This visualization helps traders see if the current market is dominated by buyers or sellers, and identify current trends. In this article we are going to discuss candlestick chart patterns.

15 stock chart patterns you should know

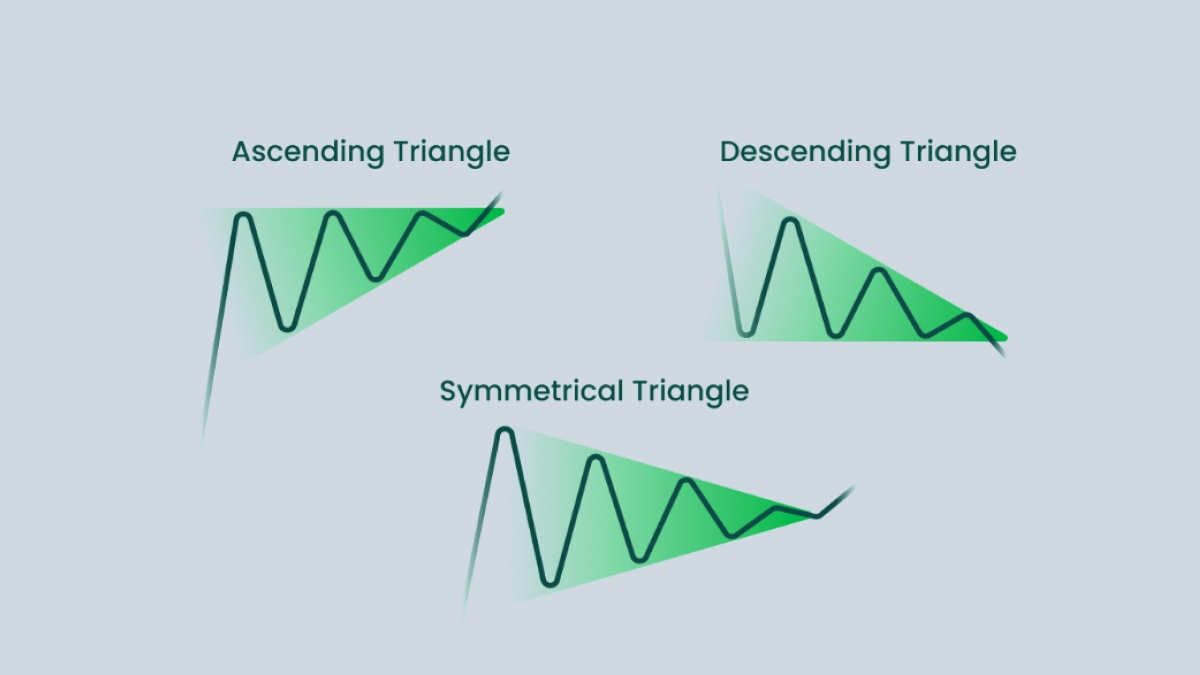

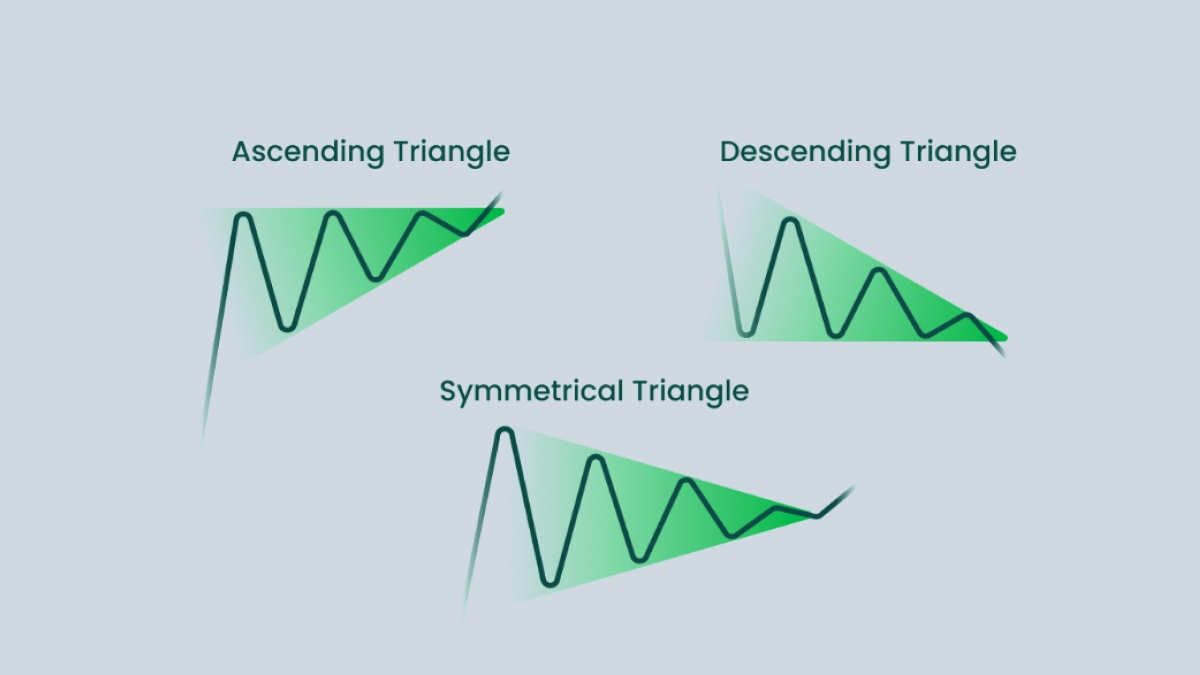

Ascending triangle

The first chart pattern we’re going to look at is an ascending triangle. This pattern is a bullish continuation pattern that is formed when a price starts to swing within a narrowing range. The upper (resistance) line of an ascending triangle is horizontal, while the lows create the lower (support) line that is climbing toward the resistance line. It maintains its ascent until the price eventually breaks the resistance line, confirming the pattern, and continues its upward movement.

