How to Trade Morning Star and Evening Star Patterns

Among the broad range of indicators traders and investors use to forecast price movements in the financial markets is the candlestick chart. This popular technical analysis tool provides a visual representation of an asset’s movement over a specific period.

This article will focus on two of the most reliable reversal candlestick patterns traders use: the Morning Star and the Evening Star.

What is a Morning Star pattern?

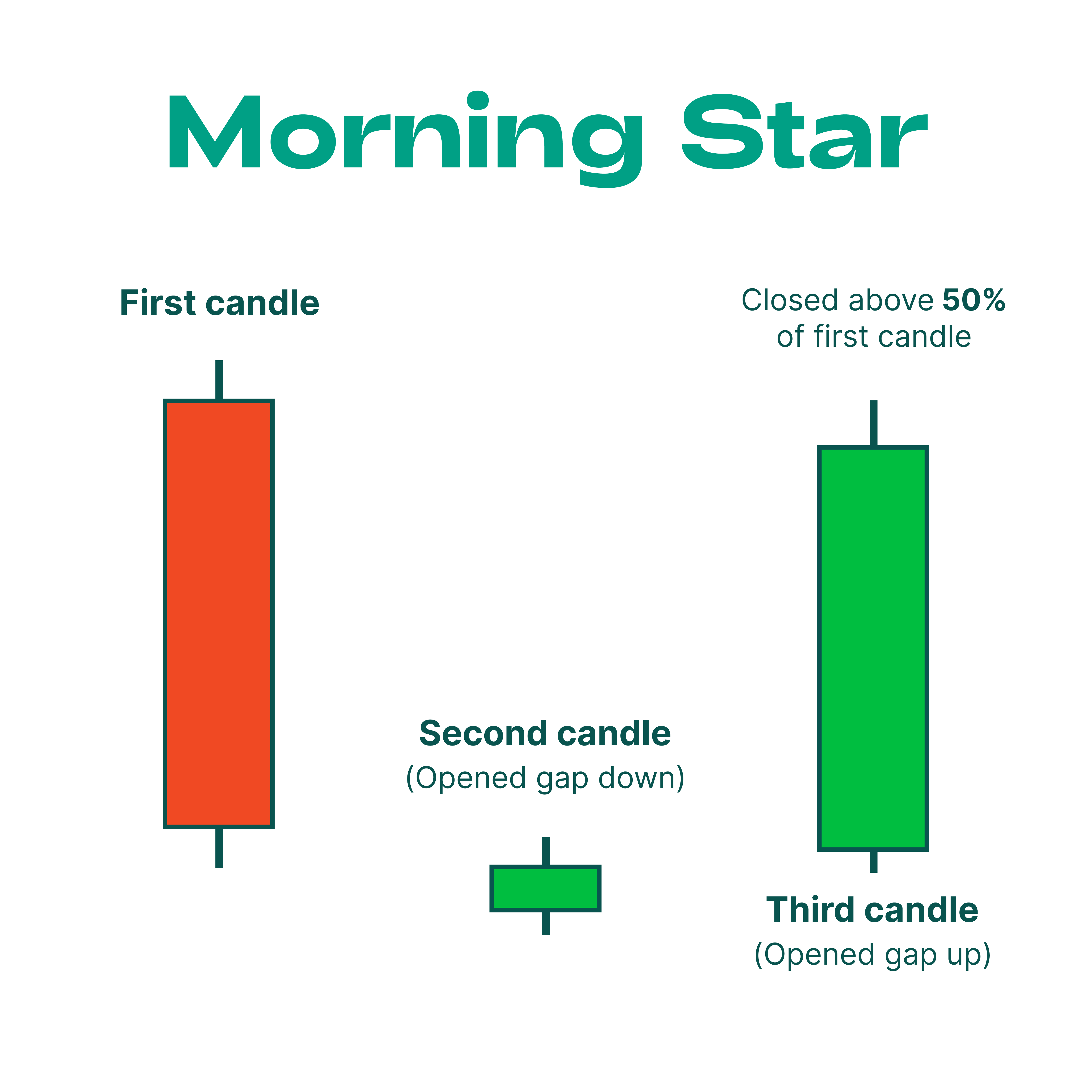

The Morning Star appears at the end of a downtrend, signaling an imminent bullish reversal. It consists of three candlesticks: the first a long red one, followed by a short red or green candlestick, and that is followed by a long green one. Ideally, the second candlestick should gap down from the first one (open lower than the previous day closed); and the third should gap up from the second (open higher than the previous day closed).

The appearance of a Morning Star drives bears to lose momentum and bulls to gain control of the market. This shift in sentiment suggests that the asset’s price is likely to rise, so traders may want to consider opening long positions.

However, traders should not rely on the Morning Star as a sole indicator when making trading decisions. Other essential factors that should be considered are the asset’s fundamental analysis, market conditions, and risk management strategies.

What is an Evening Star pattern?

