Dollar Holds Mildly Weaker

Ichimoku Kinko Hyo

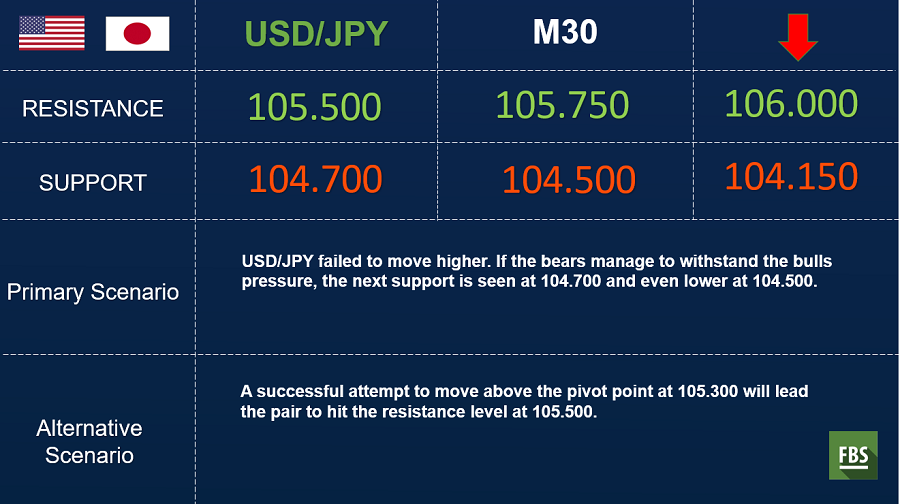

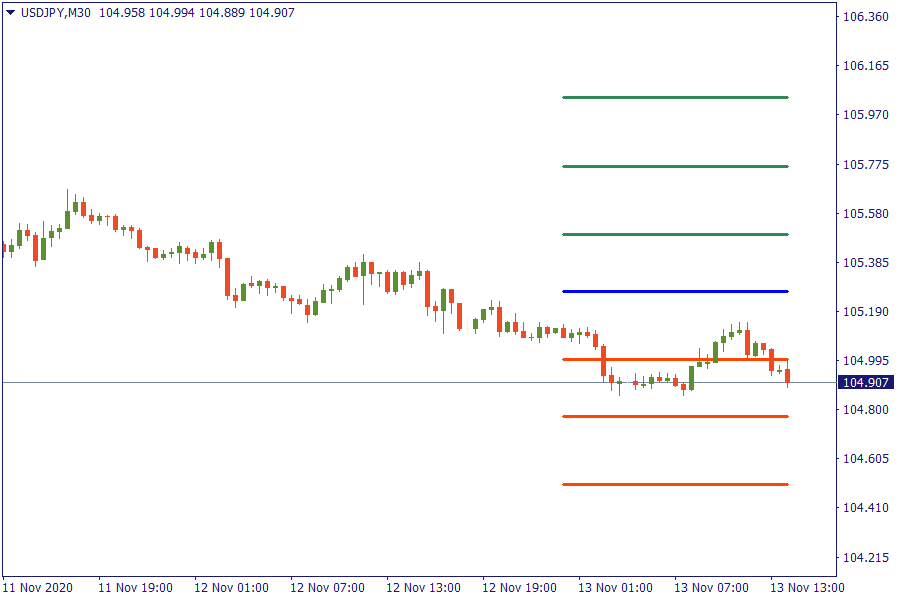

USD/JPY: The pair is trading much below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

Fibonacci Levels

XAG/USD: Silver during the last hours is trading higher close to the key retracement area of 38.2%.

US Market View

U.S. stock markets are indicated to open higher on Friday at the end of a topsy-turvy week in which the initial euphoria on finding an effective vaccine against Covid-19 has buckled under the weight of the bleak short-term outlook. Overnight, Chinese stocks had fallen after the Trump administration issued a new blacklist of companies deemed to be facilitating the Chinese military. U.S. entities will be banned from investing in the companies.

European markets were mixed, supported by confidence in more stimulus from the European Central Bank but held back by growing doubt over the ratification of the 750 billion-euro EU Recovery Fund.

The number of new infections of Covid-19 in the U.S. hit 150,000 for the first time, as cities and states moved at various speeds to contain the latest wave of coronavirus. China beat the Republican Party to congratulating Joe Biden on his election victory, nearly a week after the counting process all-but confirmed the results of Tuesday’s vote.

US Key Point

- German government spokesman says that no easing of virus restrictions is possible yet

- Equities climb higher in European morning trade

- ECB's de Cos supports that upcoming macroeconomic projections in December likely to be revised downwards

- Italy reportedly set to extend regional lockdown system beyond 3 December

- ECB's Schnabel supports that ECB is going to be there for as long as it is necessary

- GBP/USD still playing within the near-term range