Descending triangle

The polar opposite of its ascending counterpart, a descending triangle is a bearish continuation pattern that appears when the price of the stock starts moving between a downward sloping resistance line and a horizontal support line. Once the resistance and support lines merge, a breakout occurs — the price falls even lower and continues with the downtrend.

Symmetrical triangle

The last of the triangle chart patterns, a symmetrical triangle is formed by an ascending support line and a descending resistance line. The price bounces from both lines within a continuously narrowing range until the lines cross each other. It is impossible to say where the price will go after the breakout because both buyers and sellers have equal influence on the market. This is why a symmetrical triangle is considered a bilateral pattern. Traders are advised to place two stop entry orders above and below the lines.

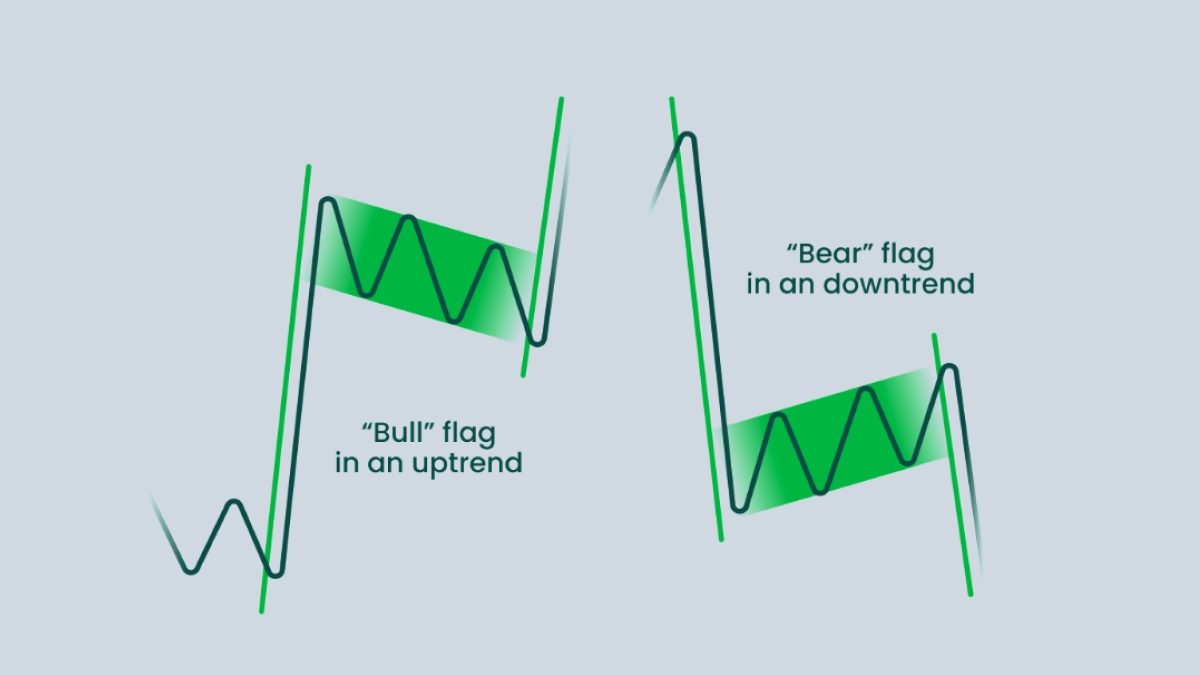

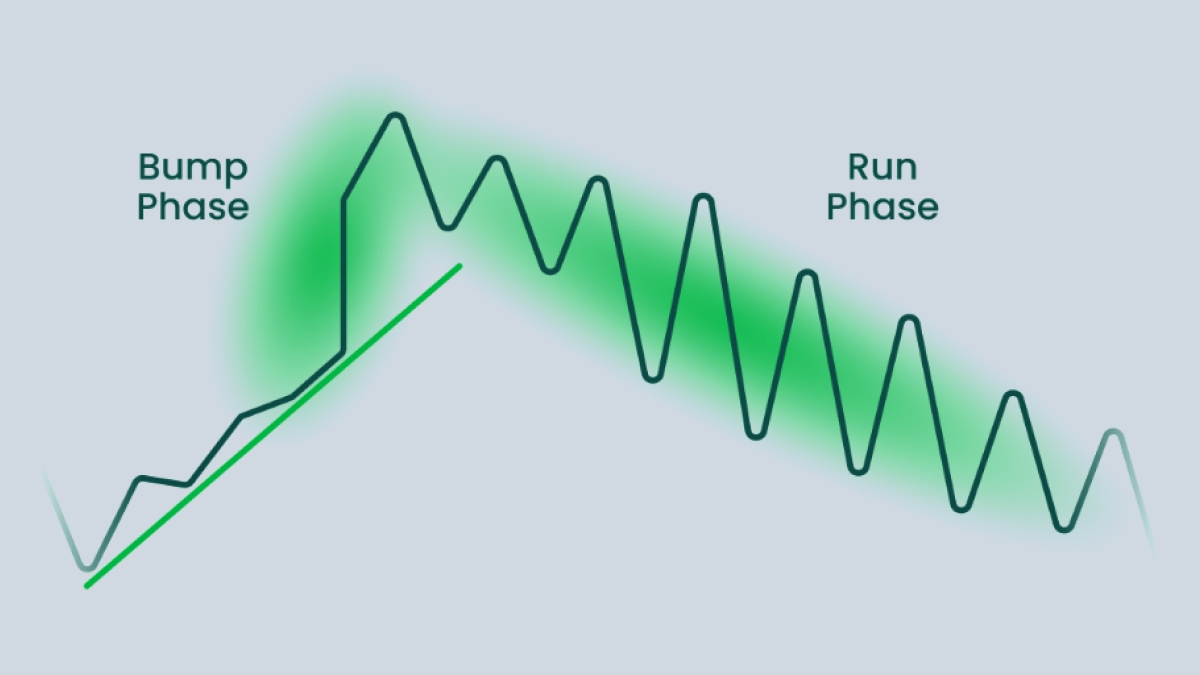

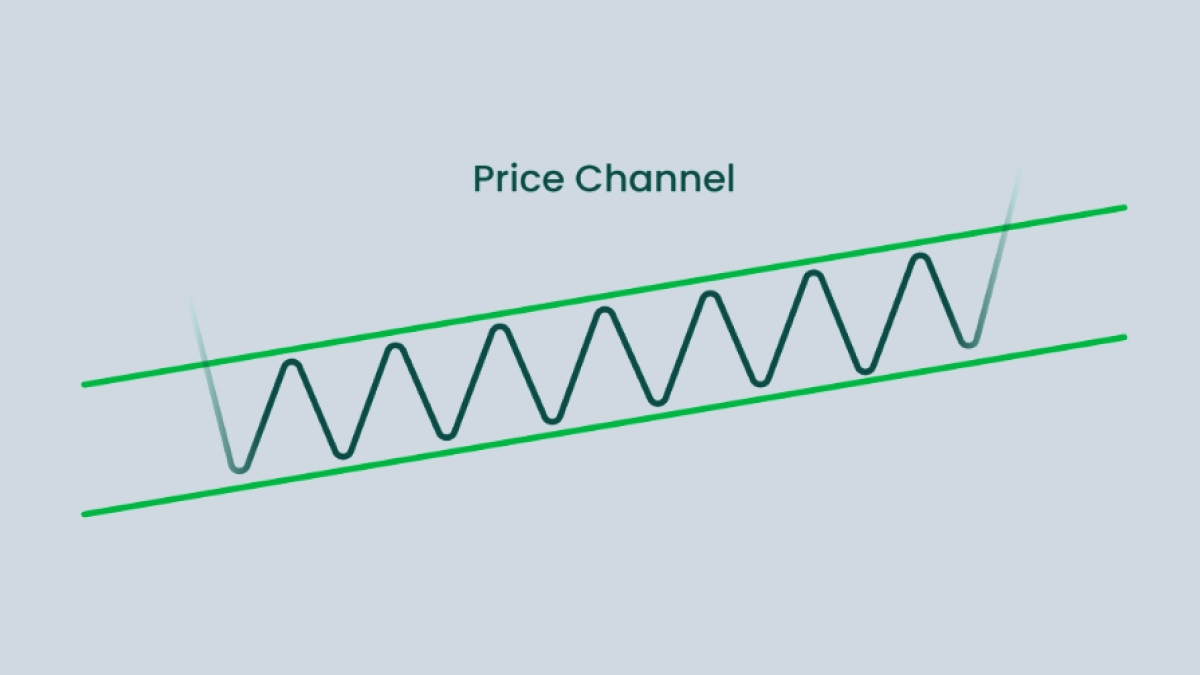

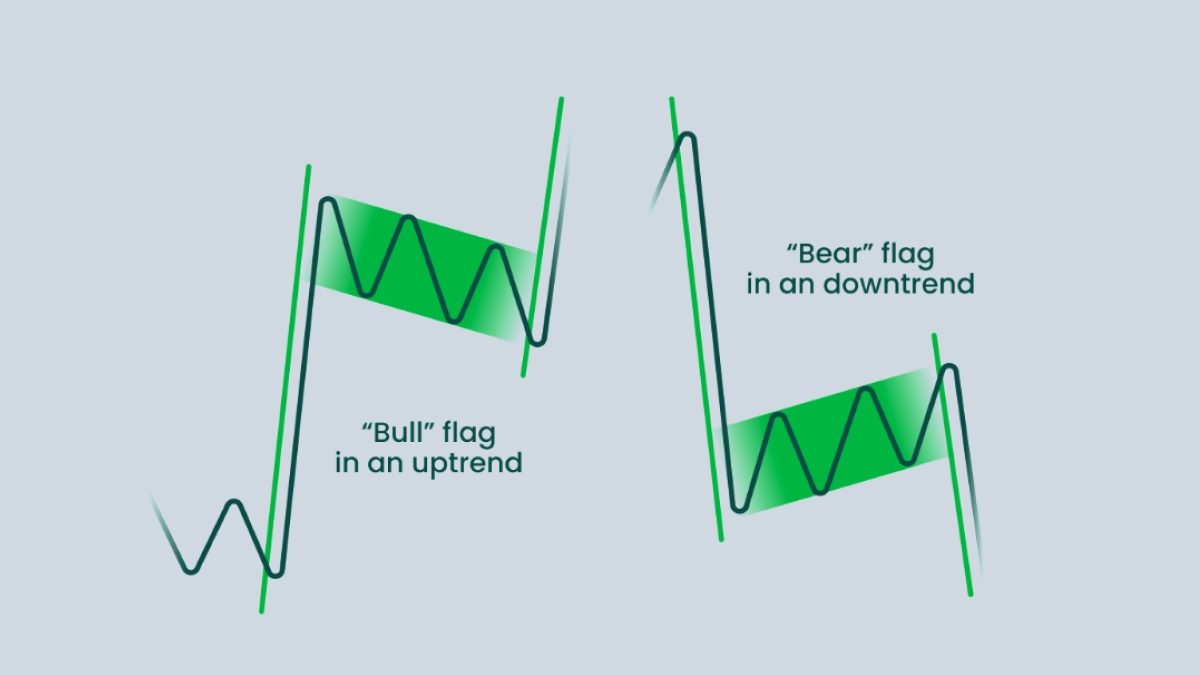

Flag

A flag pattern is often associated with low-risk investments and quick profit. It is a continuation pattern that can occur in the middle of a strong trend. A flag pattern is formed when the trend enters a brief period of consolidation, and it can be both bullish and bearish. After a sudden, almost vertical spike or fall (a so-called ‘flag pole’), the price starts to fluctuate and retraces its previous movement within a narrow range that resembles a slightly tilted rectangle. After a short while, the price breaks one of the lines and continues moving in the previous direction while rapidly gaining momentum.

