British pound breakout soon?

Great Britain released retail sales data on May 20, 9:00 GMT+3. The reading outperformed expectations greatly (+1.4% actual vs. -0.3% forecast). Consumer spending is important for the economy as it is the main metric for understanding the market’s sentiment. Looking more broadly, in the three months to April 2022, sales volumes fell by 0.3% compared with the previous three months; this continues the downward trend since summer 2021.

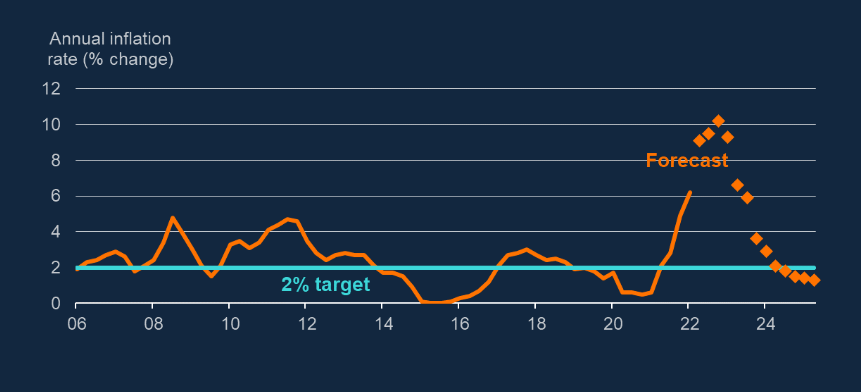

It is unusual for Britain to see an increase in spending as the UK continues the tightening program, and the UK CPI is 9.0% (a 40-year high). The MPC forecasts that it will rise to double digits in the fourth quarter of this year. This is a very uncomfortable situation for a monetary policymaker targeted at achieving inflation of 2%.

Huw Pill, head of monetary analysis in BoE, expects inflation to return to the targets shortly after entering the double-digit zone.

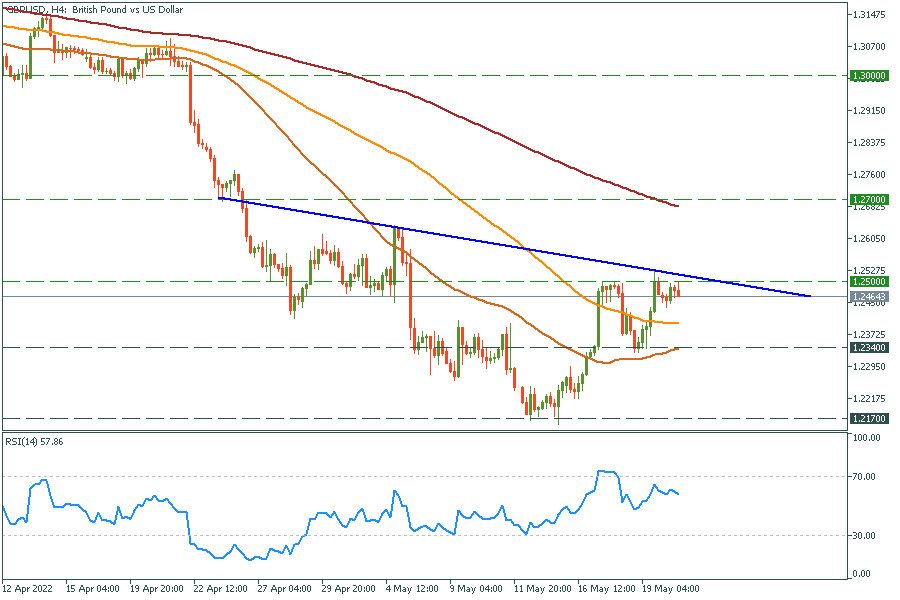

As for the chart, high retail sales data is very bullish for the GBPUSD pair. We have an inversed head and shoulders pattern. On the breakout, GBPUSD is likely to reach 1.2700 over the next week. Look for the soar above 1.2500 before opening a trade.

GBPUSD H4 chart

Resistance: 1.2500, 1.2700, 1.3000

Support: 1.2340, 1.2170