Greatest sell-off of Australian Dollar

What happened?

The Australian central bank claimed that it would indeed cut asset purchases in September as the bank initially planned and the markets expected. However, the next review of the quantitative easing program would be moved from November 2021 to February 2022.

What is important?

It signaled that the Reserve Bank of Australia (RBA) forecasted a slowdown in the economic recovery amid continuing lockdowns across the country. The RBA’s governor said that interest rates are likely to stay at the record lows of 0.10% until at least 2024. This would put the RBA behind the Bank of England and Federal Reserve, which are expected to hike rates earlier. If it is the case, the AUD will lose against the BOE and Fed.

Market reaction

The RBA’s decision pressed the Australian dollar down. However, it’s not the only factor that drove the Aussie down. The overall market sentiment has changed to risk-off today and triggered the sell-off of riskier assets including the Australian dollar.

Tech outlook

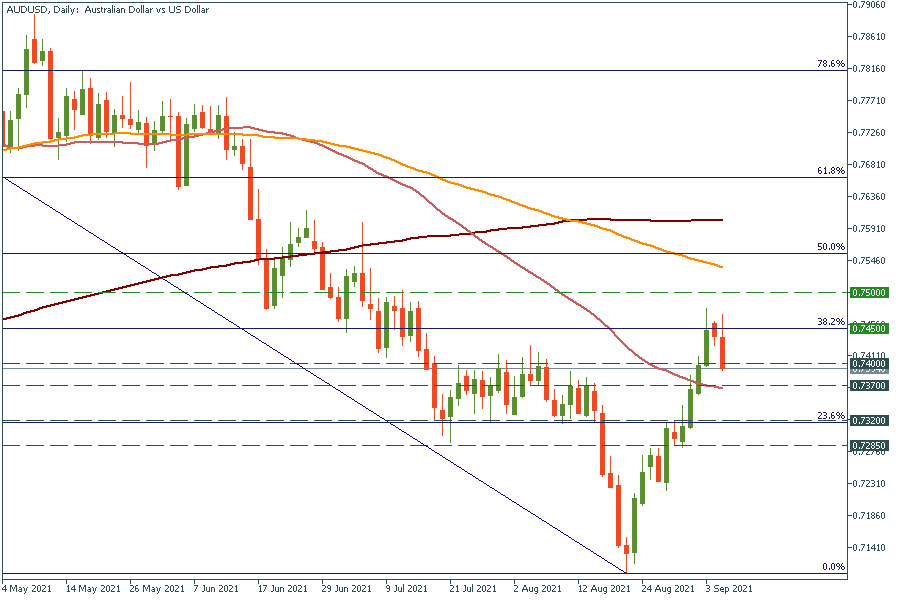

AUD/USD has failed to cross the 38.2% Fibonacci level of 0.7450 and has broken below the support line of 0.7400. Thus, the way down to the 50-day moving average (the red line) of 0.7370 is open. The pair may stop ahead of this support level and even reverse up back up to 0.7400. However, if it manages to cross this moving average, the aussie may fall to the 23.6% Fibonacci level of 0.7320.