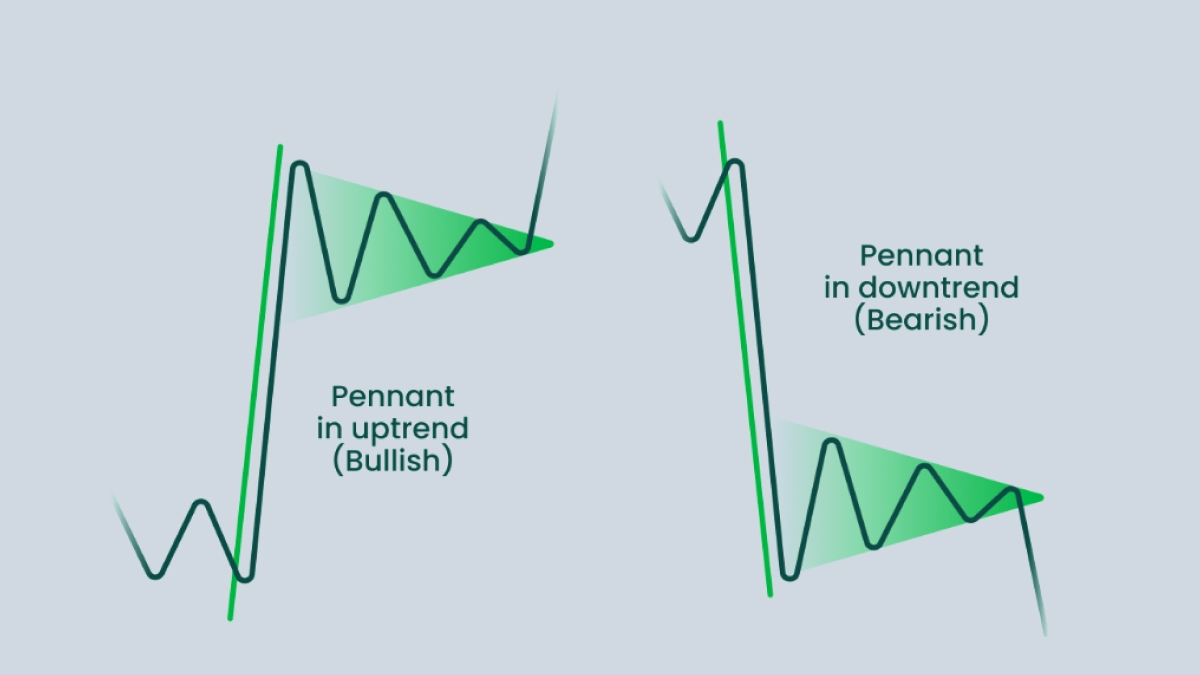

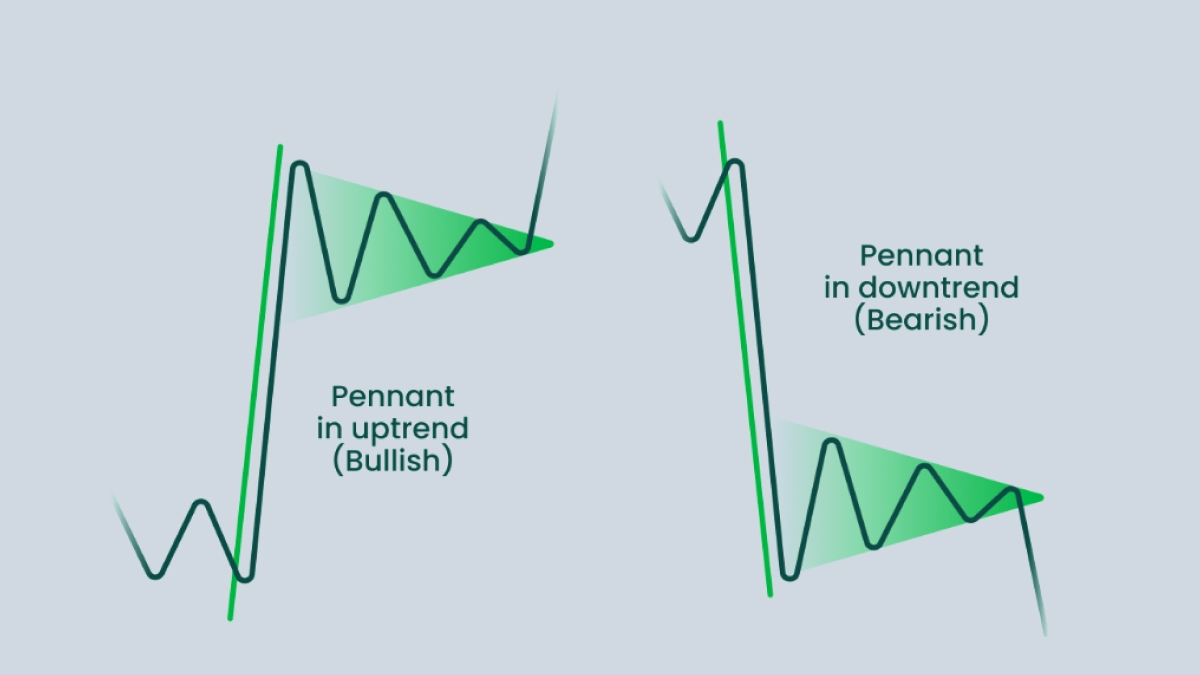

Pennant

A pennant pattern looks very similar to a flag pattern or a symmetrical triangle, being a continuation pattern as well, but it’s quite different from both of them. Like a flag pattern, it also occurs when the price enters a consolidation period after a sudden move in one direction (a flag pole). However, a pennant’s body is formed by two converging lines, not parallel ones, which makes it look like a symmetrical triangle. However, a triangle pattern is not preceded by a flag pole, as it manifests in unstable markets. A pennant, on the other hand, occurs within a strong