The chick and Forex. Level 2

Hello everybody! Ann is here again and ready to share the experience of trading with the easiest indicator “Moving average”. In this article I will describe my steps and the total profit made.

As you remember, I got the $50 Bonus and made $113 during my first 2 trading days. You can’t even imagine how I am proud of myself! I even was not so proud when earned my first money in a high school! Click here to read the first part of my story.

If you think that trading was as easy as a pie, you are mistaken, my friend! The second Forex lesson was interesting yet difficult. I got a motivation to move further and explore new secrets! The total profit is not that high but I became much smarter for sure.

My results:

Account balance at the beginning: $113 Time spent: 2 hours a day for 2 days Account balance at the end: $142

Let’s start from the beginning. I got a home task from FBS analyst – to learn the “Moving average” indicator. Oh my, that was hard to understand for a woman with degree in arts and design! But I overcame all the difficulties and now ready to demonstrate my skills!

Moving average (MA)

First of all, I looked up some theory. *Talking with a very serious voice*: Moving average is an indicator that shows the average price of a currency pair during a specific period of time. To put it simply, it shows the average price of a certain number of last candlesticks/bars. When you add this indicator to your chart, a line appears. You can choose the period of MA and its type in the settings.

There are 4 types of moving averages. I decided to use exponential moving averages because they predict the current trend with greater confidence.

I applied 3 moving averages with different periods to my chart:

1) 8 candlesticks – it’s a fast MA that shows the price movement during last the 8 candlesticks and quickly reacts to the changes of the price;

2) 21 candlesticks – this MA shows the short-term trend;

3) 100 candlesticks – it’s a “slow” MA that shows the long-term trend.

The theory sounded simple enough. If the price is above all moving averages – this is a sustained uptrend, if the price is below the MAs – we see a downtrend.

I saw that EUR/USD traded above all MAs. “Great!” I thought and opened a BUY trade. Imagine my confusion when soon after that the price turned down and fell below my entry level. What went wrong? Then the price went below the MA, and I opened a SELL trade. This time I managed to close my trade with profit.

Moving Averages with different periods

After some more trades I finally realized that the best time to open an order is when the price just crossed the MA. If it went up, I opened a BUY trade. If it went down, I opened a SELL trade. My gains slowly but surely piled up. I even opened a bottle of champagne to celebrate my new experience and success!

Analyst’s comment

As you see, it not usually enough just to add an indicator to the chart. You need to learn how to ‘read’ its signals. If you want moving averages to bring you profit, you need to have a strategy for when to enter the market. You added several MAs to the chart, so use all of them! With these lines you can create a simple but efficient trading strategy:

1. Look at 100-period MA. If the price is above is, the long-term trend is positive, so look for the opportunities to BUY. 2. The exact signal to BUY will be when 8 MA goes above 21 MA. 3. If 8MA is already above 21 MA and the price is above all of the MAs, wait for a moment when it goes down and touches the moving average. If the price then bounces up from this line, it’s a good time to BUY.

If 8- and 21-period MAs go below the 100 MA, the uptrend is changing to the downtrend, so you can start looking for SELL trades. Good luck!

Stop Loss and Take Profit

This time I was a bit busy. I had to glace away from the chart from time to time so I decided to use Take Profit and Stop Loss orders after all. I wanted to take the profit as quickly as possible and at the same time it was my greatest desire to avoid losing everything I got. I understood that sometimes the price can move really fast, so a trader has to be prepared and forearmed. In this case, my secret weapons were TP and SL!

Take Profit and Stop Loss

Truly speaking (and shame on me) I didn’t use any special techniques to find places for my Take Profits and Stop Losses. I simply looked at the chart and put these orders where it seemed appropriate.

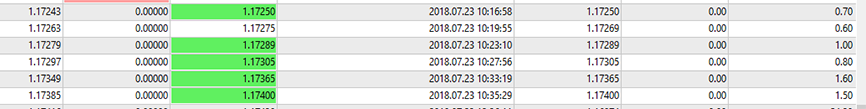

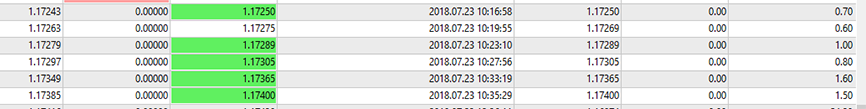

A screen from my MetaTrader

Analyst’s comment

It’s one of the main rules of risk management that your TP should be bigger than your SL. For example, your Take Profit can be 30 points, while Stop Loss is 10 points. This way is if one trade goes badly, you will still be in profit from your good trade. When you search for places for SL and TP, look at the previous highs and lows of the piece charts. If you put your orders near them, you trading will become more profitable. Try it out!

Emotions

This time I also made some observations:

1. It’s a great temptation to close a profitable trade as soon as possible to secure the profit, even when I see that the market keeps moving in my direction.

2. When I have a losing trade, I don’t want to close it because I hope that the market will reverse. As a result, there were times when I lost more than I could because I got greedy.

I can understand that situations like these make trading stressful. How can I deal with them? Except crying out loud and tearing my hair out.

Analyst’s comment

You are absolutely right, many traders suffer from this problem. The best way to deal with it is to choose your TP and SL levels in advance and not to change them afterwards no matter how strongly you want to. This way you will be more motivated to carefully think through your trades in advance. You will see that a big weight will come off your shoulders. You won’t get obsessed with just one trade and won’t miss other exciting profit opportunities.

Results

Once again I managed to achieve profit, hooray! It could have been higher but the next time (promise!) I will use recommendations given to me by the analyst and triple my gains!

Now I’m ready to draw some conclusions. Long-term planning and strategy building are the things that require a more advanced level of knowledge. With my level of experience short-term orders with small profit on each trade are more effective. Yet, even in the short term I can use indicators like MAs to get trade ideas. And Stop Loss and Take Profit help to save trader’s mental health and money (and hair on the head)!

My orders

The second important thing that happened – I realized that I don’t want to trade without an understanding of what I am doing. Surprise! You can’t always be a winner, and losses always happen, but you feel yourself a real Forex king when you made a well-thought-out profit! Sounds like a quote of Confucius but it 100% works!

Analyst’s comment

I’m proud of you! Keep calm and carry on! As your home task, study how to draw trend lines and find support and resistance levels.