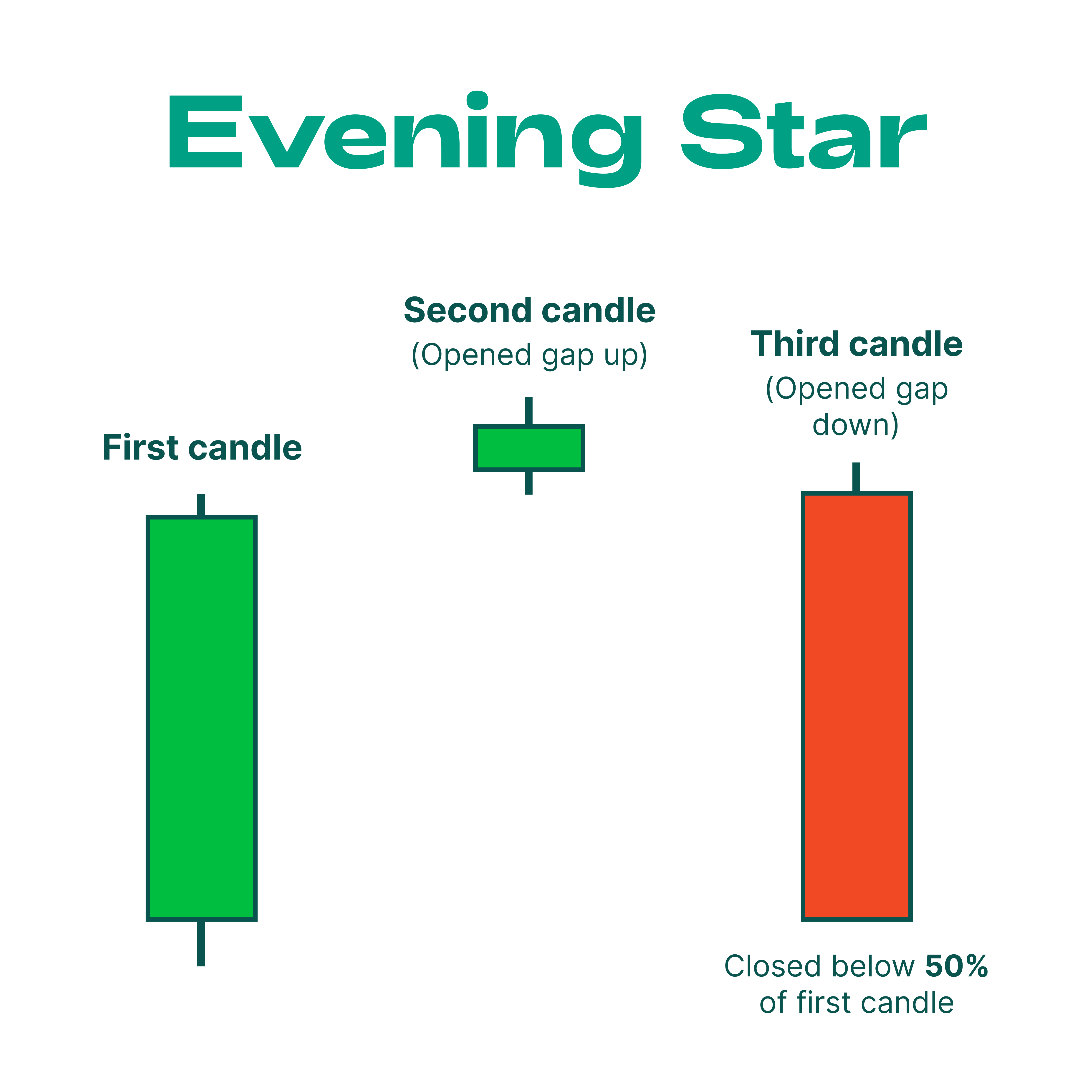

The Evening Star pattern is the exact opposite of the Morning Star. In contrast to its bullish counterpart, the Evening Star is a pattern that signals a bearish reversal in a bullish market. It consists of three candlesticks: the first a long green one, followed by a short red or green candlestick, and that is followed by a long red one. Ideally, the second candlestick should gap up from the first one (open higher than the previous day closed); and the third should gap down from the second (open lower than the previous day closed).

The Evening Star pattern helps traders and investors identify potential opportunities to sell an asset before its price drops. However, as with the Morning Star, it is important to note that no single technical indicator or pattern is foolproof. A variety of tools and analysis techniques should always be used to make sound trading decisions.

How to trade a Morning Star pattern?

When using the Morning Star pattern as a tool in trading, traders should look for the following criteria:

- The first candle should be a long red candlestick, indicating a bearish trend.

- The second candlestick should be short and gap down from the first candle.

- The third candle should be long and green and gap up from the second candle.

- The pattern should be accompanied by other technical indicators and fundamental analysis that support a bullish reversal.

If a trader is considering opening buy positions, they should place their stop-loss orders below the low of the second candle. Profit targets can be set based on the asset’s price movements and the trader’s risk management strategy.

How to trade an Evening Star pattern?

When using the Evening Star pattern as a tool in trading, traders should look for the following criteria:

- The first candle should be a long green candlestick, indicating a bullish trend.

- The second candlestick should be short and gap up from the first candle.

- The third candle should be long and red and gap down from the second candle.

- The pattern should be accompanied by other technical indicators and fundamental analysis that support a bearish reversal.

If a trader is considering opening sell positions, they should place their stop-loss orders above the high of the second candle. Profit targets can be set based on the asset’s price movements and the trader’s risk management strategy.

Limitations of using Morning and Evening Star patterns

The Morning Star and Evening Star patterns are useful indicators of potential trend reversals, but they are not foolproof. When using these analysis tools in trading, traders should be aware of the following limitations:

- These patterns may not work in all market conditions. In highly volatile markets, for example, the Morning and Evening Star patterns may be less reliable.

- Sometimes, a Morning or Evening Star pattern may be a false signal. If a trader uses these patterns alone to make trading decisions, they may lose big if the market does not reverse as expected.

In addition to always using the Morning and Evening Star patterns in tandem with other analytical tools, traders should use proper risk management strategies. Always have a plan for managing trades, including stop-loss orders and profit-taking targets.

Summary

The Morning Star and Evening Star trading patterns are useful indicators of potential trend reversals in financial markets. Traders commonly use these patterns to identify potential buying or selling opportunities. However, these tools should never be relied on alone. In making trading decisions, traders should also consider other technical indicators, fundamental analysis, and risk management strategies.