trend. After the lines converge, the price breaks out and most often continues to move in the direction of the main trend.

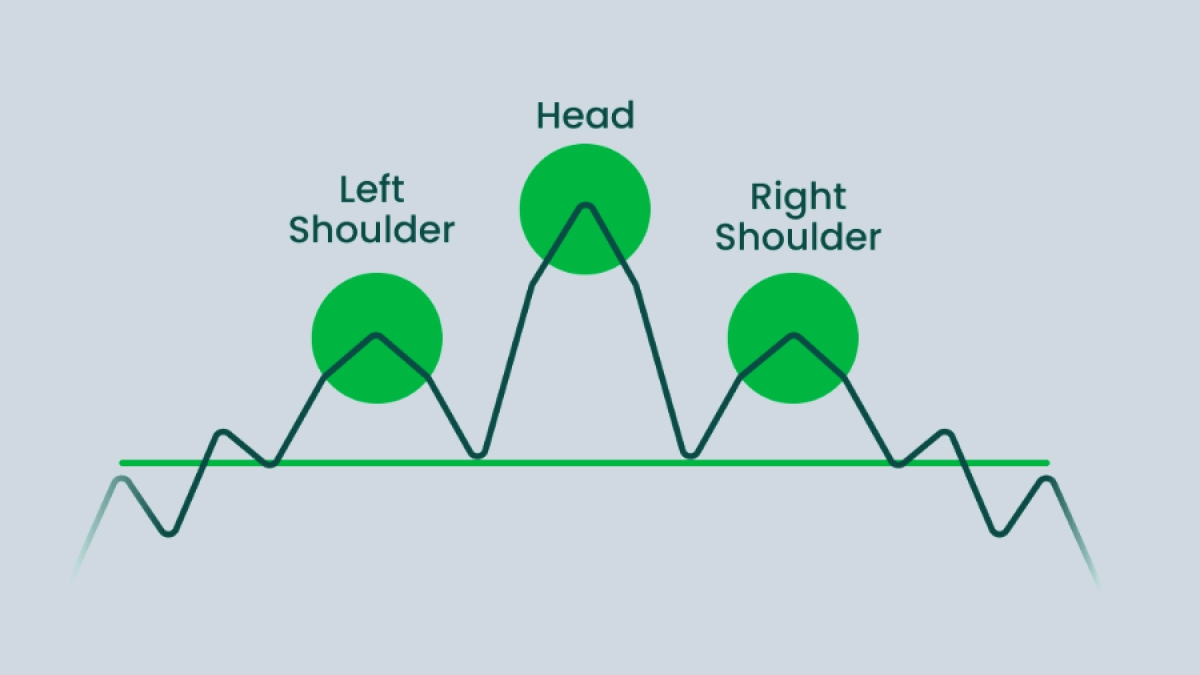

Double top

A double top is a bearish pattern that occurs before an intermediate or long-term downward reversal. A double top consists of two highs and one low and somewhat resembles the letter “M”. It begins when the price retraces back after a steady increase due to some resistance from the bears. It later picks up again, but when it reaches the level of the previous high, it plunges back down. Once it crosses the neckline, the pattern is considered confirmed, and the trend reverses from bullish to bearish.

