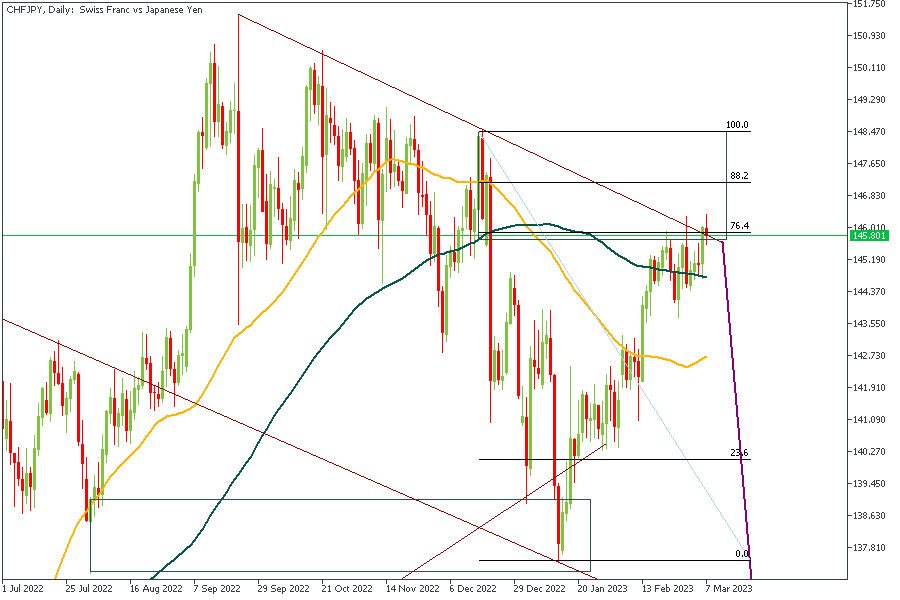

CHFJPY

We've been pursuing this particular setup for a few days. It is noticeable that the price here is still trading under the supply zone, with slight rejections already taking place. The resistance trendline and the 76% Fibonacci retracement level add additional confluences. The 50-period moving average trading below the 100-period moving average also confirms a bearish sentiment.

Analysts’ Expectations:

Direction: Bearish

Target: 142.7; and 141

Invalidation: 148.5

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.