BoC Rates Could Alter The Trend on USDCAD and others

Today, at 5:00 pm (GMT +2), the Bank of Canada will publish the Overnight Rate, which represents short-term interest rates, and is pivotal to the overall pricing of the Canadian Dollar in the global markets. Let's look at how the markets are faring ahead of the BoC rates release.

USDCAD

USDCAD is currently trading around a Daily drop-base-rally demand zone above the 200-EMA (Exponential Moving Average). The moving averages suggest that we are currently bullish on price action. Moreover, coupled with the trendline support, bullish break of structure (marked by the short arrowed line), and the demand zone region, we can expect a bullish reaction from the marked rectangular area.

GBPCAD

GBPCAD has recently broken structure bullish, as shown by the arrowed line to the left. There is also trendline support overlapping with the 50-SMA right around 61.8% of the Fibonacci retracement level. Thus, the price would deliver a bullish reaction from the marked demand zone.

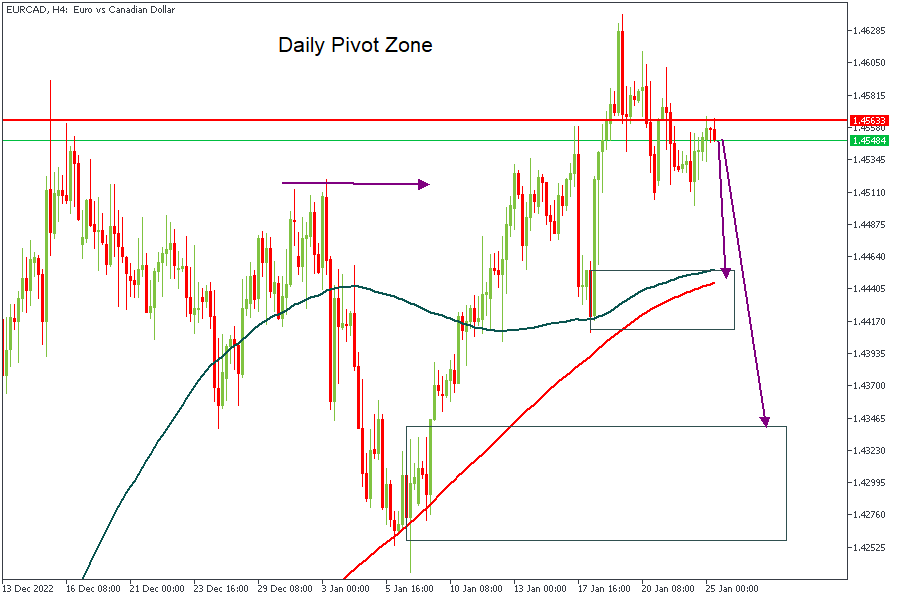

EURCAD

EURCAD has been trading around a Pivot zone on the Daily timeframe. Considering the bullish lay of the Moving Averages, we may not see the bearish move extend below 1.44640. The interest rates will bring clarity to the direction in the future.

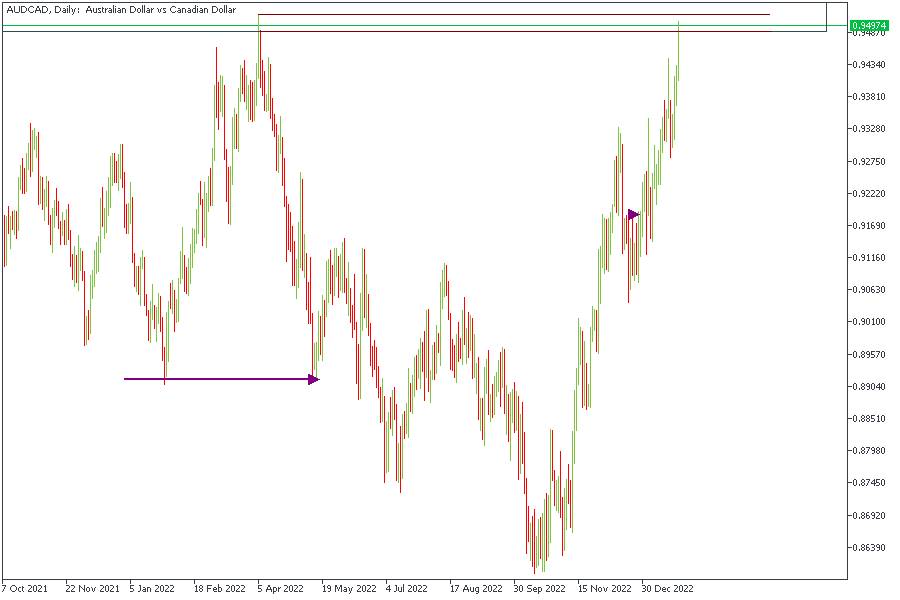

AUDCAD

The daily timeframe of AUDCAD shows the price currently within a supply zone. It seems logical to expect some bearish relief from the last bullish run. My target for the bearish retracement would be 0.93810.

Analysts’ Expectations:

Previous: 4.25%

Forecast: 4.50%

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

You can access more of such trade ideas and prompt market updates on the telegram channel.