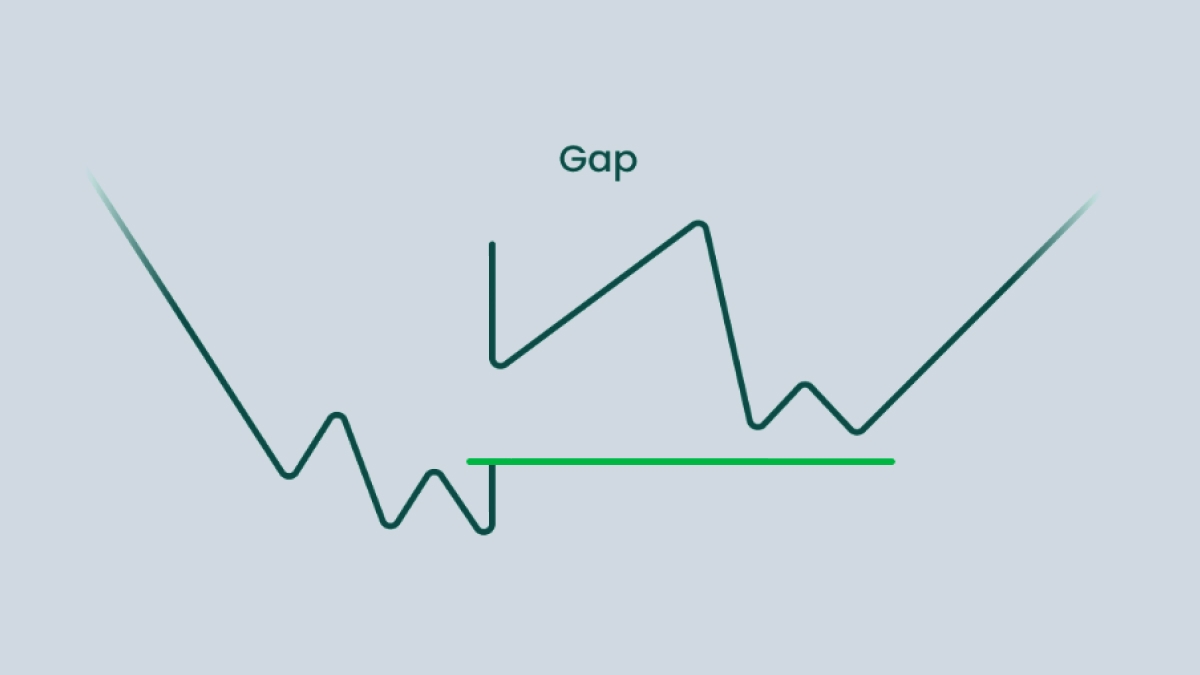

Double bottom

A double bottom is the opposite of a double top as it occurs after a downtrend and generally signals the reversal to an uptrend. A double bottom looks like a “W” and is formed when the price rises a bit after a prolonged decline, then goes back down but bounces off the support line and begins to rise, breaking through the neckline. This pattern is often used by traders to identify the best opportunities to start long-term bullish trades.

