Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2022-03-15 • Updated

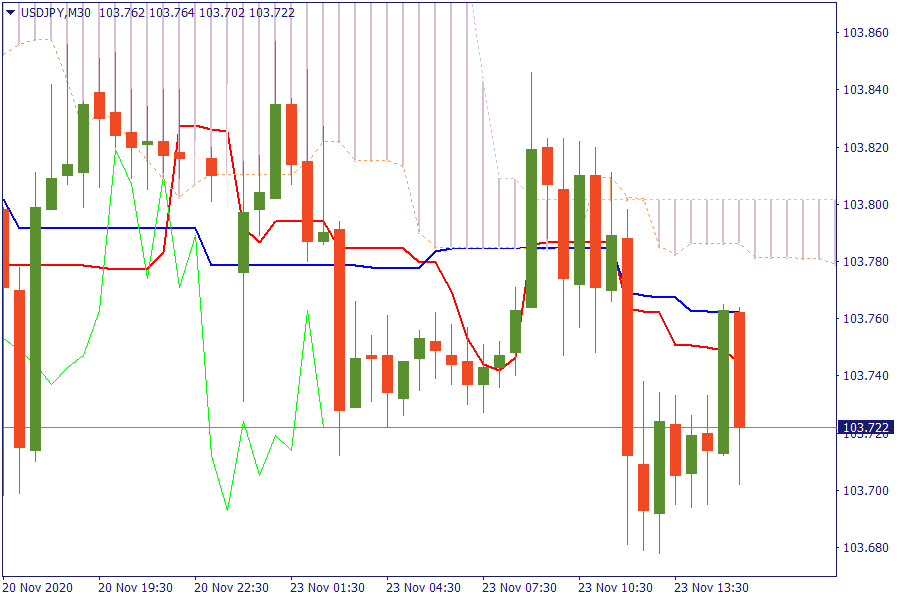

USD/JPY: The pair is trading below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

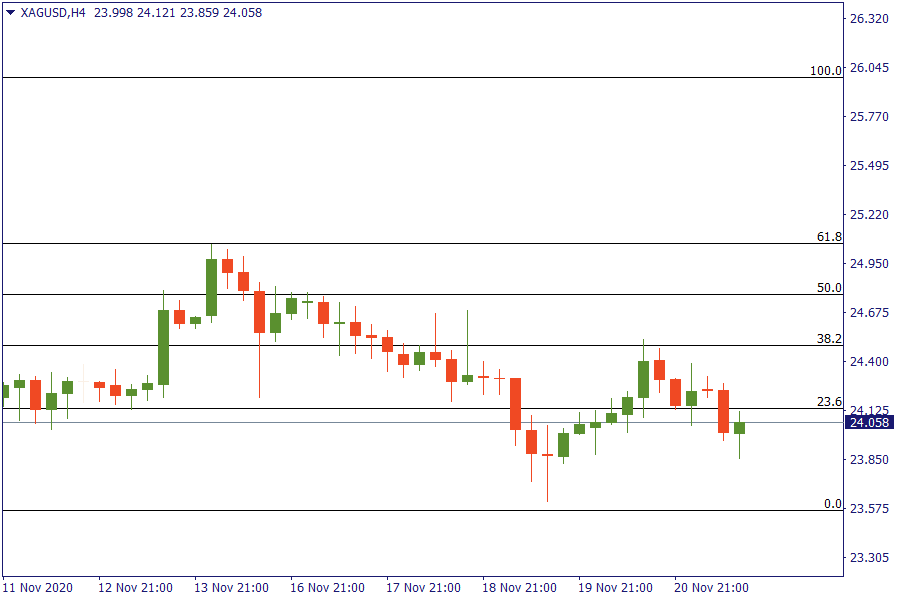

XAG/USD: Silver continues to stay below the key resistance area of 23.6%, it seems that bears still have control.

U.S. stock markets are set to open higher amid the prospect of an end in sight to uncertainty over the election and the incremental good news on the vaccine front. A federal judge in Pennsylvania threw out a lawsuit filed by President Donald Trump’s lawyers that aimed to overturn the result of the election, removing the last major obstacle to Joe Biden being declared the official victor. The dollar fell and risk assets rose around the globe on more positive news about the development of vaccines to treat Covid-19. Europe’s economy contracted in November for the first time in five months under the pressure of lockdown restrictions. n more positive news, France announced it would reopen non-essential stores ahead of Christmas in response to a sharp drop in new infections of Covid-19, while the U.K. is likewise expected to announce later Monday that some lockdown measures will be relaxed as of December 1. Crude oil prices hit their highest level since August overnight, after reports of a military strike by Yemeni Houthi rebels against a Saudi Arabian oil storage and distribution center.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!