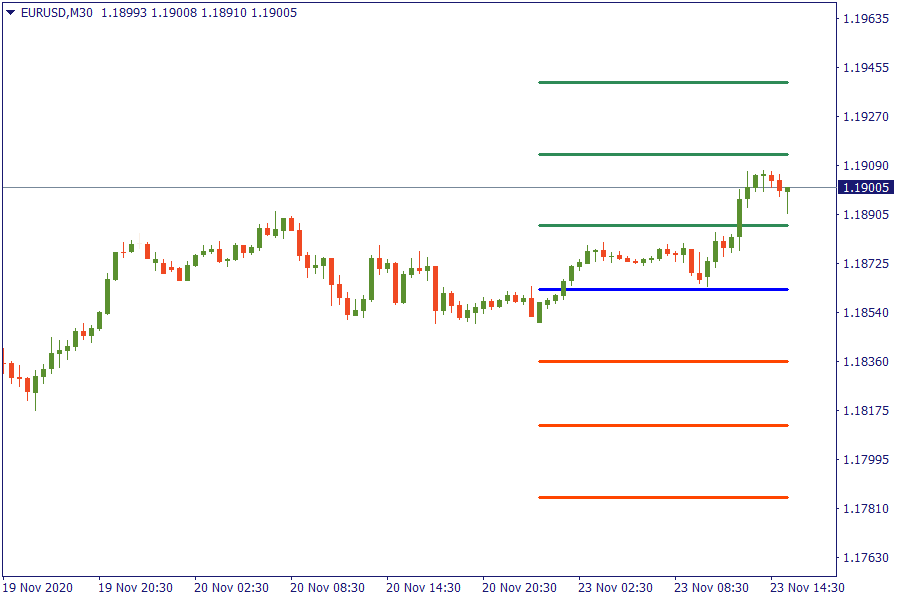

EUR/USD targets new highs

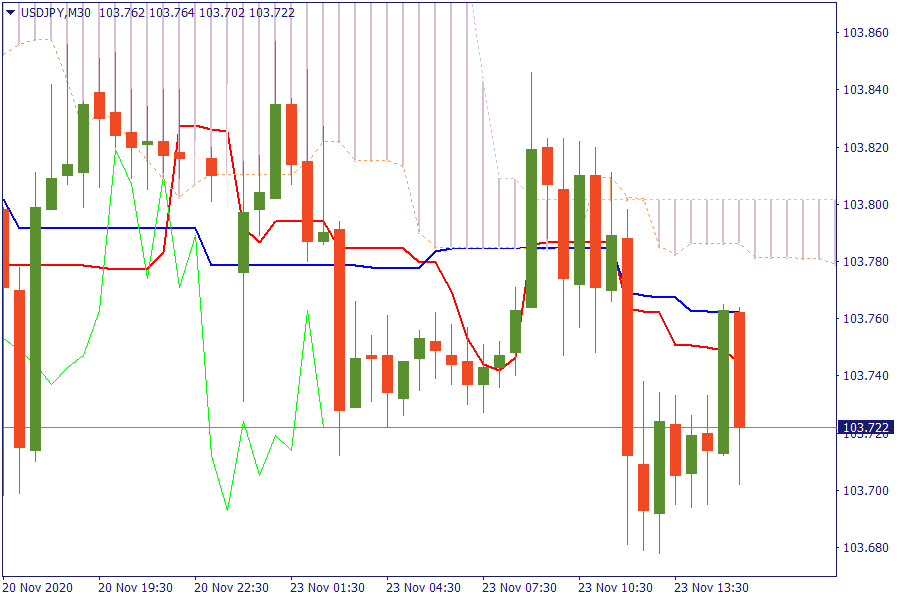

Ichimoku Kinko Hyo

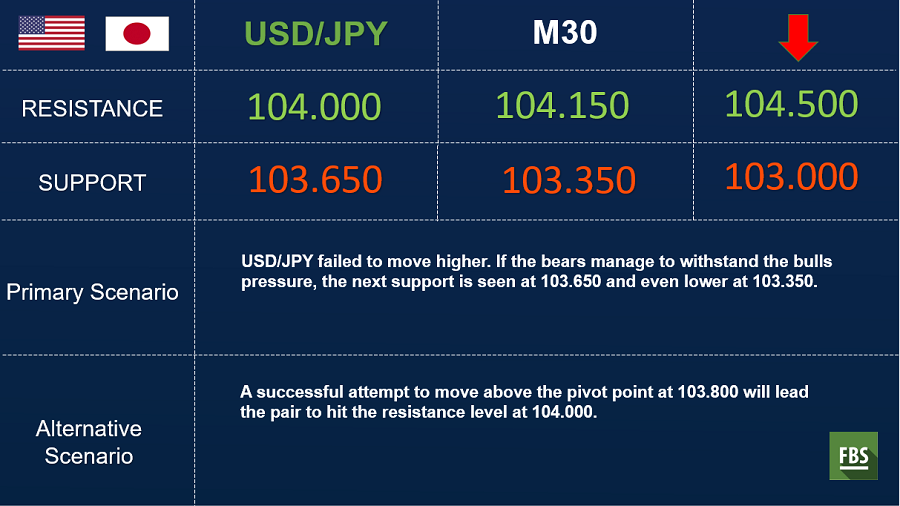

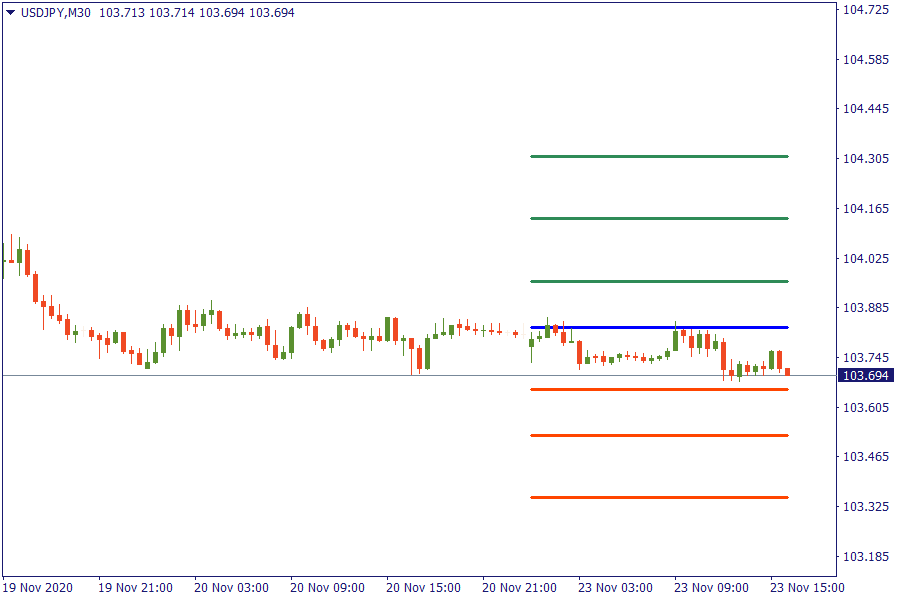

USD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

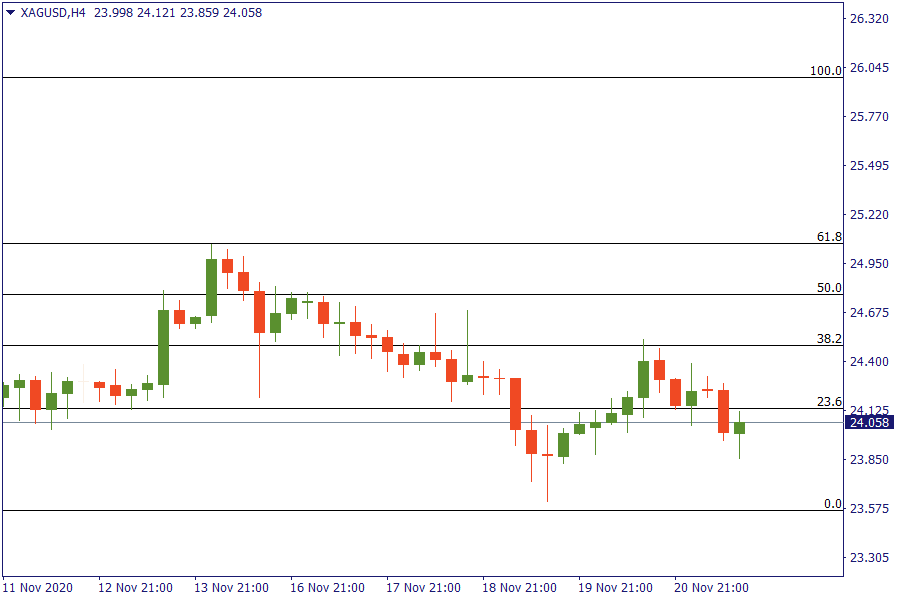

Fibonacci Levels

XAG/USD: Silver continues to stay below the key resistance area of 23.6%, it seems that bears still have control.

US Market View

U.S. stock markets are set to open higher amid the prospect of an end in sight to uncertainty over the election and the incremental good news on the vaccine front. A federal judge in Pennsylvania threw out a lawsuit filed by President Donald Trump’s lawyers that aimed to overturn the result of the election, removing the last major obstacle to Joe Biden being declared the official victor. The dollar fell and risk assets rose around the globe on more positive news about the development of vaccines to treat Covid-19. Europe’s economy contracted in November for the first time in five months under the pressure of lockdown restrictions. n more positive news, France announced it would reopen non-essential stores ahead of Christmas in response to a sharp drop in new infections of Covid-19, while the U.K. is likewise expected to announce later Monday that some lockdown measures will be relaxed as of December 1. Crude oil prices hit their highest level since August overnight, after reports of a military strike by Yemeni Houthi rebels against a Saudi Arabian oil storage and distribution center.

USA Key Point

- The GBP is the strongest and the USD is weakest

- EUR/USD touches 1.1900 as dollar eases lower on the session

- EU's Barnier supports that fundamental divergences remain, continuing to work hard for a deal

- The pound continues to lead the charge on the session