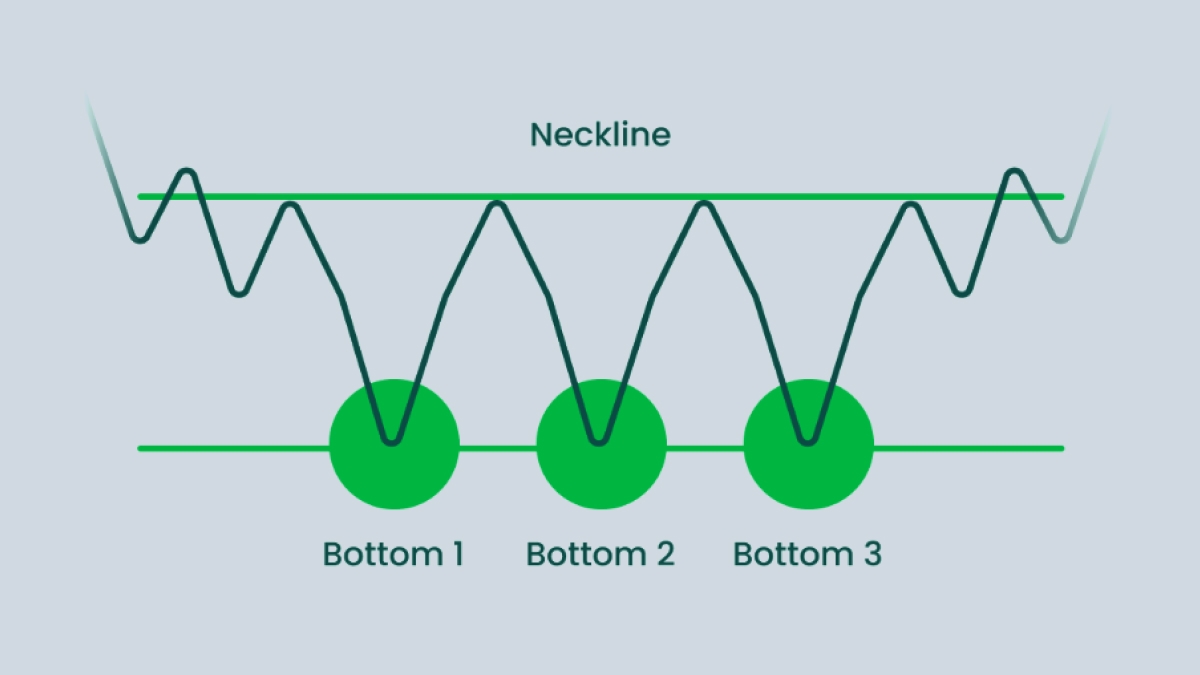

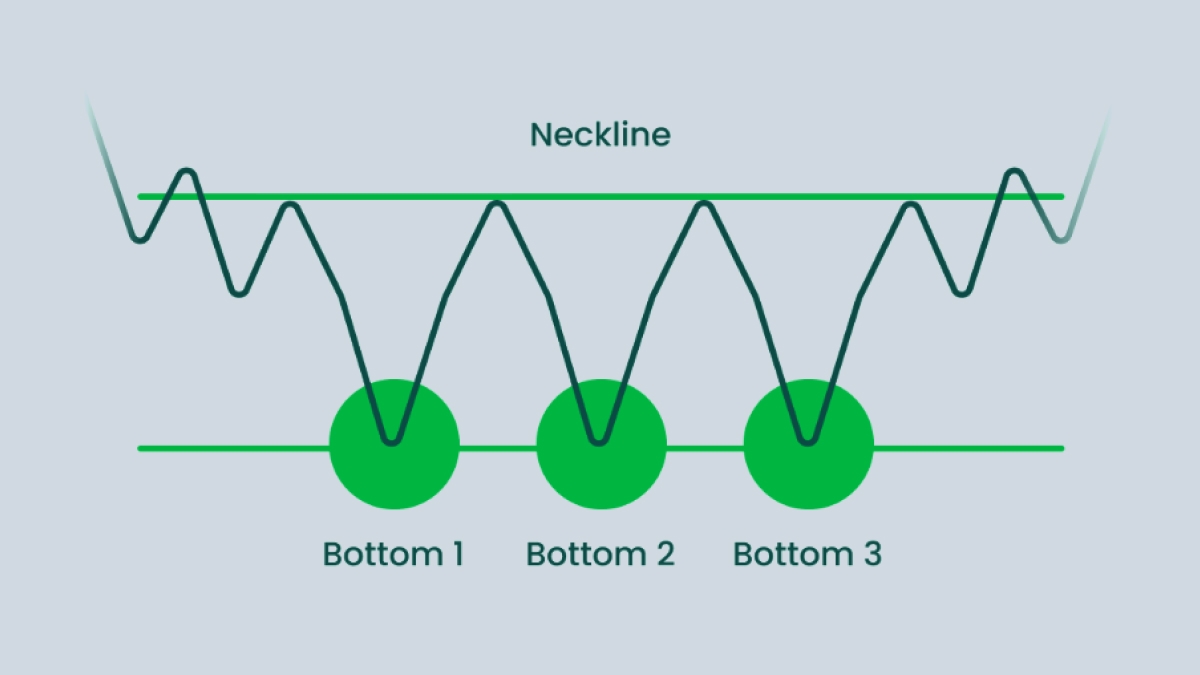

Triple bottom

A triple bottom is a bullish reversal pattern that occurs after an extended period of a downtrend. It consists of three consecutive but spaced out lows, each located on or near the same price level. A triple bottom signals that, despite buyers’ efforts, sellers aren’t willing to give up their positions easily. However, after the third low they usually surrender to the buyers and let the price begin its upward movement after breaking through the neckline. This pattern is one of the rarest, but also one of the strongest and most reliable patterns. So if you manage to identify it on a chart, be sure to make the most of it.

