Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-11-13 • Updated

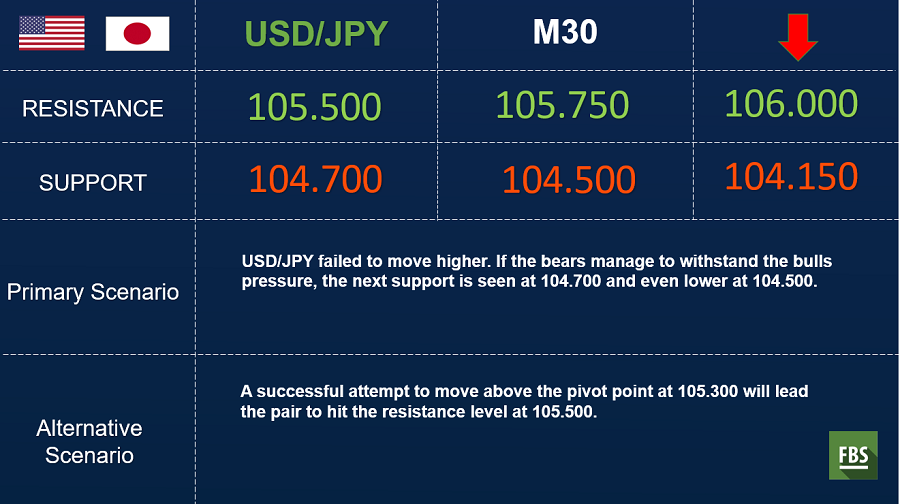

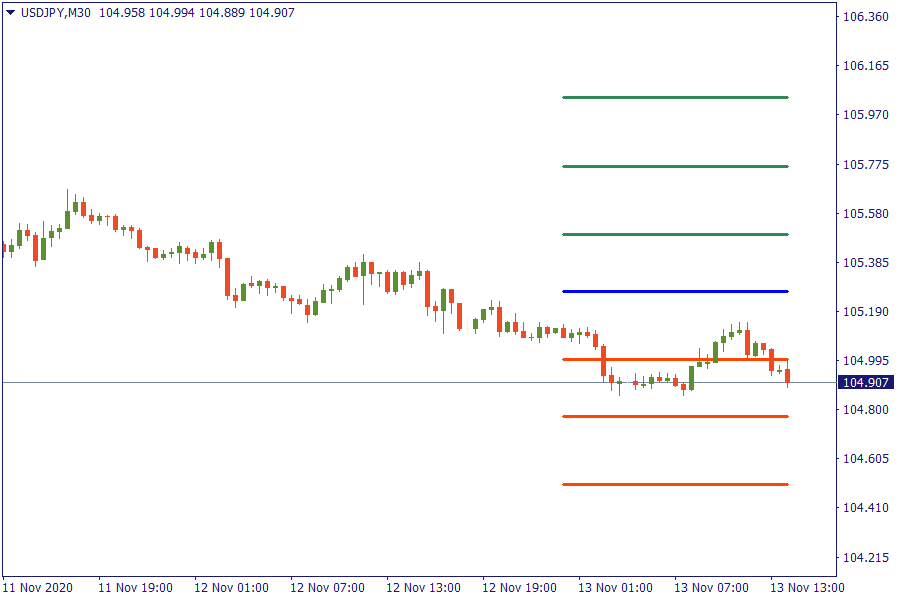

USD/JPY: The pair is trading much below the cloud. A downward pressure would lead the pair to exit further the cloud, confirming a bearish outlook.

XAG/USD: Silver during the last hours is trading higher close to the key retracement area of 38.2%.

U.S. stock markets are indicated to open higher on Friday at the end of a topsy-turvy week in which the initial euphoria on finding an effective vaccine against Covid-19 has buckled under the weight of the bleak short-term outlook. Overnight, Chinese stocks had fallen after the Trump administration issued a new blacklist of companies deemed to be facilitating the Chinese military. U.S. entities will be banned from investing in the companies.

European markets were mixed, supported by confidence in more stimulus from the European Central Bank but held back by growing doubt over the ratification of the 750 billion-euro EU Recovery Fund.

The number of new infections of Covid-19 in the U.S. hit 150,000 for the first time, as cities and states moved at various speeds to contain the latest wave of coronavirus. China beat the Republican Party to congratulating Joe Biden on his election victory, nearly a week after the counting process all-but confirmed the results of Tuesday’s vote.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!