Summary

- Current BoE Interest Rate: 5.25%

- Rate Cut Probability (May 9th Meeting): 85%

- GBPUSD: Under pressure after CPI miss

- UK Bond Yields: Falling, reinforcing dovish bets

Fundamental Factors Affecting the Pound

- UK Inflation Falls Below Forecast

- March CPI YoY: 2.6%, down from 2.8% and below the 2.7% expected.

- Key drags: Recreation (-4.2%), data equipment (-5.1%), and motor fuel (-5.3%).

- Core inflation eased slightly to 3.4%, supporting the case for easing.

- Monthly CPI: Rose 0.3%, slightly below forecast (0.4%).

- BoE Policy Outlook

- With inflation nearing target, BoE is widely expected to cut rates in May.

- This would mark the first cut of the cycle after holding at 5.25% since September 2023.

- Policymakers may act pre-emptively, given falling inflation and global slowdown risks.

- Upside Inflation Risks Still Exist

- Energy & water bills are expected to add 0.8 percentage points to the April CPI.

- ING projects inflation will rebound to 3.2% in April, possibly reaching 3.5% in Q3.

- Services inflation remains sticky but still within BoE projections.

- Tariff uncertainty (especially with the U.S. and EU) could exacerbate cost pressures.

- Consumer Behavior & Growth Risks

- High rates and economic uncertainty are prompting cautious consumer spending.

- Weaker demand could dampen future inflation and slow growth.

Key Takeaway for Traders

- Short-term: Lower-than-expected CPI and high rate-cut expectations are bearish for GBP.

- Medium-term: Rising energy costs and sticky services inflation may limit BoE’s dovish path.

- Long-term: If inflation re-accelerates in Q2-Q3, BoE may pause after one or two cuts.

- FX Impact:

GBPUSD – H1 Timeframe

.png)

Following the bearish break of structure and the break below the trendline support on the 1-hour timeframe chart, GBPUSD went slightly bullish following the decline in inflation figures. The bullish reaction may, however, turn out to be a retracement, as the bullish trend on GBPUSD is currently overextended. Additional confluences include the Fibonacci retracement levels and the drop-base-drop supply zone.

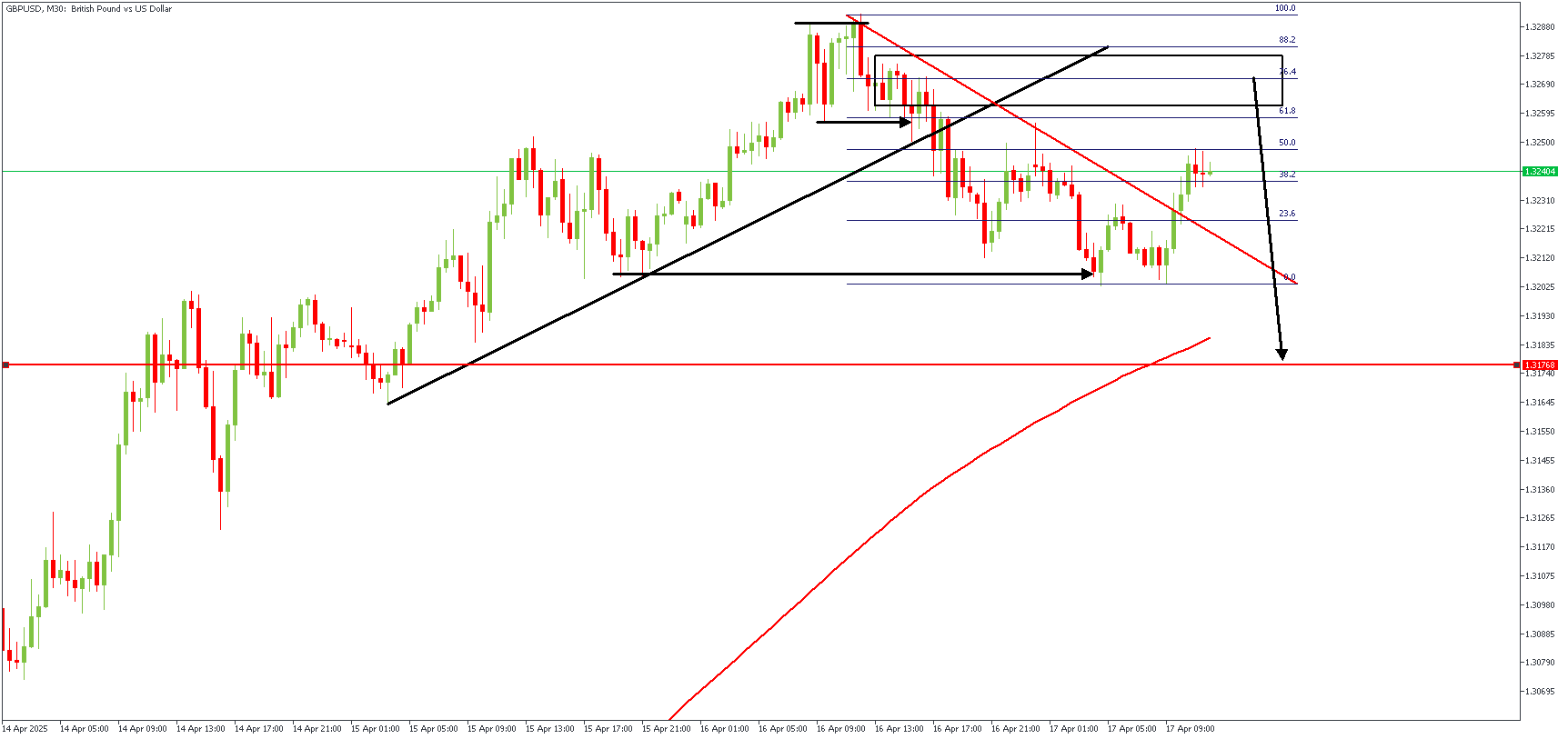

GBPUSD – M30 Timeframe

The primary criteria on the 30-minute timeframe chart of GBPUSD is the SBR (Sweep-Break-Retest) pattern, as seen above. The region between 76% and 88% of the Fibonacci retracement tool is the Area of Interest as we watch for confirmations of a bearish intent.

Analyst’s Expectations:

Direction: Bearish

Target- 1.31768

Invalidation- 1.32948

CONCLUSION

You can access more trade ideas and prompt market updates on the telegram channel.