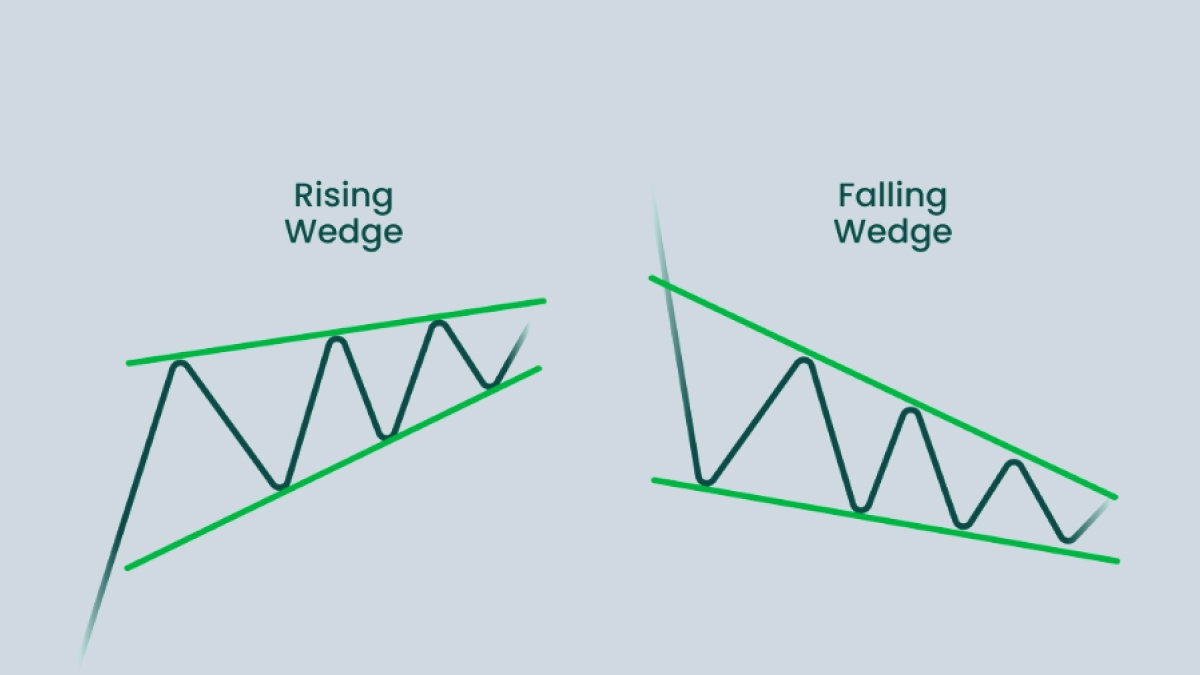

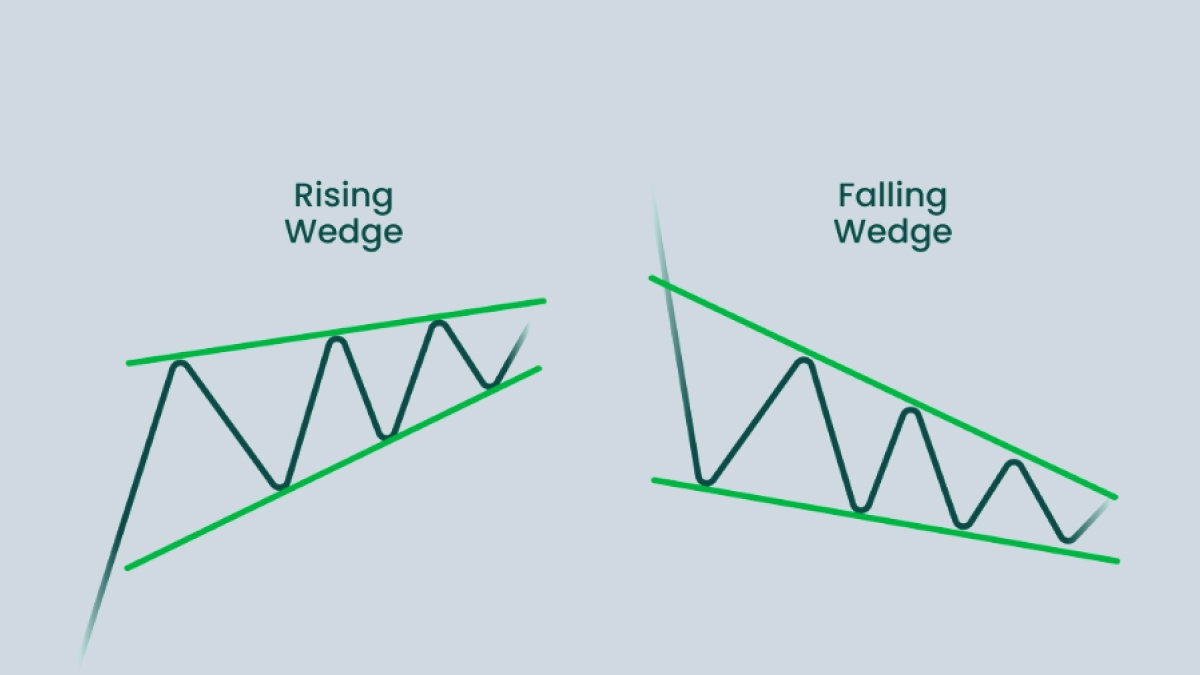

Wedge

A wedge pattern occurs when the price starts moving between two converging trend lines that form a continuously narrowing range. This pattern can be either bullish or bearish, depending on the variation of the pattern itself.

A falling wedge is considered a bullish pattern. It can occur after a downtrend or an uptrend, and serve as a reversal or continuation signal. A falling wedge looks widest at the top and then continues to narrow as the price moves downward. When the pressure from sellers subsides, buyers get a chance to slow the price decline, which leads to the price breaking through the resistance line and continuing on with an uptrend.

A rising wedge is the opposite of a falling wedge. It is generally a bearish pattern that can signal a continuation or reversal of the trend, depending on where the market was moving before the pattern occurred. It consists of two converging trend lines, and the price moving upwards within the consolidation period. Buyers eventually get weaker, so sellers manage to break through the support line, marking a new (or continuing with the previous) downtrend.